The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

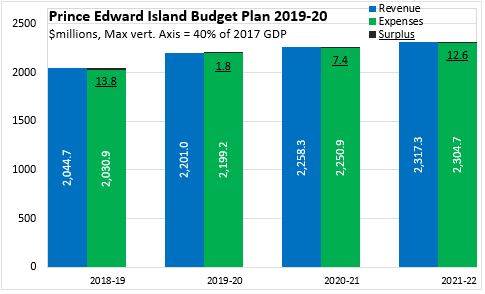

June 26, 2019PRINCE EDWARD ISLAND BUDGET 2019-20 The Province of Prince Edward Island has released its 2019-20 Budget, featuring a small surplus of $1.8 million in 2019-20. Both revenues and expenses have increased compared to last year's fiscal plan, however the budget surplus remains little changed compared to last year's plan.

In 2019-20, Prince Edward Island's revenues are projected to grow by 7.6 per cent (notably from Federal sources) while expenditures rise by 8.3 per cent. Thereafter, revenue growth slows to 2.6 per cent per year from 2019-20 to 2021-22 while expenditure growth slows to 2.4 per cent per year.

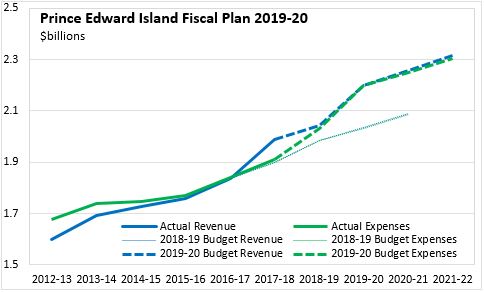

The projected rise in revenues in 2019-20 was not anticipated in the previous Budget's 3-year outlook. Higher revenues are largely matched by rising expenditures. Furthermore, higher revenues and expenditures are projected to carry out through the planning horizon out to 2021-22.

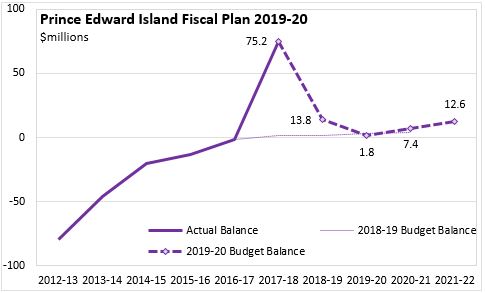

Although Prince Edward Island has reported stronger-than-budgeted surpluses in each of the last two fiscal years, the planned surpluses for 2019-20 and the next two years are about the same as projected in the 2018-19 provincial Budget, rising from $1.8 million in 2019-20 to $12.6 million by 2021-22.

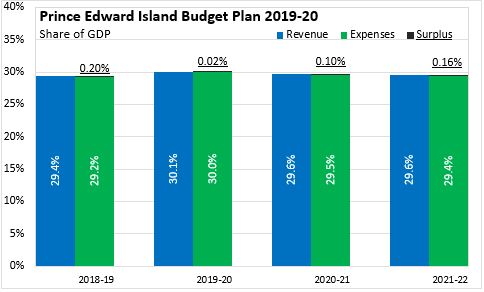

Prince Edward Island's Budget is expected to remain very stable, measured as a share of nominal GDP. Revenues range from 29.4-30.1 per cent of GDP while expenditures range from 29.2-30.0 per cent of GDP. Prince Edward Island's expected surpluses amount to 0.2 per cent or less of nominal GDP.

Prince Edward Island's net debt-to-GDP ratio is estimated at 31.3 per cent for 2018-19. Prince Edward Island's net-debt-to-GDP ratio is projected to fall to 30.7 per cent by the end of 2019-20. It is projected to decline in each of the next two fiscal years, reaching 29.1 per cent by the end of 2021-22.

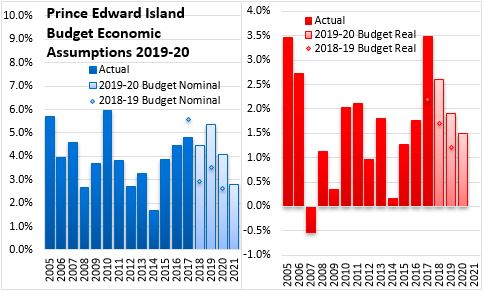

Owing to very strong immigration, Prince Edward Island's economy has enjoyed several years of stronger economic growth, particularly from higher retail sales and housing construction. The Prince Edward Island economic outlook has been revised up compared with last year's outlook (though nominal GDP growth fell short of expectations in 2017). Strong GDP growth is projected for 2019 and 2020, with high immigration and improved retention rates. Rising investment and tourism are also expected to be strong contributors to short run economic growth on Prince Edward Island. Over the medium term, continued investment and industrial expansion should support rising shipments and exports, though the Budget anticipates that the pace of growth will slow in the medium term.

Key Measures and Initiatives

The new government of Prince Edward Island noted that it "inherited a sound economic environment and a strong approach to fiscal stewardship" and the 2019-20 Budget reflects input from all parties of the Legislature. In addition to rising expenditure commitments for health care, education, affordable housing and infrastructure, Prince Edward Island's Budget also:

- Raises the Basic Personal Amount for personal income tax from $9,160 to $10,000 (effective January 1, 2020)

- Lowers the small business corporate income tax rate by 0.5 per cent to 3.0 per cent (effective January 1, 2020)

- Increases the threshold for calculation of the low-income tax reduction from $17,000 to $18,000.

Prince Edward Island Budget 2019-20

<--- Return to Archive