The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

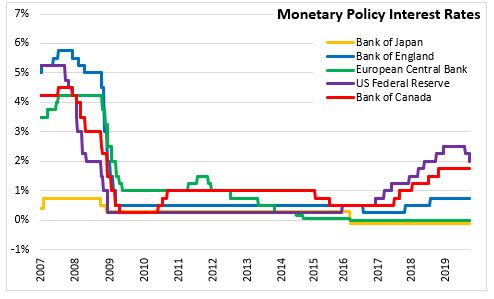

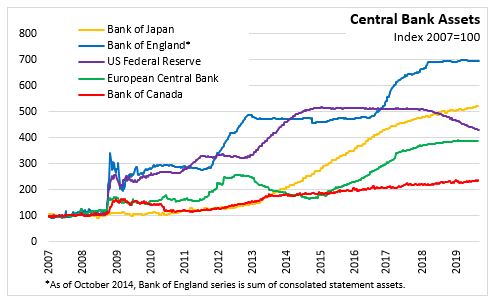

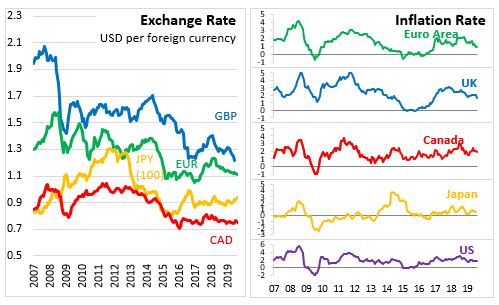

September 19, 2019BANK OF ENGLAND MONETARY POLICY The Bank of England's Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 0.75 per cent. The MPC also voted to maintain the stock of UK non-financial corporate bonds stock at £10 billion and the stock of UK government bond purchases at £435 billion. The MPC notes that the appropriate path of monetary policy will depend on balancing the effects of Brexit on demand, supply and the exchange rate. In the event of a no-deal Brexit, the expectations are the exchange rate falls, CPI inflation increases, and GDP growth slows. A balancing between upward inflation pressure and reduction in demand would have to be made by the Committee. A known smoother Brexit resolution and a global growth upswing would led the Committee to view that gradual increases in the Bank Rate would be warranted to return inflation to the 2 per cent target.

The trade war between the United States and China has intensified, and the outlook for global growth is now weaker. Several major economies have loosened monetary policy. Changing expectations about the timing and nature of Brexit continue to generate volatility in UK asset prices, currency, and GDP. The Committee’s view is that underlying growth has slowed but remains positive and there is a degree of excess supply within some companies. Brexit uncertainties continue to weigh on business investment, but household consumption is supported by real household income growth. A weaker global environment weighs on exports. The Government's announcement for increased departmental spending in 2020-21 are expected to be a positive lift to economy.

Inflation fell to 1.7 per cent in August from 2.1 per cent the previous month and is expected to remain slightly below the 2 per cent target in the near term. The labour market remains tight with unemployment under 4 per cent. Annual pay growth has strengthened further to the highest rate in over a decade. Unit wage cost growth has risen to a level consistent with meeting inflation target in the medium term.

Bank of England

<--- Return to Archive