The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 22, 2019QUEBEC BUDGET 2019-20 The Province of Quebec released its 2019-20 Budget on March 21. In Quebec's financial framework, the province makes payments to a Generations Fund out of the surpluses it reports. These payments to the Generations Fund are typically the excess of revenues (plus any contributions from the Stabilization Reserve) over expenditures.

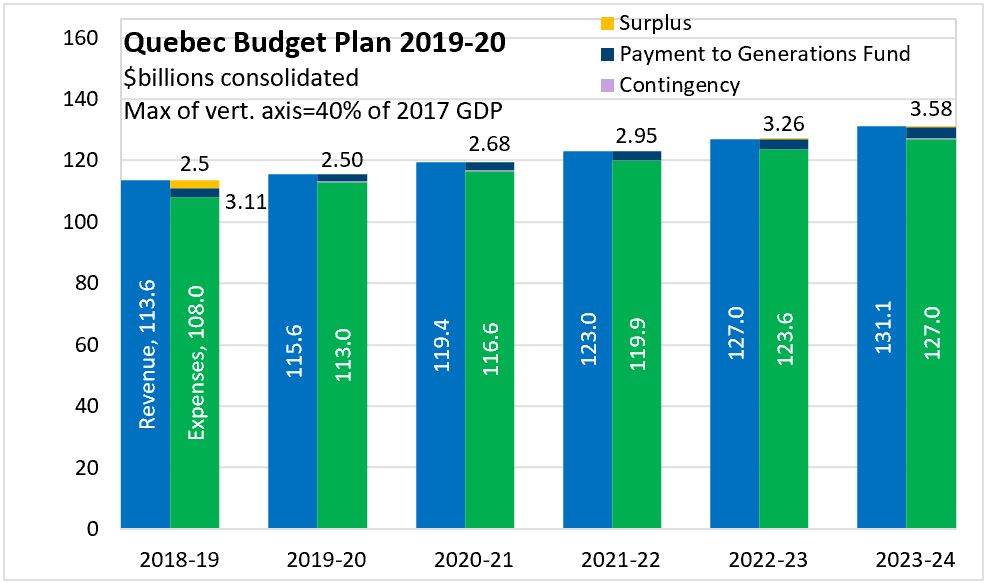

After making a $3.11 billion payment to the Generations Fund and recording an additional surplus of $2.5 billion in 2018, the Quebec government anticipates making only a $2.5 billion payment to the Generations Fund in 2019-20. These payments to the Generations Fund rise in each subsequent fiscal year, reaching $3.58 billion by 2023-24. Quebec includes a $100 million contingency in each fiscal year from 2019-20 to 2023-24.

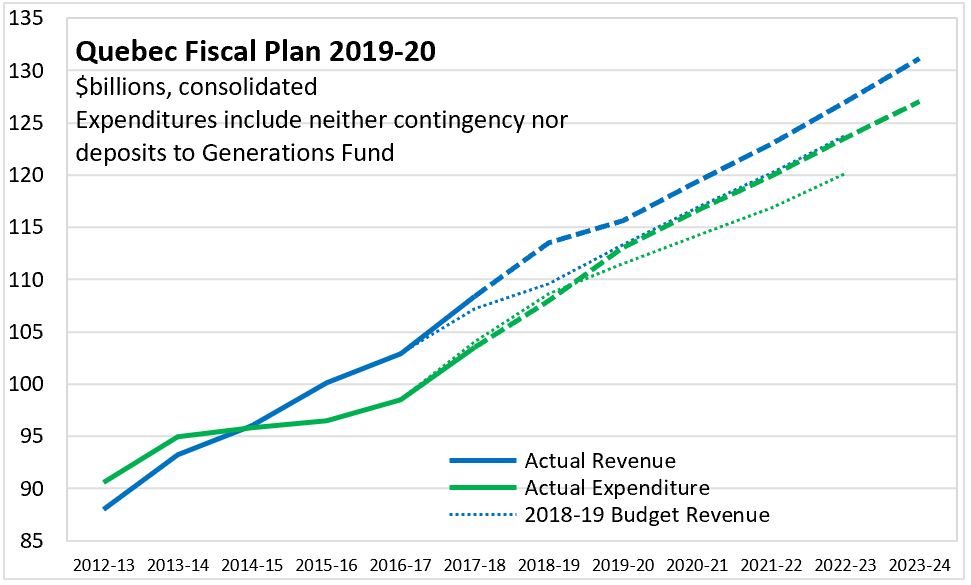

Economic growth in Quebec accelerated in 2017 and 2018. As a result, Quebec recorded stronger revenue growth than anticipated for 2018-19, contributing to a much larger surplus as expenditure growth was little changed. Going forward into 2019-20 and beyond, growth from Quebec's larger revenue base is expected to allow for higher expenditures to fund priorities while maintaining surpluses and reducing debt as a share of GDP.

