The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

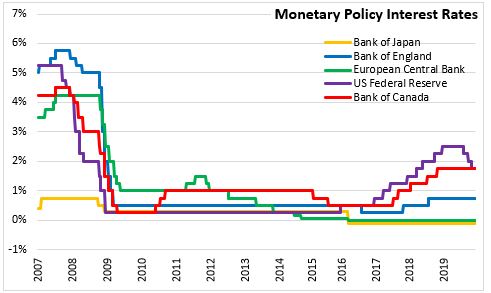

December 04, 2019BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.00 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that future interest rate decision will be guided by the assessment of adverse impact of trade conflicts against sources of resilience in Canadian economy (consumer spending and housing).

The Bank of Canada views is that global economic growth is evolving as projected in October. There is some evidence that the global economy is stabilizing and growth is still expected to edge higher next year. Financial markets have been supported by central bank actions, waning recession concerns, and positive news on trade discussions. The ongoing trade conflicts and related uncertainty are still the largest source of risk to the outlook.

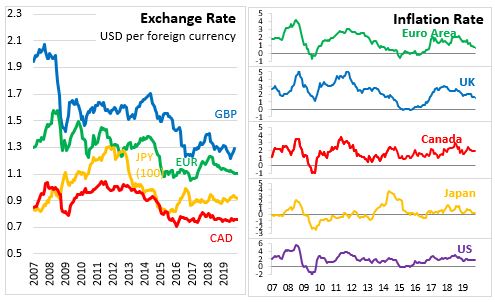

Canada’s real GDP grew 1.3 per cent in Q3 2019 as consumer spending expanded. Housing investment was a source of strength, supported by population growth and low mortgage rates. Exports of non-energy commodities contracted in Q3 as expected. Business investment showed strong growth, related to transportation equipment and engineering projects.

Inflation remains at target and core inflation measures are around 2 per cent. Inflation will increase in coming months with higher year-over-year gasoline prices. The Bank of Canada expects inflation to track close to the 2 per cent target over the next two years.

Bank of Canada

<--- Return to Archive