The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 07, 2019STUDY: ECONOMIC WELL-BEING ACROSS GENERATIONS OF YOUNG CANADIANS: ARE MILLENNIALS BETTER OR WORSE OFF? Statistics Canada recently published an article on the economic well-being of young Canadians over time. Economic well-being refers to the ability of households to meet their needs, accumulate assets, and build wealth. The study answered two questions:

- Are millennial households better or worse off than previous generations at the same age in terms of income levels, debts, assets and net worth?

- Are some millennial households, such as those with lower levels of educational attainment or who did not invest in the housing market, being left behind in terms of building wealth?

The study compared household balance sheets of millennials and previous generations at the same point of their lives to determine differences in economic well-being. In this study, millennials were born between the years 1982 and 1991 (aged 25 to 34 in 2016) and are compared to Generation X (aged 25 to 34 in 1999) and Baby boomers (aged 25 to 34 in 1984). Income data came from the Canadian Income Survey and data on assets, debts, and net worth came from the Survey of Financial Security (1999 and 2016) and the Assets and Debt Survey (1984). All measures have been adjusted for inflation using the Consumer Price Index

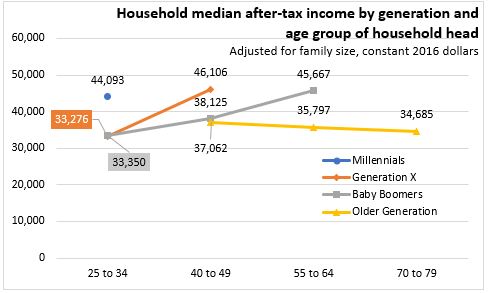

In 2016, millennials had real median after-tax household income of $44,093. This was higher than incomes of both Baby boomers ($33,350) and Gen-Xers ($33,276) of the same age.

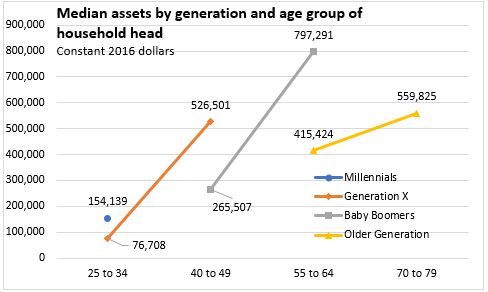

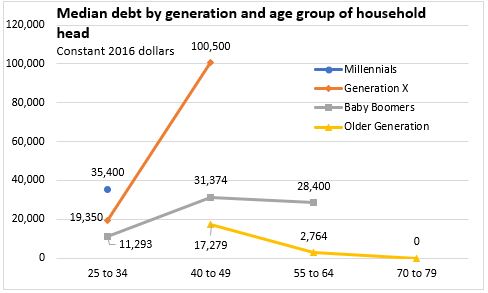

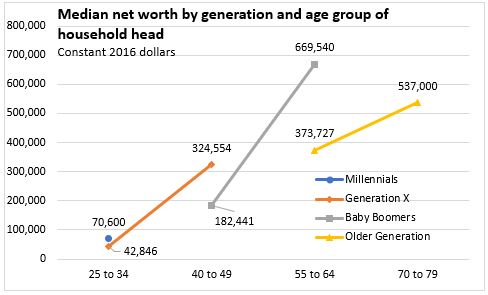

Compared to young Gen-Xers, millennials accumulated higher levels of both assets and debt. Median net worth (total household assets less debts) was $70,600 for millennials compared to $42,800 for Gen-Xers of the same age in 1999. Although millennials were relatively more indebted, their assets yielded a stronger outcome in terms of overall net worth. Higher net worth was mainly due to higher values for principal residences, which is coupled with higher mortgage debt. Data are not available to make the comparison for young Baby boomers.

Debt to after-tax income levels have grown for younger generations. Millennials had the highest debt-to-income ratio at 216% - more than 1.7 times higher than for young Gen-Xers and 2.7 times higher than for young Baby Boomers. It was also the highest among different generations at any point in their lives.

This study takes place during a period of significant home price inflation, while millennials continued to enter the housing market at the same rate as previous generations of young adults. Although homeownership rates were similar across generations of young Canadians, millennials (aged 30 to 34) took on larger mortgages relative to their incomes than previous generations. The median value for mortgage debt on principal residences for millennials was 2.5 times the value of median after-tax income. This is compared to 1.8 times the median after-tax income of young Gen-Xers, while mortgage values and incomes were similar for young Baby boomers.

Disparities in economic well-being have become larger from one generation to the next. The spread in net worth between the top 25% and the bottom 25% of millennials is larger compared to young Gen-Xers. The disparity is more pronounced at the top of the distribution, as the top 10% of millennials held about 55% of the total net worth accumulated by all millennials.

Net worth was higher among millennials aged 30 to 34 who had bought a home ($261,900) compared to those who had not ($18,400). The study showed that millennials who are not homeowners are not accumulating the same wealth as homeowners, as only 8% of millennial renters had net worth greater than $216,900 (the median among homeowners) in 2016.

Millennials are more educated than the generations before them, with about 70% between the ages of 30 and 34 holding a post-secondary certificate compared to about 55% of Gen-Xers. Higher educational attainment was accompanied by higher student debt, and millennials had more student debt than previous generations. However, millennials with a university education were still in a better financial position with net worth of $116,000 compared to $34,100 with only high school education or less. This is partly explained by housing, as millennials with post-secondary education had higher principal residence values and mortgage debt than those with only high school.

Millennials living in Toronto and Vancouver had a higher median net worth ($145,000 and $91,000, respectively) compared to other cities or the national level. This largely reflects differences in housing markets across the country, as principal residence values were highest in Toronto and Vancouver. Among millennials in these two cities, median principal residence values were more than twice the national level.

Daily release | Full article

<--- Return to Archive