The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 10, 2019BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.0 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that Canadian economy is returning to potential growth but the outlook is clouded by ongoing trade tensions.

Global Growth

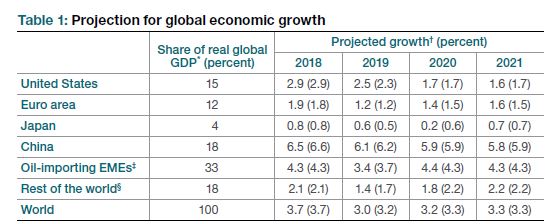

Escalating trade conflicts, geopolitical tensions and uncertainty are leading to a broad-based slowdown in global economic activity. There has been a moderation in trade and business investment growth. The Bank of Canada now expects global real GDP growth to be 3.0 per cent in 2019, 3.2 per cent in 2020 and 3.3 per cent in 2021 with the effects of trade policies and uncertainty larger than previously assumed. With a weaker outlook for the global economy, bond yields and commodity prices have declined and central banks have shifted to signalling more accommodative monetary policy.

Chart Source: Bank of Canada

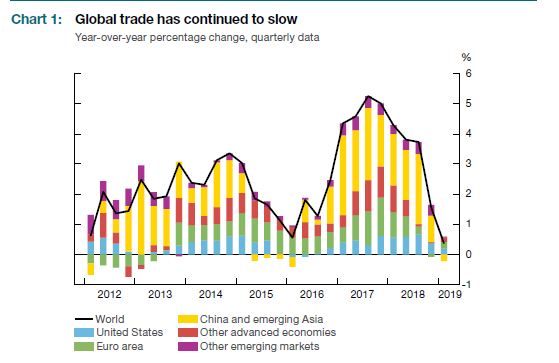

The trade conflict between the US and China is dampening global economic activity and spilling over to other countries trade and investment. Trade has slowed sharply in China and countries that share in its supply chains. The Bank of Canada's base-case projections include the effects of tariffs imposed to date and related uncertainty reducing with global GDP projected to be lower by 0.6 per cent at the end of 2021.

Chart Source: Bank of Canada

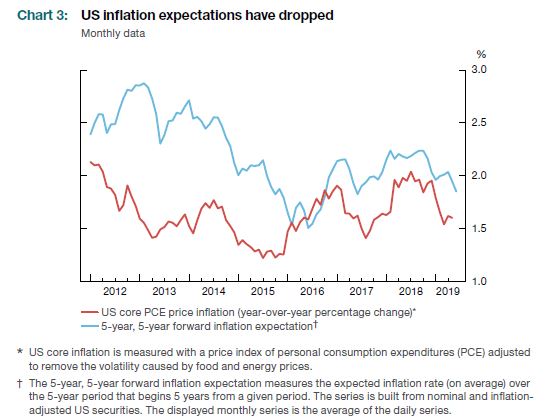

The US economy grew at a strong pace in Q1 due to rising net exports and inventories that offset weakness in household spending and from the federal government shutdown. Data for Q2 shows the economy softening due to trade conflicts and waning fiscal stimulus. The tight labour market in the US should support wage gains and household spending as the real GDP growth rate declines back towards potential in 2020 and 2021. US price inflation has declined to around 1.5 per cent in recent months due to transitory factors, but market-based inflation expectations have also recently fallen below 2 per cent. The US Federal Reserve has communicated a willingness to provide additional monetary stimulus to sustain the expansion.

Chart Source: Bank of Canada

Euro area growth and inflation will remain modest as political and trade uncertainty dampen business sentiment. The labour market has been performing well and household spending should support growth. Continued weak inflation has led the European Central Bank to signal that policy interest rates will remain low for longer.

China's export growth has slowed significantly while imports from the US and some East Asian countries have declined. Policy support is expected to help the economy although it could exacerbate financial vulnerabilities. Oil importing emerging-market economies are experiencing a broad-based slowdown in 2019, but will improve in 2020 with Turkey emerging from recession and other country specific challenges dissipating.

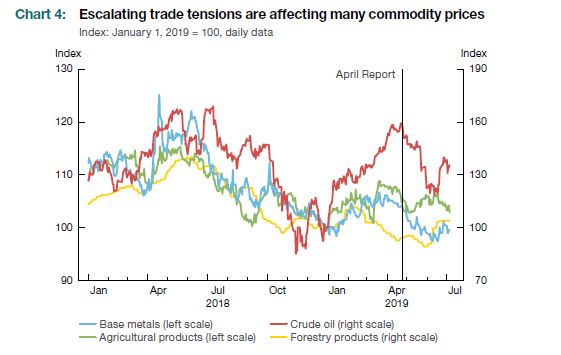

Despite geopolitical tensions and an extension in OPEC productions cuts, oil prices have declined since April. Challenges in global manufacturing are putting downward pressure on base metal prices. Lumber prices have risen in recent months because of production cuts or closures at several Canadian sawmills.

