The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

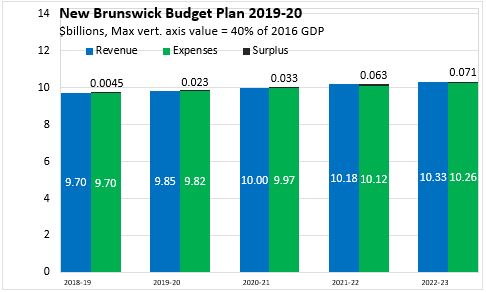

March 20, 2019NEW BRUNSWICK BUDGET 2019-20 The Province of New Brunswick released its 2019-20 Budget on March 19. New Brunswick anticipates ongoing balanced budgets including a surplus of $23 million in 2019-20. Surpluses are expected to rise over the next three fiscal years to $71 million by 2022-23. Revenues are projected to grow at an annual average rate of 1.6 per cent while expenditures grow by 1.4 per cent.

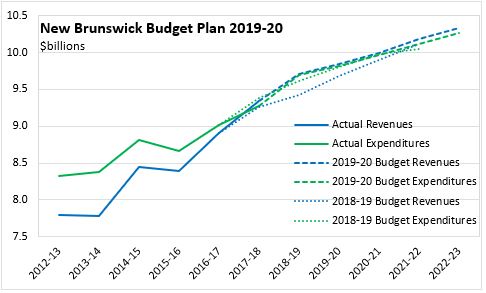

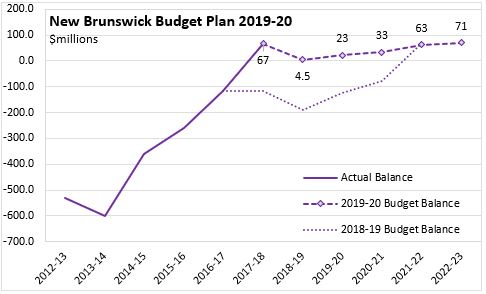

New Brunswick's fiscal outlook has changed since the 2018-19 Budget estimates. Revenue growth has been stronger than anticipated owing to higher corporate and personal income taxes, particularly in 2017-18. Faster revenue growth has allowed for higher expenditures and moving to a surplus earlier than anticipated.

The 2019-20 surplus would mark the third year of balanced budgets for New Brunswick. This is a notable improvement over the deficit projections made in the 2018-19 Budget. Most of the improvement came with unanticipated revenue growth for 2017-18. Over the next three years of the fiscal plan, New Brunswick's surplus is projected to rise to $71 million by 2022-23.

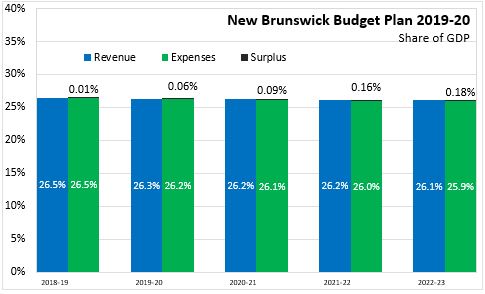

New Brunswick's surpluses are projected to be small relative to the size of the province's GDP. The 2019-20 and 2020-21 surplus projections are less than 0.1 per cent of GDP. New Brunswick's provincial government revenues are expected to decline from 26.5 per cent of GDP in 2018-19 to 26.1 per cent in 2022-23. Provincial government expenditures are projected to decline from 26.5 per cent of GDP in 2018-19 to 25.9 per cent in 2022-23.

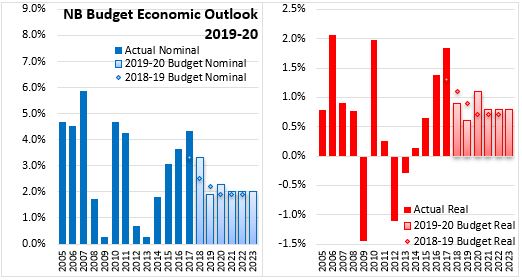

New Brunswick's economy outperformed expectations for 2017, contributing to its unanticipated revenue growth. However, the pace of this growth is expected to slow as manufacturing, housing and trade indicators all deteriorated in later 2018. New Brunswick's households are expected to slow their spending as they adjust to higher interest rates. Business investment is projected to slow with less major project spending anticipated in coming years. The New Brunswick Budget assumes that uncertainty will cloud the outlook for exports and investment until the new Canada-US-Mexico Agreement is ratified and implemented. There are also expected to be short-run impacts to production and exports resulting from shut-downs needed during repair of the Saint John refinery. Over the long run, New Brunswick's economic growth is expected to be limited by demographic shifts.

Key Measures and Initiatives

New Brunswick's Budget focused on returning to balance and reducing debt to put the province on a more sustainable fiscal path.

- Public capital spending will be $188 million (28 per cent) lower

- New Brunswick’s debt is projected to decline for the first time in 13 years

- Merging the Departments of Finance and Treasury Board and implementing enhanced quarterly reporting

- Increasing funding to the Office of the Auditor General

- Declining to implement Federal changes to taxation of passive investment income earned by a corporation

- Revised regulatory structure for repayable financial assistance programs for agriculture, aquaculture and fisheries

- Renewing a bursary program for students attending both public and private universities/colleges in New Brunswick

- Reintroducing the New Brunswick Tuition Tax Credit

New Brunswick Budget 2019-20

<--- Return to Archive