The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

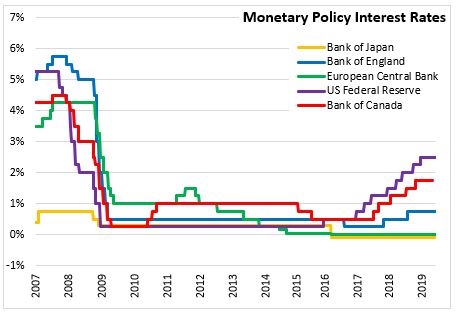

May 29, 2019BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.00 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that recent data reinforces their view that the slowdown in late 2018 and early 2019 was temporary and future policy decisions will remain data dependent, particularly to developments in household spending, oil markets and global trade environment.

Recent economic data for Canada is inline with the Bank of Canada's projection from April with the slowdown in late 2018 and early 2019 not continuing into the second quarter. The oil sector is beginning to recover as production and prices rise. The housing market appears to be stable but there has been weakness in some regions. Recent pickups in consumer spending, exports and a firming of business investment growth have been positive developments. The escalation of trade conflicts has heightened uncertainty about economic prospects for global economy and Chinese trade restrictions on Canadian exports are having a direct effect. However, the removal of US steel and aluminum tariffs and prospects of CUSMA ratification are positive for Canadian exports and investment.

Inflation continue to evolve in line with projections with Bank of Canada expecting CPI inflation to remain near 2 per cent in coming months. Measures of core inflation have remained close to 2 per cent.

Bank of Canada

<--- Return to Archive