The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

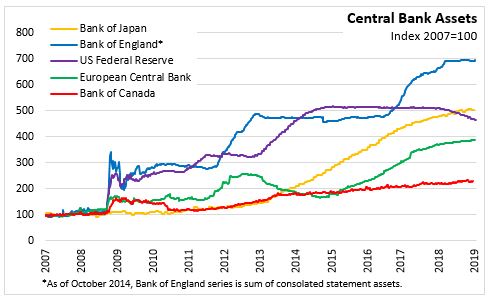

January 23, 2019BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan announced today that it will maintain a short term policy interest rate of negative 0.1 per cent on balances held by financial institutions with the Bank. The Bank will continue its purchases of Japanese Government Bonds in order to keep 10-year yields at around zero per cent. These bond purchases will be flexible, with amounts outstanding rising by about 80 trillion yen per year. The Bank will continue purchasing exchange-traded funds at 6 trillion yen per year and real estate investment trusts at 90 billion yen per year. Commercial paper (2.2 trillion yen) and corporate bond (3.2 trillion yen) holdings by the Bank will be maintained.

The Bank of Japan is continuing with its policy of "Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control", with the aim to achieve price stability target of 2 per cent, as long as is necessary for maintaining the target in stable manner. The monetary base will continue to expand until the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) exceeds 2 per cent and stays above the target in stable manner. The Bank of Japan noted that they intend to maintain the current extremely low short- and long-term interest rates for an extended period of time.

The Bank of Japan projects that the economy will continue on an expansion trend near its potential growth rate with growth of around 1.0 per cent per year through the fiscal year 2020. Overseas economies are expected to continue growing and produce a moderate increasing trend in Japan's exports. In terms of domestic demand, the virtuous cycle from income to spending is expected to be maintained by corporations and households against a background of accommodative financial conditions. A cyclical slowdown in business fixed investment and scheduled consumption tax increase are also factored into the outlook. Public investment is expected to increase due to Olympic Game preparations and rebuilding post natural disasters.

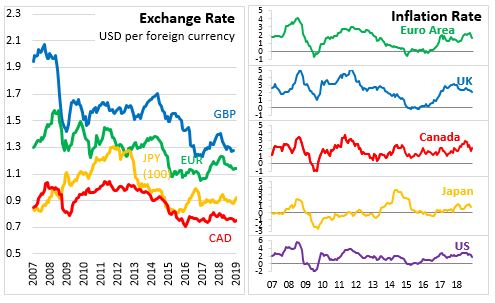

CPI growth has been positive but remains weak compared to the economic expansion and the labour market tightening that has occurred. The Bank of Japan noted that behaviours based on price and wage assumptions are deeply entrenched from the prolonged period of low growth and deflation. With significant room for productivity improvements outside the manufacturing sector and the high wage elasticity of labour supply among women and seniors, firms have maintained a cautious stance towards raising prices amid the economic expansion. The Bank of Japan expects CPI to increase gradually towards 2 per cent as the output gap remains positive and medium term inflation expectation rise. The CPI forecast (excluding effects of consumption tax hike) by the Bank is for increase of 0.9 per cent in fiscal 2019 and 1.4 per cent in fiscal 2020.

Source: Bank of Japan's Statement on Monetary Policy

<--- Return to Archive