The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 11, 2019FAMILY INCOME AND INDIVIDUAL INCOME, T1 FAMILY FILE, 2017 Statistics Canada has released estimates of family and individual income generated from 2017 T1 personal income tax returns. This data shows how income is changing over time for particular types of families as well as how it compares by type of income and geography.

Within Statistics Canada’s estimates, there are income results for those who are in census families (couples and lone-parent families) as well as for those who are not in census families. The data shows median income for families (which often include more than one earner) as well as for persons within families (which allows for comparison with those who are not in census families). There are data available for provinces, for Census Metropolitan Areas (CMA), smaller Census Agglomerations (CA) and areas outside CMA and CA communities.

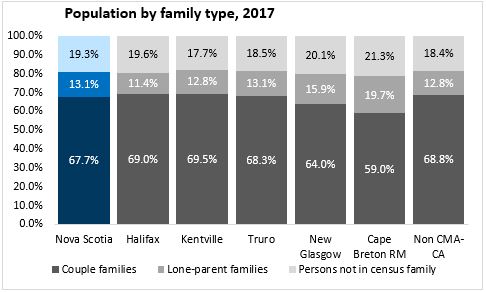

For Nova Scotia, the T1 records indicate a total of 915,400 persons (totals will not align with official population estimates). Of these, 67.7 per cent were in couple families – the lowest such proportion among the provinces while there were 13.1 per cent in lone-parent families (second highest among provinces) and 19.3 per cent not in any form of census family (second highest among provinces).

Within Nova Scotia, the portion of couple families is lower in New Glasgow and the Cape Breton Regional Municipality, where there are more lone-parent families as well as persons not in a census family.

Over time, the share of Nova Scotia's population in census families has declined as has the share in lone-parent families. The population's share of persons not in a census family is rising (concentrated among older residents).

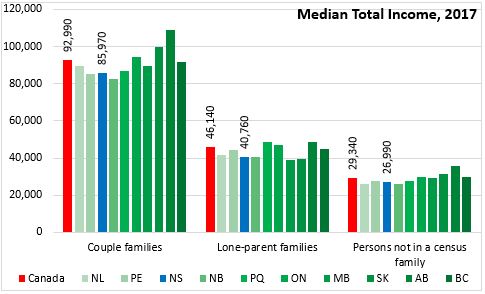

Median total income for couple families were $85,970 in Nova Scotia in 2017, which was 92.5 per cent of the national average ($92,990). Median income from all sources among persons in lone-parent families who had income in Nova Scotia during 2017 was $40,760, 88.3 per cent of the national median ($46,140). Median income from all sources among persons not in census families who had income was $26,990 or 92.0 per cent of the national median ($29,340).

Within Nova Scotia, the Halifax CMA had higher median total income among couple families, lone-parent families, and persons not in families while areas outside of Halifax had lower median incomes across all family types.

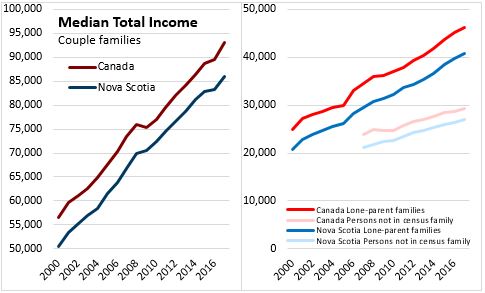

Nova Scotia's median total income for couple families grew by 3.3 per cent from 2016 to 2017, slightly below the national pace of 3.8 per cent. Since 2007, median income among couple families has grown at an annual average pace of 2.6 per cent in Nova Scotia, slightly faster than the national average pace of 2.4 per cent. Income growth for Nova Scotia lone-parent families was 2.4 per cent in 2017, outpacing national growth of 2.0 per cent. Since 2007, income of lone parent families in Nova Scotia has grown by 3.3 per cent per year, faster than the national growth rate of 2.9 per cent. Among Nova Scotia's persons not in a census family, 2017 median income was 2.7 per cent higher than in 2016, about the same growth as the national median for this group (2.6 per cent). Since 2007, the median income of Nova Scotians not in a census family has grown at an annual average pace of 2.5 per cent, faster than the national growth rate of 2.0 per cent.

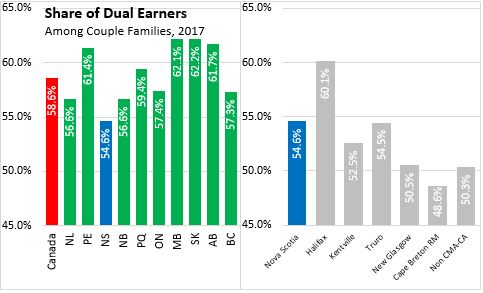

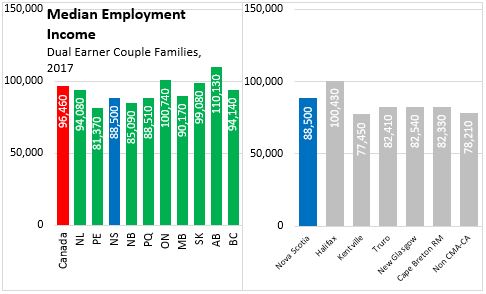

Couple families typically report higher incomes, particularly for those that have two earners. Nova Scotia reports the lowest proportion of dual earners among couple families. The share of dual earners among couple families is notably lower in New Glasgow, Cape Breton Regional Municipality and rural Nova Scotia (outside of Halifax and the Census Agglomeration areas).

