The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

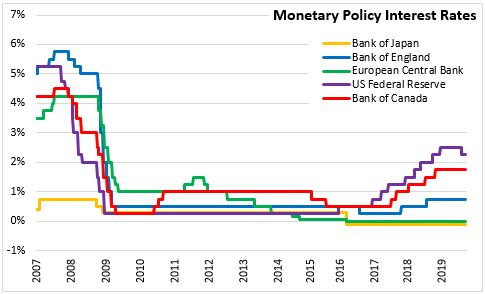

September 12, 2019MONETARY POLICY: EURO AREA At today’s meeting, the Governing Council of the European Central Bank (ECB) announced that the interest rate on the deposit facility will be decreased by 10 basis points to -0.50 percent, while main refinancing operations and the marginal lending facility rates will remain unchanged at 0.00% and 0.25%, respectively. Rates are expected to remain at their present levels or lower until ECB’s inflation outlook converges sufficiently close to 2 per cent.

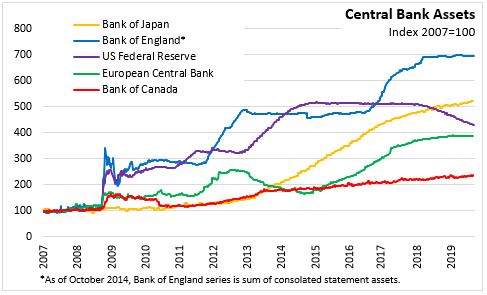

Net purchases will be restarted under the Asset Purchase Programme (APP) at a monthly pace of €20 billion starting in November. Under the APP, private and public sector securities are purchased to address the risks of prolonged periods of low inflation over the medium term. Net purchases are expected to run for as long as necessary to reinforce the impact of policy rates, and to end shortly before the ECB raises key interest rates. Reinvestment of the principal payments from maturing securities will continue alongside future rate increases, to maintain favourable liquidity conditions and continued monetary support.

The Euro Area real GDP grew 0.8 per cent in Q2 2019 after 1.7 per cent in Q1 2019. Weaker consumer and business confidence, softening external demand and some temporary country and sector specific factors have tempered Euro Area economic growth. However, improvements in services, the construction sector and the labour market should continue. The Euro Area economic expansion is supported by favourable financing conditions, employment and wage growth, increased retail trade and an expansionary fiscal stance.

Euro Area inflation was 1.0 per cent in July 2019, down from 1.3 per cent in June, as slower growth in energy prices were offset by rising prices in the index excluding food and energy. Underlying inflation remains muted and inflation expectations have declined. Labour cost pressures have strengthened amid higher capacity utilisation and tighter labour markets, but pass-through of cost pressures is taking longer than anticipated.

Sources:

European Central Bank

<--- Return to Archive