The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 28, 2020US GDP 2020 Q1 (SECOND ESTIMATE)

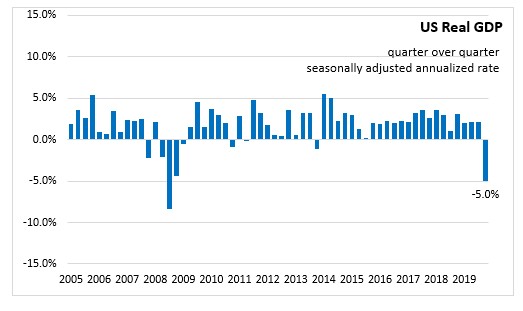

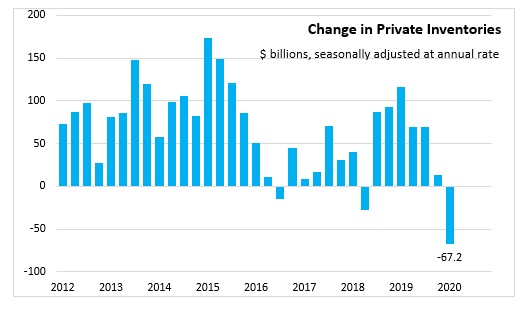

The Bureau of Economic Analysis (BEA) released the first quarter of 2020 US Real Gross Domestic Product (GDP) “second” estimate today. In the second estimate, the US GDP decreased 5.0 per cent (seasonally adjusted annualized rate, chained 2012 dollars) in Q1 2020, reflecting a downward revision of 0.2 percentage points from the “advance” estimate of 4.8 per cent. With the second estimate, a downward revision to private inventory investment was partly offset by upward revisions to personal consumption expenditures (PCE) and non-residential fixed investment.

The decline in the second estimate of first quarter GDP reflected the response to the spread of COVID-19 as governments issued “stay at home” orders beginning in March 2020. This led to rapid changes in demand with businesses and schools switching to remote work arrangements and consumers restricting or redirecting their spending. However, the BEA states that the full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.

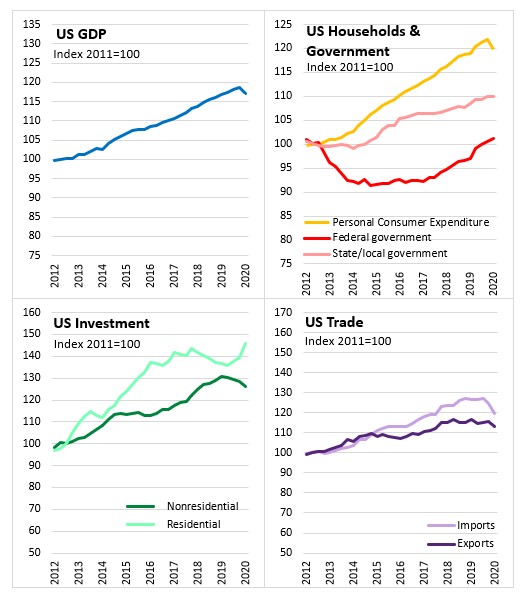

The decrease in real GDP in the first quarter reflected negative contributions from PCE, private inventory investment, non-residential fixed investment, and exports that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending.

Personal consumption expenditure growth slowed with a decline of 6.8 per cent compared to averaging 3.2 per cent growth over the previous three quarters. The decrease in PCE reflected a decrease in services, led by health care as well as food services and accommodations, and durable goods.

Non-residential investment decline was 7.9 per cent primarily reflecting a decrease in equipment (-16.7%) led by transportation equipment. Non-residential structure spending also declined 3.9 per cent. Residential investment increased 18.5 per cent. Within private inventory investment, the contributors to the downward revision were nondurable goods manufacturing and wholesale trade inventories (led by petroleum products) and non-farm inventories.

Exports declined 8.7 per cent mainly reflecting a decrease in services exports (-21.5%) led by travel. Goods exports were also down 1.2 per cent. Imports declined 15.5 per cent.

Federal government nondefense spending increased by 3.1 per cent in Q1 while defense spending was up 1.0 per cent. Local state spending increased 0.2 per cent in the first quarter.

US nominal GDP (including the impacts of rising prices) decreased 3.5 per cent in Q1, compared to an increase of 3.5 per cent reported in the fourth quarter. The personal consumption expenditure price index increased 1.7 per cent, following a 1.4 per cent increase last quarter.

Source: US Bureau of Economic Analysis

<--- Return to Archive