The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

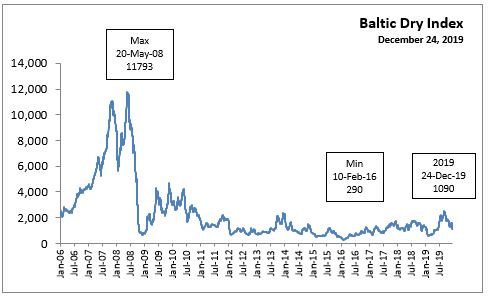

January 13, 2020BALTIC DRY INDEX 2019, PLUS RECENT ACTIVITY The BDI measures procurement costs of shipping raw materials by sea. When these costs go down, producers benefit from increased margins, and consumers benefit from lower prices for finished products.

On May 20, 2008, the Baltic Exchange reported the BDI = 11,793 a new high for the index. Before the year was out, the BDI dropped to 663 on 5 December 2008.

On February 10, 2016, the Baltic Exchange reported the BDI = 290 a new low for the index. When the index drops below 500, shipping companies tend to idle their fleets as variable costs cannot be recovered.

On the last trading day in 2019, the Baltic Exchange reported the BDI = 1,090, an increase of 800 points over February 10, 2016.

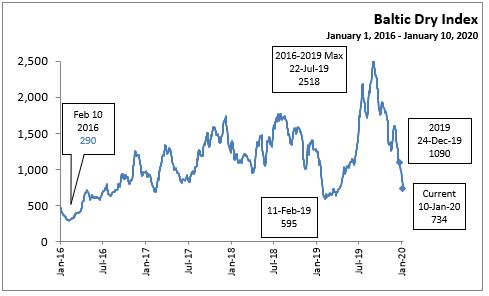

Recent Activity to January 10, 2020

The Baltic Exchange reported the BDI increased from 595 (February 11, 2019) to a recent high of 2,518 (July 22, 2019) before declining to 1,090 (December 24, 2019); a net increase of 495 points over February 10, 2016.

On 10 January 2020, the Baltic Dry Index has decline a further 356 points over 24 December 2019, to 734, or 1,784 points since 22 July 2019.

QUOTES

" the index is considered as a leading indicator (forward looking) of economic activity..... A high BDI index is an indication of a tight shipping supply due to high demand and is likely to create inflationary pressures along the supply chain."

"A sudden and sharp decline of the BDI is likely to foretell a recession since producers have substantially curtailed their demand leaving shippers to substantially reduce their rates in an attempt to attract cargo."

"Between 2005 and 2009 when it behaved as a bubble.... A factor is that many ships were ordered during the “bubble years” and have entered the market, providing capacity growth above demand growth. In recent years the BDI remains low, underlining a situation of excess capacity in the shipping industry."

The Baltic Dry Index, 1985-2019, The Geography of Transport Systems

"July 15 (Reuters) – The Baltic Exchange’s main sea freight index hit a five-and-a-half-year high on Monday on the back of strong demand for capesize vessels shipping iron ore."

REFERENCES

The Surprising Relevance of the Baltic Dry Index, New Yorker, June 22, 2016

LLYod Baltic Dry

CNBC (one year+)

Trading Economics (intercative chart)

Bloomberg (interative chart)

Baltic Dry Index - BDI (BALDRY), wikinvest

The Shipping News

The Baltic Exchange

<--- Return to Archive