The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

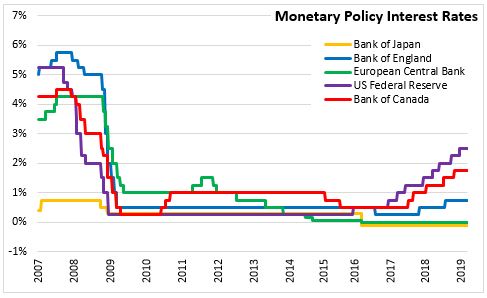

March 07, 2019MONETARY POLICY: EURO AREA At today’s meeting, the Governing Council of the European Central Bank (ECB) announced that the key ECB interest rates are unchanged with the interest rates on main refinancing operations, marginal lending facility and the deposit facility at 0.00%, 0.25% and -0.40% respectively. The rates are expected to remain at their present levels at least through the end of 2019 (previously Summer 2019), and for as long as necessary in order to converge inflation levels to around 2 per cent over the medium term.

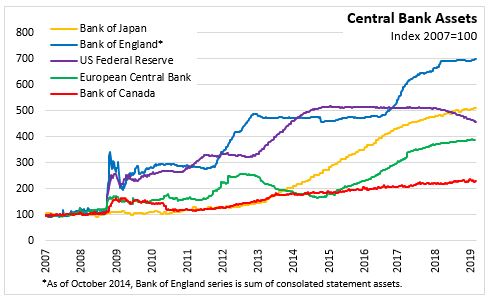

Net purchases under the asset purchase programme (APP) ended in 2018 and the ECB will reinvest the full principal payments from maturing securities for an extended period of time past the date when it starts raising key interest rates. The ECB introduced a new series in its targeted longer-term refinancing operations (TLTRO-III) that will allow banks to borrow, up to 30% of the stock of eligible loans at a rate indexed to the interest rate on the main refinancing operations, in order to preserve favourable lending conditions and to facilitate the smooth transmission of monetary policy.

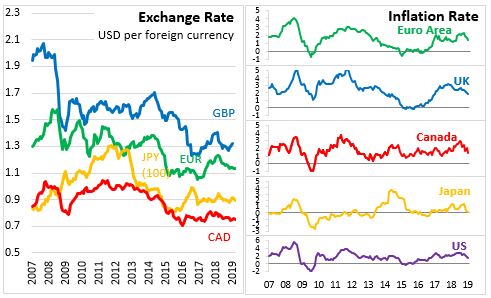

Euro area real GDP grew 0.2 per cent in Q4 2018. Recent data continued to be weak, particularly in the manufacturing sector and reflecting external demand slowdown. The impacts of the slowdown appear to be longer-lasting, but euro area expansion is being supported by favourable financing conditions, employment and wage gains, and expanding global activity. The ECB projections were revised down substantially in 2019 and slightly in 2020 with the expectations now that real GDP will grow by 1.1 per cent in 2019, 1.6 per cent in 2020, and 1.5 per cent in 2021

Euro area inflation was up to 1.5 per cent in February 2019, reflecting somewhat higher energy and food prices. Headline inflation is expected to remain around current levels before declining towards the end of 2019. Labour costs pressures have increased amid higher capacity utilization and tightening labour markets. The ECB projections for euro area inflation were revised down to be 1.2 per cent in 2019, 1.5 per cent in 2020 and 1.6 per cent in 2021.

Sources:

European Central Bank

<--- Return to Archive