The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

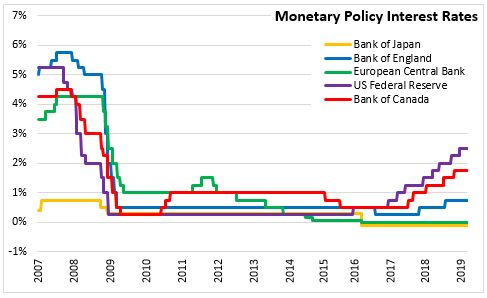

March 06, 2019BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.00 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that the economic outlook continues to warrant a policy interest rate below the neutral range. Recent data shows a mixed picture that generates uncertainty around the persistence of below-potential growth and impact on inflation outlook.

The Bank of Canada noted that the slowdown in the global economy is more pronounced and widespread than their forecast in January. Trade tensions and uncertainty are weighing on confidence and economic activity. Several central banks have eased financial conditions in acknowledgment of building headwinds to growth. Progress with US-China trade talks and policy stimulus in China have helped.

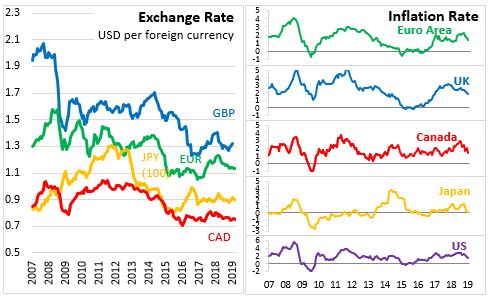

The Bank of Canada was projecting a temporary slowdown for end of 2018 into early 2019 due to the decline in oil prices last year. Weak exports and investment in the energy sector and a slowdown in household spending in oil-producing provinces were expected, but the slowdown in Q4 was sharper and more broad-based than anticipated. Consumer spending and the housing market were soft while employment and labour income had strong growth. Growth is anticipated to be weaker in the first half of 2019 than previously projected by the Bank of Canada.

Core inflation measures are close to 2 per cent while total CPI inflation fell to 1.4 per cent in January due to lower gasoline prices. CPI inflation is expected to be slightly below 2 per cent through most of 2019 reflecting temporary lower energy prices and wider output gap.

Bank of Canada

<--- Return to Archive