Chart Source: Bank of Canada

Canada Growth Outlook

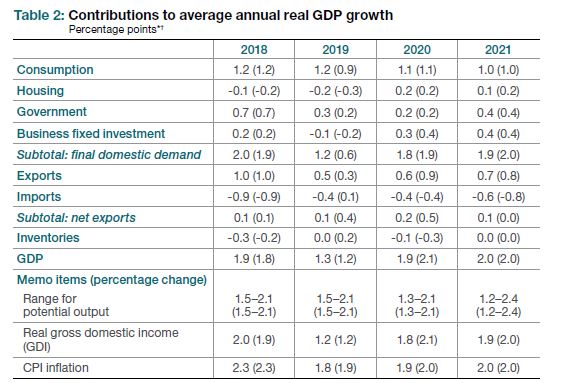

Global trade conflicts and related uncertainty will hold back activity in Canada and are the main headwind to the outlook. The Bank of Canada revised its real GDP projection up 0.1 percentage points to 1.3 per cent for 2019 and down 0.2 percentage points to 1.9 per cent for 2020. Growth in the Canadian economy is expected to be broad-based although the oil sector will continue to adjust. After below-potential growth in 2019, the economy will grow slightly faster than potential in 2020 and 2021 as consumption expands moderately, housing recovers and there is improvement in exports and business investment.

Chart Source: Bank of Canada

The Bank of Canada estimates that the economy was operating with an output gap between -1.25 and -0.25 per cent in Q2 2019 that is consistent with easing of capacity pressures and labour shortages reported in the Business Outlook Survey in 2019. Recent slowdowns in activity havebeen concentrated in some regions and industries. Employment growth is particularly strong in service sectors and outside oil-producing regions. The Canadian labour market continues to be healthy with the unemployment rate near an all-time low for the monthly Labour Force Survey. Prime-age participation rate are near historical highs and wages are rising.

Household consumption is expected to grow moderately in 2019 as elevated consumer confidence, labour income gains and climate action incentive payments from the federal government support spending in the short-term. Over the forecast horizon, consumption will continue to grow moderately as it is supported by wage gains, employment, and rising immigration. Spending decisions are also expected to be cautious because of elevated debt levels.

Household imbalances have stabilized and mortgage borrowing quality has improved. Lower mortgage interest rate are providing support to housing demand with the Bank of Canada noting that home sales rebounded in Q2 and new construction activity is anticipate to be up in Q3. Housing markets continue to differ across regions. Halifax, Montreal and Ottawa housing markets have strengthened with solid resales and new construction activity as prices rise moderately. Toronto has seen a recent increase in resales an and prices. Vancouver resales remain low and prices continue to fall. The outlook for new construction in Alberta is weighted down by challenges in the oil industry.

Business investment is expected to strengthen despite elevated trade policy uncertainty. A positive environment for business investment is being driven by capacity constraints, digitalization trends, government incentives and low financing costs. The Bank of Canada expects a solid pace of expansion for sectors outside oil and gas sector. Large projects such as a liquefied natural gas terminal in British Columbia and the Trans Mountain Pipeline expansion will lift spending. Investment in the oil and gas sector projected to contract 20 per cent in 2019 and stabilize afterwards. Firms in the energy sector note transportation capacity and production curtailments weighing on prospects.

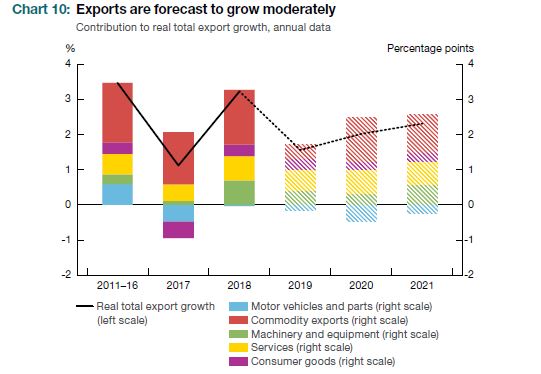

Exports are projected to have a moderate expansion over projection horizon even as competitiveness challenges and global trade policy uncertainty weigh on growth. Recent developments have been mixed with removal of US steel and aluminum tariffs and progress towards Canada-United States-Mexico(CUSMA) ratification, but also new trade restrictions being imposed by China. Non-commodity exports are projected to rise, but auto sector exports will decline based on changes to production mandates. Exports of services are expected to continue to expand at a strong pace.

Chart Source: Bank of Canada

Inflation Outlook

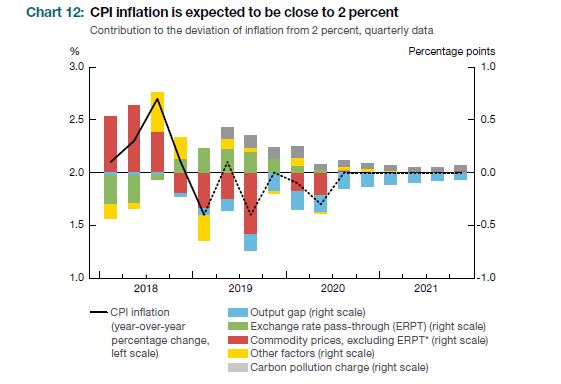

CPI inflation is expected to temporarily decline to 1.8 per cent for 2019 and then return to around 2 per cent in 2020 and 2021. Lower oil prices and the removal of tariff countermeasures on US steel and aluminum are factored into the inflation projection for the next year. Economic slack is expected to put modest downward pressure on inflation that is largely offset by small boost from federal carbon pollution charges. As economic slack is concentrated, the impact on inflation may be less than if economic slack were uniform across the country.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is September 4, 2019. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on October 30, 2019.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive