The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

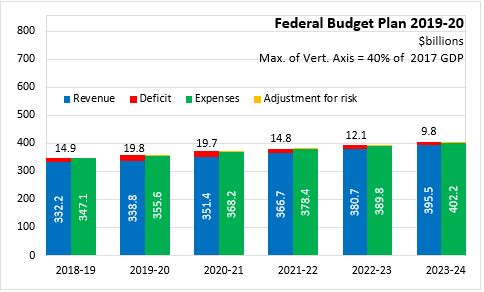

March 20, 2019FEDERAL BUDGET 2019-20 Canada's Federal Budget was tabled on March 19 with a deficit of $19.8 billion estimated for 2019-20. This is a $4.9 billion increase in the deficit compared with the latest forecast for 2018-19. However, the 2019-20 estimates include a $3 billion adjustment for risk that is not part of the 2018-19 forecast. The adjustment for risk is maintained in each of the next five fiscal years.

Through 2023-24, the Federal deficit is projected to narrow, but not be closed as revenue growth averaging 3.5 per cent per year outpaces expenditure growth averaging 3.0 per cent.

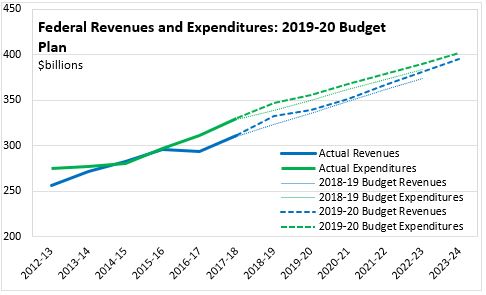

The latest forecast for 2018-19 anticipates that revenues will be $8.8 billion above the Budget estimate, including stronger increases reported for personal income tax, corporate income tax, harmonized sales tax and non-resident taxes. Expenditures for 2018-19 are $8.6 billion above the Budget estimate with several new initiatives announced in the Fall Economic Statement and in the 2019-20 Budget, including a new $1 billion transfer to the Green Fund administered by the Federation of Canadian Municipalities. Through the remainder of the five year planning horizon, Federal revenues are expected to return very close to the levels projected in last year's Budget. However, expenditures over the next five years are now projected to be higher than in last year's fiscal plan.

Stronger revenue growth and elimination of the adjustment for risk narrowed the deficit in 2018-19. However, the Federal government's revised fiscal plan in 2019-20 introduced a number of new measures that are expected to raise expenditures and increase the deficit in 2019-20 and the next two fiscal years. By 2023-24, the Federal deficit is projected to narrow to $9.8 billion.

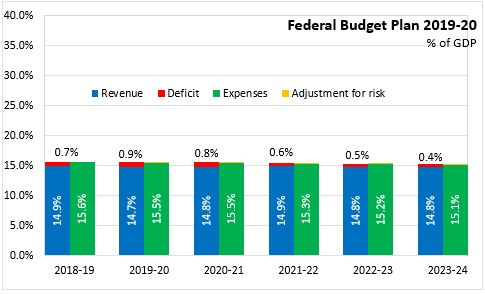

Measured as a share of GDP, the Federal deficit projections are small, amounting to 0.9 per cent in 2019-20 and declining slowly to 0.4 per cent of GDP by 2023-24. Over this time, Federal revenues are projected to maintain a steady share of GDP between 14.7 per cent and 14.9 per cent. Federal expenditures are projected to decline slightly as a share of GDP, falling from 15.5 per cent in 2019-20 to 15.1 per cent by 2023-24. The Federal governments debt is projected to fall from 30.8 per cent of GDP in 2018-19 to 30.7 per cent of GDP in 2019-20. Steady improvements are forecast to reduce the Federal debt:GDP ratio to 28.6 per cent by 2023-24.

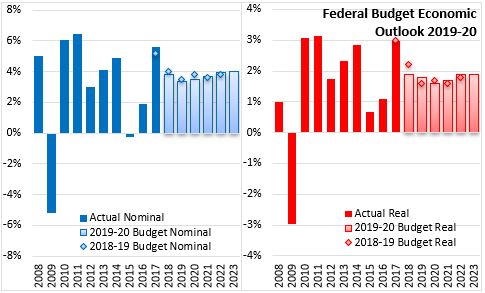

Canada's economy enjoyed robust growth in 2017 and the start of 2018. Like many other advanced economies strong growth in 2017 was not repeated in 2018 and projections. Economic growth for Canada is projected to slow again in 2019, particularly for nominal GDP as the pace of broad price growth slows. Although labour market conditions are strong (low unemployment rates, healthy wage growth), household spending and residential investment are expected to contribute less to growth. Oil-producing regions are still adapting to price volatility and transportation constraints. Households across Canada are adjusting to higher interest rates. Over the next couple of years, Canada's growth is expected to come from renewal of business investment as the uncertainty over trade agreements fade and non-energy exports are supported by a lower Canadian dollar.

Key Measures and Initiatives

The Federal Budget prioritizes improving economic security and advancing reconciliation with Indigenous peoples

- First time home buyers will be able to finance up to 10 per cent of the cost of a newly-build home through a shared-equity mortgage through the CMHC (5 per cent for a resale home). This is expected to reduce monthly cash outlay for younger Canadians who may struggle to accumulate a down payment.

- The limit for Home Buyers withdrawal from an RRSP will be increased from $25,000 to $35,000

- A Universal Broadband Fund will help meet a commitment to extend broadband internet service (50 Mbps download, 10 Mbps upload) to all residents by 2030.

- A new Canada Training Credit ($250/year refundable) will assist workers with training costs, accumulating to a maximum of $5,000 in lifetime credits.

- A new Employment Insurance training support benefit will begin in 2020, providing 4 weeks of income support every 4 years to cover living expenses while on training.

- The interest rates on student loans will be lowered to the prime rate (a reduction of 2.5 percentage points).

- A Canadian Drug Agency will be established to set up a national formulary and negotiate drug prices. Additionally, a national strategy for high-cost drugs used to treat rare diseases will start in 2022-23.

- The Guaranteed Income Supplement for Seniors will extend the earnings exemption to self-employment income starting in 2020-21. The amount of full exemption will be raised from $3,500 to $5,000 per year.

- The Federal Budget includes several provisions with new funding to advance reconciliation with Indigenous peoples, including closing the gap in living standards between Indigenous and non-Indigenous communities, extending funding for children's services based on Jordan's Principle, adding to funding for specific claims settlements and forgiveness of claim negotiation loans, and improving drinking water infrastructure.

- The Federal Budget includes a one-time addition of $2.2 billion in infrastructure funding for 2019-20 through the gas tax transfer to municipalities.

- Supply managed sectors (such as dairy) are eligible for funding to compensate for income losses and lost quota value as a result of new trade agreements (CETA, CPTPP).

Federal Budget 2019-20

<--- Return to Archive