The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 20, 2019BRITISH COLUMBIA BUDGET 2019-20 British Columbia has tabled its 2019-20 provincial budget.

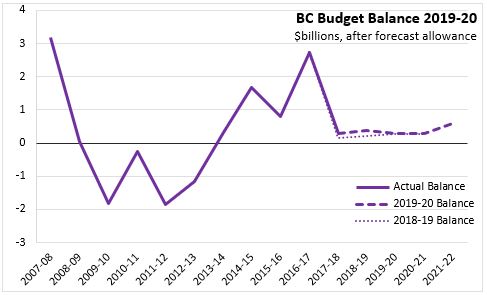

British Columbia anticipates a surplus of $274 million for the 2019-20 fiscal year. This is after a forecast contingency of $500 million as well as contingency vote of $750 million in the expenditure plan. In 2020-21, both revenue and expenditure growth are expected to slow, but the surplus remains at a similar level at $287 million.

In 2021-22, the British Columbia government expects revenue growth to outpace expenditure growth, increasing the surplus to $585 million.

In each of fiscal years 2020-21 and 2021-22, the British Columbia government provides a $300 million forecast contingency as well as a $400 million contingency vote.

The government expects to end the 2018-19 fiscal year with a surplus of $374 million, while maintaining a forecast contingency of $500 million. This is a larger surplus than originally estimated in the 2018-19 Budget (and a larger forecast contingency).

Growth in 2018-19 revenues from personal and corporate income taxes was revised up (particularly on adjustments to prior years). This stronger revenue was partially offset by erosion in property tax revenues, sales taxes as well as net income from the Insurance Corporation of British Columbia (higher claims costs) and BC Hydro (writing off rate smoothing regulatory account). British Columbia's 2018-19 provincial expenses were also higher than in the Budget because of increased fire management costs, elimination of student loan interest, film tax credit claims as well as new supplementary spending on infrastructure and research.

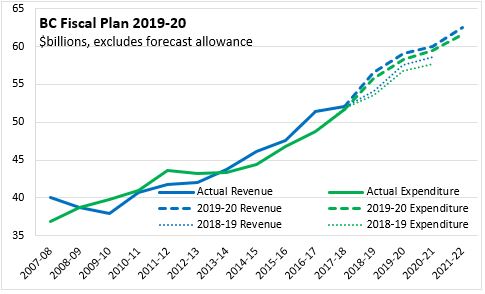

From 2018-19 through 2021-22, the British Columbia fiscal plan anticipates annual average revenue growth of 3.3 per cent and slightly faster growth in expenditures at 3.4 per cent.

The increase in tax revenues and expenditures reported in 2018-19 establish a new base for revenue and expenditure growth in 2019-20, 2020-21 and 2021-22. In the 2019-20 fiscal plan, the pace of growth of revenues and expenditures as well as the size of the British Columbia surplus are expected to be similar to those reported in the 2018-19 fiscal plan.

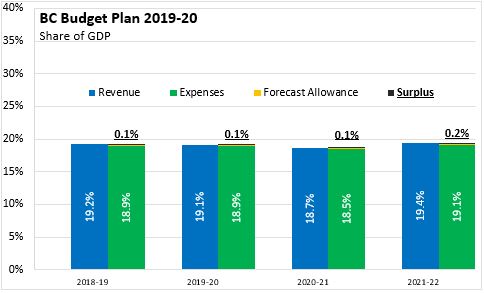

The size of the British Columbia government relative to the overall economy is expected to remain stable over the next three fiscal years with revenues between 18.7 per cent and 19.2 per cent of GDP while expenditures are between 18.5 per cent and 19.1 per cent of GDP. British Columbia's projected surpluses are between 0.1 and 0.2 per cent of GDP in each of the next three fiscal years.

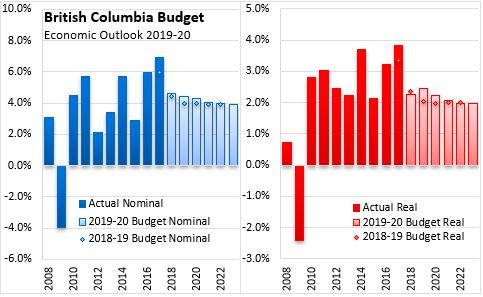

British Columbia's economy enjoyed strong real GDP growth in 2016 (3.2 per cent) and 2017 (3.8 per cent). Estimates for growth in 2018 (2.2 per cent) and 2019 (2.4 per cent) are more modest. For 2019 and 2020, the British Columbia economic outlook assumes that the source of growth will switch from residential activities and consumer expenditures to non-residential investment as construction of liquefied natural gas terminals gets underway. The British Columbia economic outlook notes that housing affordability remains a concern and may undermine the province's otherwise sound fundamental sources of growth such as population/employment growth and diversified trade. The British Columbia Budget's investment plan includes expenditures on housing and infrastructure to improve affordability.

Key Measures and Initiatives

The British Columbia Budget uses its increased tax revenues to fund new initiatives focused on affordability:

- A new BC Child Opportunity Benefit providing families with children under 18 up to $1,600 per year for one child, $2,600 per year for two children and $3,400 per year for three children.

- Eliminating interest on student loans with immediate implementation

- Increasing income and disability assistance payments by $50 per month

- Sharing gaming revenue with First Nations communities.

- CleanBC initiatives to reduce greenhouse gas emissions (zero emission vehicle adoption, home heating fuel switching)

British Columbia Budget 2019-20

<--- Return to Archive