Among dual earner couples, Nova Scotia's median total earnings were $88,500 in 2017 (91.7 per cent of the national median). Dual earner couples' income was notably higher in Halifax than across the rest of the province.

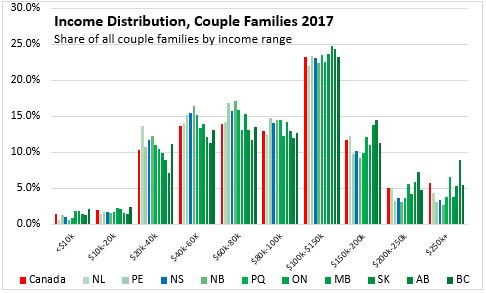

The Annual T1 Family File provides breakdowns of family income by income range.

Among couple families in 2017, there was a higher share of Nova Scotia families reporting less than $100,000 in income than the national average. The share of Nova Scotia couple families reporting incomes between $100,000 and $150,000 was about the same as the national share, but the portion of Nova Scotia couples with incomes in excess of $150,000 was below the national share in these income ranges.

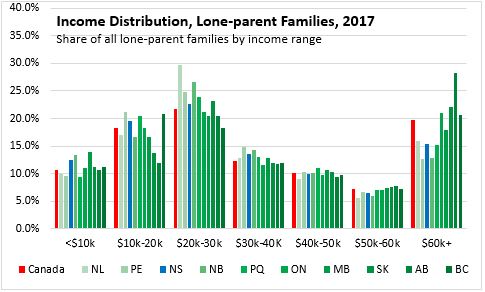

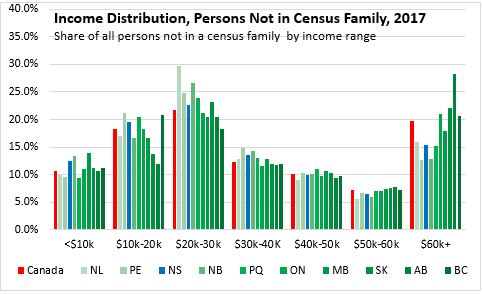

The income distribution for lone parent families in Nova Scotia is closer to the distribution observed at the national level. There is a higher share of Nova Scotia lone-parent families earning under $40,000 (compared to the national average) and a lower share earning $50,000 or more. A similar pattern of income distribution is observed among Nova Scotia's persons not in a census family: a greater proportion earning less than $40,000 in total income and a smaller portion earning $50,000 or more.

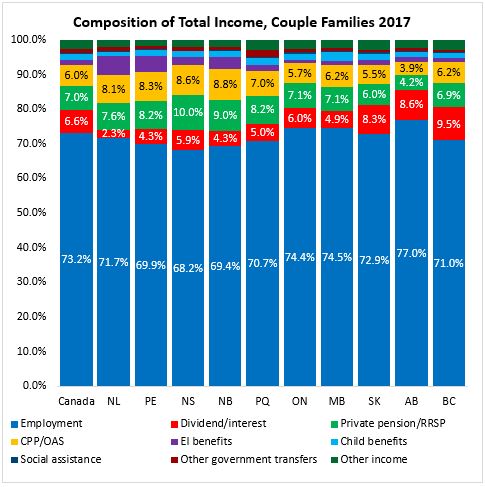

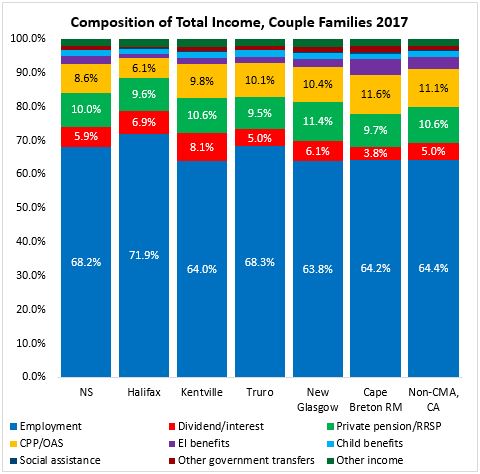

Nova Scotia couple families had the smallest share of total income from employment income in 2017 at 68.2 per cent. Nationally, 73.2 per cent of total income reported by couples was derived from employment income with the highest share in Alberta (77.0 per cent). Nova Scotia couples report the highest share of income from pension sources (private pensions, RRSPs, CPP and OAS).

