The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

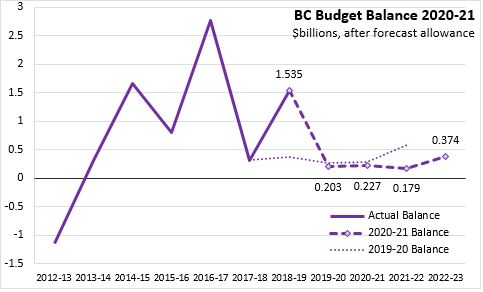

February 19, 2020BRITISH COLUMBIA BUDGET 2020-21 British Columbia tabled the first Provincial Budget of 2020-21. The Budget plan includes a surplus of $227 million (after $300 million in forecast allowance) for 2020-21. This follows from a surplus of $203 million in the revised forecast for 2019-20. British Columbia's revenue estimates for 2020-21 are $60,585 million - an increase of 2.1 per cent from the 2019-20 forecast. Expenditures are estimated at $60,058 million in 2020-21, an increase of 2.1 per cent from the 2019-20 forecast.

British Columbia's revenues in 2019-20 were slightly stronger than estimated (+0.5 per cent) while expenditures were 0.9 per cent above estimate. Over the next two years of the fiscal plan (2021-22 and 2022-23), British Columbia plans similar surpluses along with the same forecast allowances. Revenues are projected to grow by 2.7 per cent per year between 2019-20 and 2022-23 while expenditures grow by 2.6 per cent per year. Apart from higher expenditures in 2019-20, the growth of British Columbia's revenues and expenditures are little changed from last year's fiscal plan.

After posting an unexpectedly large surplus in 2018-19 (+$1,535 million), British Columbia's suplus has returned in line with expectations in 2019-20 and 2020-21. The surplus for 2021-22 is projected to be $179 million, lower than previously expected. For 2022-23, British Columbia plans on a provincial surplus of $374 million.

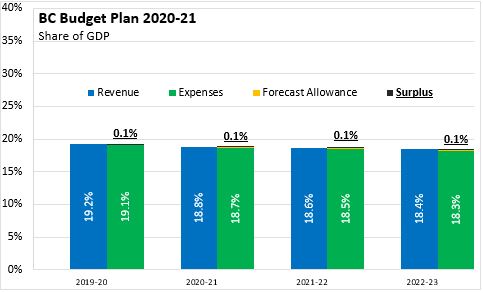

British Columbia's surpluses are all expected to be relatively small compared with the size of the provincial economy, amounting to 0.1 per cent of GDP in each year of the fiscal plan. The footprint of provincial government expenditures in the British Columbia economy is projected to shrink from 19.1 per cent of GDP in 2019-20 to 18.3 per cent of GDP in 2022-23. Revenues as a share of GDP are projected to decline from 19.2 per cent in 2019-20 to 18.3 per cent in 2022-23. British Columbia's debt to GDP ratio ("taxpayer-supported" debt) is projected to rise from 14.6 per cent of GDP to 15.5 per cent of GDP in 2020-21 and to 17.1 per cent of GDP by 2022-23.

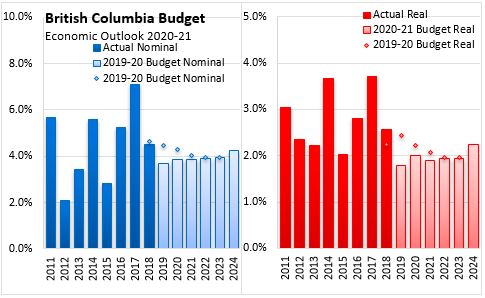

British Columbia's economic growth fell short of expectations in 2019, rising by an estimated 1.8 per cent. The outlook for growth in each of 2020 (2.0 per cent) and 2021 (1.9 per cent) has been revised down compared with last year's Budget. Although housing markets performed better than expected, exports declined and consumer spending slowed in 2019. The growth outlook for 2020 and 2021 depends on modest improvements assumed for consumer spending, residential investment and exports. However, the prospects for growth are muted because of trade uncertainty and weaker global economic growth.

Key Measures and Initiatives

British Columbia's government has introduced a number of initiatives in the first two Budgets under the current mandate, including a new BC Child Opportunity Benefit, the Childcare BC expansion of childcare spaces, the Building BC housing strategy and the CleanBC climate change plan. The 2020-21 British Columbia Budget builds on many of these initiatives, including:

- a $50 million 3-year plan to support the homeless or those who are at risk of homelessness through an enhanced shelter model called a 'navigation centre'

- a further $56 million for development of 200 new units of supportive modular housing for those who are homeless or at risk of becoming homeless

- $20 million to increase the earnings exemption for income assistance payments (+$100/month)

- $13 million over three years to develop the bioeconomy sector and revitalize forest industries

- A new personal income tax rate of 20.5 per cent on incomes above $220,000

- Removal of sales tax exemptions for carbonated beverages that contain sugar, natural sweeteners or artificial sweeteners

- Addition of a $0.295/unit tax on heated tobacco products

British Columbia Budget 2020-21

<--- Return to Archive