The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

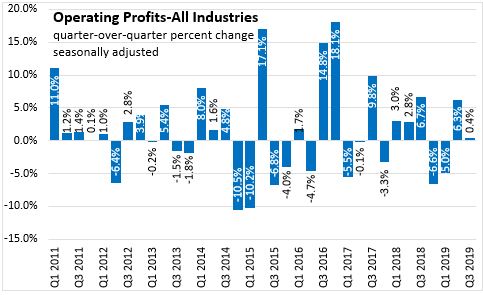

November 26, 2019QUARTERLY FINANCIAL STATISTICS FOR ENTERPRISES, Q3 2019 Canadian corporations earned $108.6 billion in operating profits (seasonally adjusted) in the third quarter of 2019 - an increase of 0.4 per cent compared to the previous quarter. Compared to Q3 2018, operating profits were down 5.4 per cent. Since the most recent trough in the second quarter of 2016, Canadian corporate operating profits have been on an upward trend with an increase of $33.9 billion through Q3 2019.

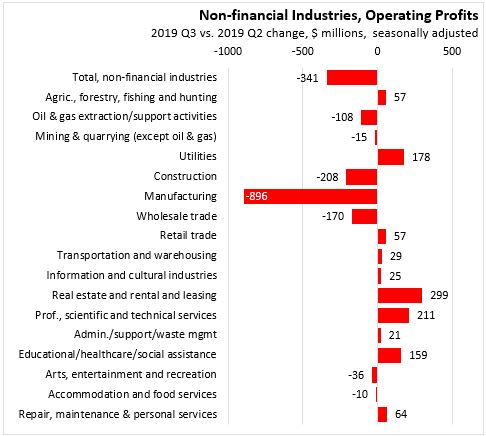

Non-financial sector operating profits (seasonally adjusted) were down 0.5 per cent to $74.3 billion in the third quarter with increases in 10 of the 17 non-financial industries. Oil and gas extraction profits were down 6.1 per cent ($108 million) with a decline in oil prices. Manufacturing sector profits declined 6.3 per cent ($896 million) led by petroleum and coal product manufacturing (-16.9 per cent). Profits declined in wood and paper for the fifth consecutive quarter on weak market conditions and high log costs. Wholesale trade profits declined 1.9 per cent while retail trade profits increased 0.9 per cent.

Financial industry profits were up $729 million (2.2 per cent) in the third quarter, the second consecutive quarterly increase. Operating profits for insurance carriers and related activities was up $1.15 billion on the quarter due to lower actuarial liabilities expense of life, health and medical insurance carriers. Depository credit intermediation profits declined $732 million while other financial sector activities had higher profits in Q3.

Year-to-Date

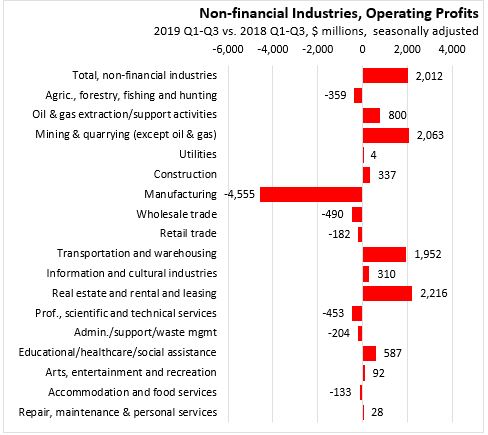

Comparing the Q1-Q3 2019 with the same period of 2018, operating profits among non-financial industries are up 0.9 per cent or $2.0 billion with increases in 10 of 17 subsectors. Profits are down in agriculture, forestry, fishing and hunting, manufacturing, wholesale and retail trade, professional and technical services, administrative and support services, and accommidation and food services. The largest increases in profits have been in mining (except oil and gas), transportation and warehousing, real estate and rental and leasing, and oil and gas extraction.

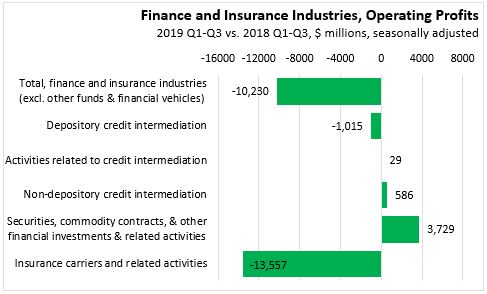

Operating profits are down $10.2 billion in financial industries compared to the first three quarters of 2018. Operating losses among insurance carriers are offsetting an increase in securities, commodity contracts and other financial investments.

Source: Quarterly financial statistics for enterprises; Table 33-10-0008-01 Quarterly statement of changes in financial position and selected financial ratios, by industry

<--- Return to Archive