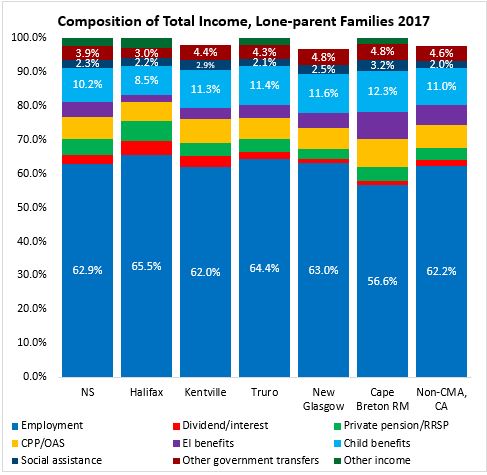

The introduction of a new Federal child benefit accounted for 1.6 per cent of total income of couples in Nova Scotia, but it was much higher at 10.2 per cent of the income of lone-parent families in the province. Lone-parent families across Canada all report more than 60 per cent of their income from employment earnings (though this portion is below 60 per cent in Cape Breton Regional Municipality). There is a higher share of lone-parent family income accounted for by employment insurance in Atlantic provinces.

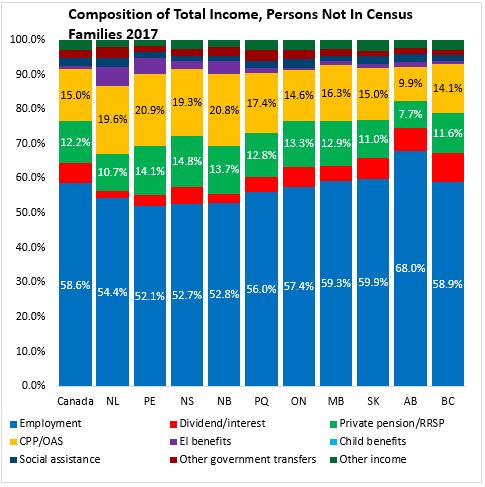

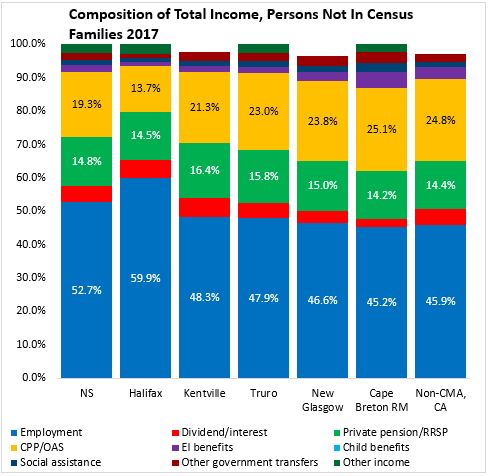

Persons not in a census family draw a much larger portion of their income from pension sources: private pensions, RRSPs, CPP and OAS. This is particularly the case in Atlantic Canada, where older populations reduce the share of the population in the labour force. Pension income is particularly important as a source of income in communities outside of Halifax.

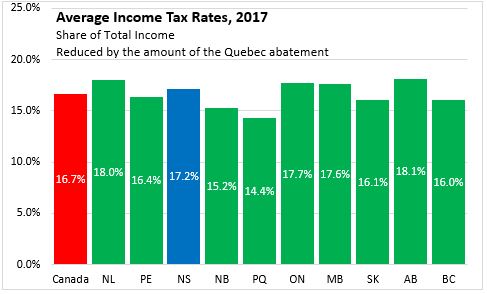

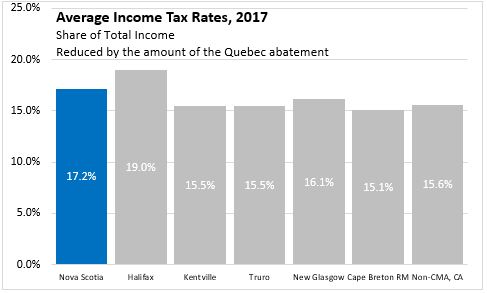

Measuring total income taxes paid to Provincial and Federal governments (and removing the Quebec abatement on Federal income taxes), the average national income tax rate is 16.7 per cent of total national income. Nova Scotia's average income tax rate is 17.2 per cent of total income. The highest average income tax rates were in Alberta, Ontario and Manitoba. The lowest average income tax rates were in Quebec and New Brunswick. Average income tax rates were higher in Halifax than across the rest of the province.

Statistics Canada Notes:

In this release, income has been adjusted for inflation as measured by the Consumer Price Index, and is expressed in 2017 dollars.

Total income includes employment income, dividend and interest income, government transfers, pension income and other income. In accordance with international standards, capital gains are excluded from total income.

This release uses the census family concept. A census family refers to a married or a common-law couple, with or without children at home, or a lone-parent family. Results also include persons not in a census family.

Statistics Canada. Table 11-10-0009-01 Selected income characteristics of census families by family type ; Table 11-10-0014-01 Sources of income by census family type ; Table 11-10-0034-01 Tax filers and dependants with income by sex, income taxes, selected deductions and benefits

<--- Return to Archive