Quebec's excess of revenues over expenditures (a surplus within the meaning of the Public Accounts, after contingency and before payments to the Generations Fund) reached over $5.6 billion in 2018-19, a $4.7 billion improvement over the 2018-19 Budget estimates. This is projected to narrow to $2.5 billion in 2019-20, though this is still over $700 million higher than anticipated at this time last year. In subsequent fiscal years, Quebec's surplus is projected to be in line with the previous fiscal plan, rising to over $4 billion by 2023-24.

Quebec's government maintains a very stable footprint in the provincial economy. From 2019-20 through 2023-24, revenues remain at 27.0 - 27.1 per cent of GDP while expenditures are stable between 26.2 and 26.4 per cent of GDP. Quebec's payments to the Generations Fund over this period are expected to rise slightly from 0.6 per cent of GDP to 0.7 per cent of GDP.

As the Generations Fund is used to reduce Quebec's debt, the province's net debt to GDP ratio is falling rapidly, declining from 42.3 per cent at the end of FY2018-19 to 40.0 per cent at the end of 2019-20. Quebec's net debt is projected to decline to 34.8 per cent of GDP by the end of FY2023-24.

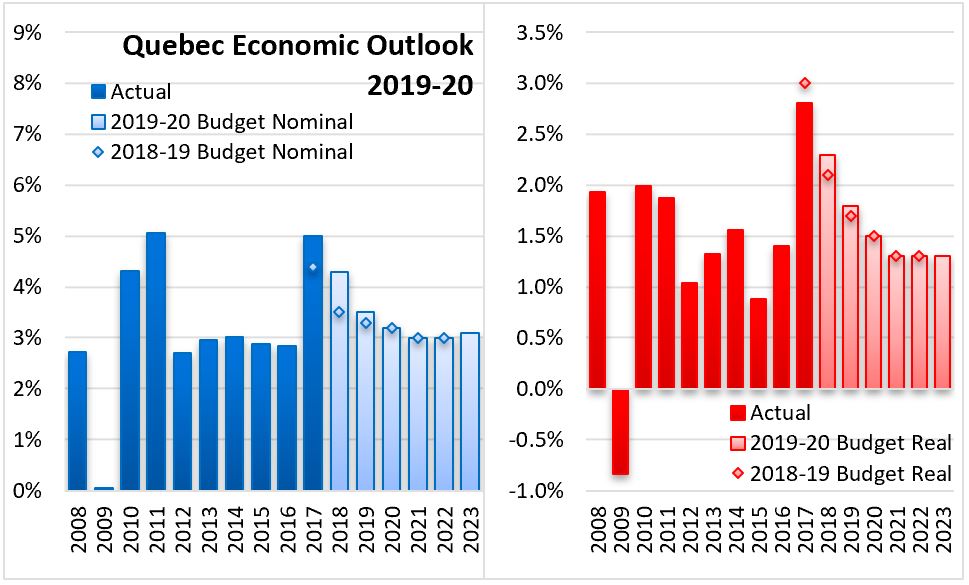

Quebec's economic growth accelerated to 2.8 per cent real GDP growth in 2017 (5.0 per cent nominal). Further real GDP growth of 2.3 per cent (4.3 per cent nominal) is estimated for 2018. Strong growth in GDP over the short run has outpaced the province's potential GDP growth, estimated at 1.3 per cent over the long run due to an aging population. For 2019, real GDP growth is forecast at 1.8 per cent (3.5 per cent nominal), followed by 1.5 per cent (3.2 per cent nominal) in 2020.

Quebec's recent growth spurt has depended on robust household spending on consumption and residential structures. The Quebec labour market remains tight, with low unemployment rates and wage gains that exceed productivity improvements. In the coming years, household spending is expected to contribute less to growth as there is little capacity for employment increases and interest rates normalize. Business investment is expected to pick up some of the burden of growth as Quebec's producers need to expand capacity. However, business investment growth is uncertain in an environment of global trade tensions and rising interest rates. Export growth is expected to continue at its elevated pace as the exchange rate remains favourable and Canada's new trade agreements reduce uncertainty. Import growth is expected to slow as domestic demand wanes. Inflation is also expected to moderate in the near term, further slowing growth in nominal GDP.

Key Measures and Initiatives

With more revenues available, the Quebec government is able to advance on a number of priorities: putting money back in the pockets of Quebecers, improving health and education services, increasing economic potential, acting for the environment and supporting communities. Key initiatives include:

- Putting money back in the pockets of Quebecers: elimination of additional child care fees over 4 years, standardization of school tax rates

- Education: rolling out kindergarten for 4-year olds across Quebec, adding an extra hour to secondary school schedules for homework/extracurriculars

- Health care: increasing funding for home care and adding new residential/long term care facilities

- Expand economic potential: enhance the incentive for older workers (over 60), integrate immigrants into the economy, increase capital to Investissement Quebec by $1 billion (to $5 billion) to improve capital investment, $200 million equity envelope for shipyards, spur innovation (with a focus on artifical intelligence) and boost regional development through broadband internet access

- Environment: extend the Drive Green program, support business investments in energy transformation.

- Supporting communities: enhanced social housing investment and repair, investments in transit and transformation of the taxi industry

Quebec Budget 2019-20

<--- Return to Archive