The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 24, 2019STUDY: MEASURING INVESTMENT IN DATA, DATABASES AND DATA SCIENCE Statistics Canada has released a study on how national accounting concepts and methods for measuring data can be expanded to identify changes in society related to the rising usage of data. Data usage has increased significantly due to the ease and low cost of capturing, storing and analyzing information. However, data have little visibility in the modern national accounting framework (as assets, factors of production or outputs) because economic indicators released by statistical agencies are mostly market-determined values. Examples of where data production has been missed include organizations producing data for own use, and households offering data to organizations as payment-in-kind for services, such as Facebook, Google and many other online services.

The paper aims to address this issue by expanding current national accounting concepts and statistical methods for measuring data. By exploring various case studies, the paper addresses key questions such as: (1) what are the types of data, (2) what are the data sources, and (3) how are data produced. These questions are explored using an information chain model, and a classification system/typology for data is proposed. The paper also discusses the topic of data ownership in relation to the System of National Accounts (SNA).

This paper is an effort to build upon the established economic statistics framework in a way that makes the roles of data, databases and data science more evident. It elaborates on the character of these three product types and tries to situate them within the modern SNA structure. A subsequent paper is expected, which will offer a range of numerical estimates of the size of recent investments in data products, and in the associated accumulation of capital assets in Canada.

Defining Data and the Information Chain

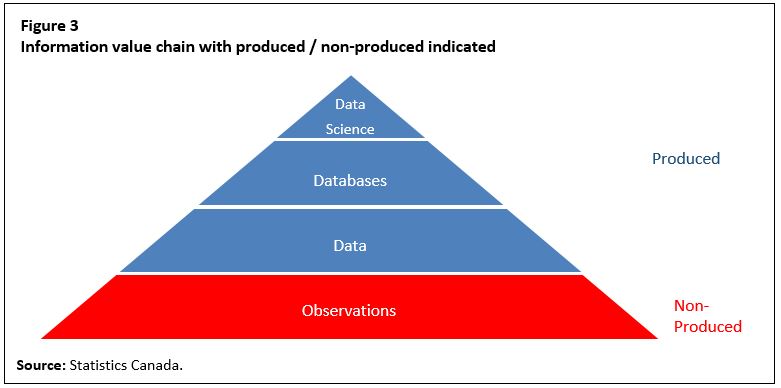

For the purposes of the study, data are defined as observations converted into a digital form that can be stored, transmitted or processed. This definition places data within a larger information chain, with four unique and separable states. The base of the chain is formed by observations. Recorded observations form the second ‘data’ layer of the chain. Data can be produced, and if done for economic purposes, the SNA recommends recording the creation of data as production. Additional value can be added by organizing and structuring data into a database, to permit resource-effective access and use of the data. Databases or structured data form the third tier of the information chain. The fourth tier involves insights or new knowledge from organized data through ‘data science’. This part of the information chain is in keeping with the 2008 SNA definition of ‘research and development’.

Identifying which parts of the information chain are ‘produced’ and which are ‘non-produced’ determines what gets included in gross domestic product (GDP). For the SNA, databases are recognized assets and are produced, with the value often grouped with database management software. Research and development, including data science, are recognized as produced assets within the Canadian System of National Accounts (CSNA) under the asset category ‘intellectual property products’. While the CSNA conceptually includes all data science assets, the study claims that the information collected is biased towards the selection of firms engaged in more traditional forms of research and development (e.g. pharmaceuticals). The number and diversity of firms engaged in data science activities is likely underrepresented.

According to the 2008 SNA, since there is no production process leading to their existence, observations and data fall outside the economic production boundary. Increases in observations or data are viewed as having no impact on measures of economic activity such as GDP. However, ‘data’ as defined by the paper requires a process to convert observations into bytes of data. Furthermore, businesses and households spend significant resources protecting data, and an increasing number of businesses are selling data as either a primary or secondary output, suggesting that data are a product that should be considered by the SNA.

Transfer of Ownership

The study argues that data are an asset used on a continuous basis in the process of production. As with other kinds of intellectual property, data can be duplicated, sold and easily transferred from one location to another. Transferring data from one location or economic territory to another poses a significant challenge for the SNA measurement framework. If data are moved, the national accountant would flow data’s share of value added to the country where the data are located. Given the ease with which data can be transferred from one location to another, this may lead to results where large amounts of value added are allocated to economic territories where very little of the relevant economic activity is taking place.

To avoid this issue, the authors purpose that data assets should be ‘located’ where the data are used, even if the data reside on a server in another economic territory. The rationale for this approach is tied to the valuation method. The value of gross fixed capital formation of data is tied, to a large extent, to the value of labour and capital used to produce the data. The idea is that the information should not be separated from the factors of production that brought it into existence.

Valuing Data Assets

According to the study, there is a need to develop methods of determining the economic value of data, given that the market for data is relatively new. The fact that people are engaged in data-related activities points to a potential method of valuing data. The study purposes using a sum of costs approach, where the value of the asset is represented by the sum of the costs of the inputs used to create the asset plus an appropriate rate of return. While new ‘data accumulator’ firms selling data have emerged in recent years, the authors of the study suggest that a more mature marketplace is needed before these firms can be used as a source for valuing data.

Daily release | Full article

<--- Return to Archive