The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 24, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada increased its target for the overnight rate by 0.25 percentage points to 1.75 per cent. The Bank Rate is correspondingly 2.0 per cent and the deposit rate is 1.50 per cent. The Bank of Canada expects that the policy interest rate will need to rise to a neutral rate to achieve the inflation target with the timing of rate increases taking into account how the economy is adjusting to higher interest rates and global trade policy developments.

Global Growth

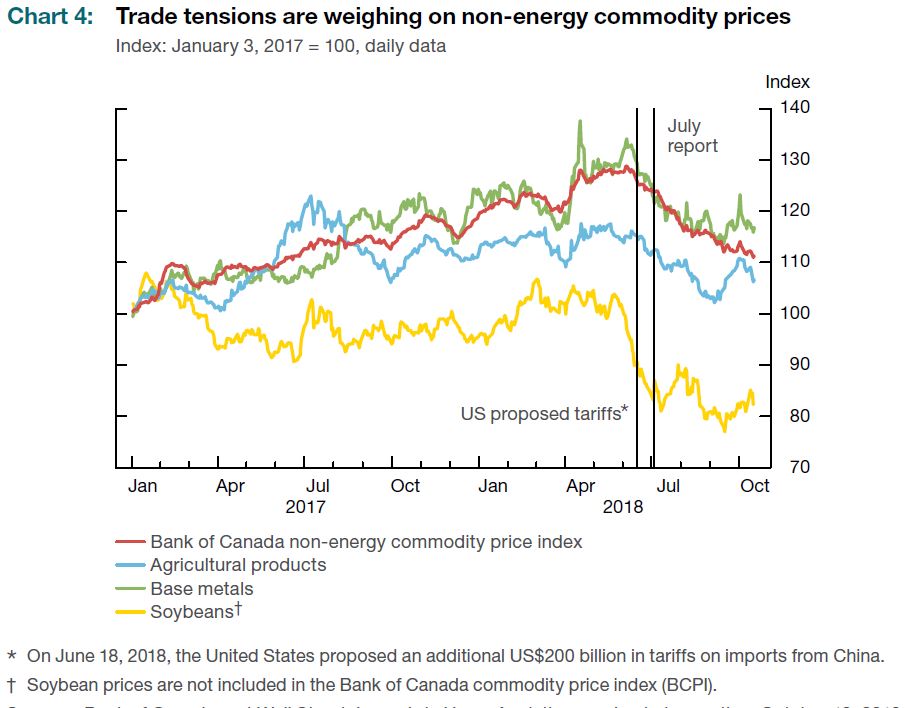

Global economic growth is expected to remain solid with the United States remaining strong while there are risks around global protectionism, emerging-market economies and China. United States trade tensions with other countries are weighing on some commodity prices and have likely contributed to a recent slowing in global trade and investment and if continue are estimated to reduce global gross domestic product (GDP) by 0.3 per cent by the end of 2020.

Chart Source: Bank of Canada

Recently, the United States economy has been expanding at a rapid pace with fiscal stimulus and robust consumption and business investment. The labour market is tight and wage growth is steadily rising. US exports benefited from a surge in the second quarter ahead of tariffs imposed by China. US businesses are reporting that trade policy uncertainty is dampening investment and tariffs are leading to higher prices on some products. The Bank of Canada forecasts that the US economy will grow above potential at 3 per cent in 2018 and 2.5 per cent in 2018 before moderating back closer to potential with growth of 1.5 per cent in 2020.

Euro area growth has been weaker than expected due to some temporary factors and appreciation of the euro while domestic demand is healthy. Growth should be around 2 per cent in 2018 but decline to around 1.5 per cent in 2019 and 2020 as monetary policy becomes less accommodating.

Financial conditions remain accommodative in most countries but will becomes less so in advanced economies as monetary policy stimulus is gradually removed. The Bank of Canada noted that emerging market economies are particularly vulnerable to tighter global liquidity as US denominated debt has risen in recent years. Even with new fiscal and credit stimulus, China's economy is expected to slow as US trade tensions weigh on exports and investment.

Trade concerns are putting down pressure on non-energy commodity prices. The Bank of Canada's non-energy commodity price index is 10 per cent lower than in July. Concerns for a slowing Chinese economy have weighed on base metal prices and tariffs against the United States are impacting prices in the agricultural sector. Lumber prices have fallen with lower than expected US housing demand. The decline in Western Canada Select (WCS) and non-energy commodity prices will weigh on Canada's terms of trade.

Chart Source: Bank of Canada

Canada Growth Outlook

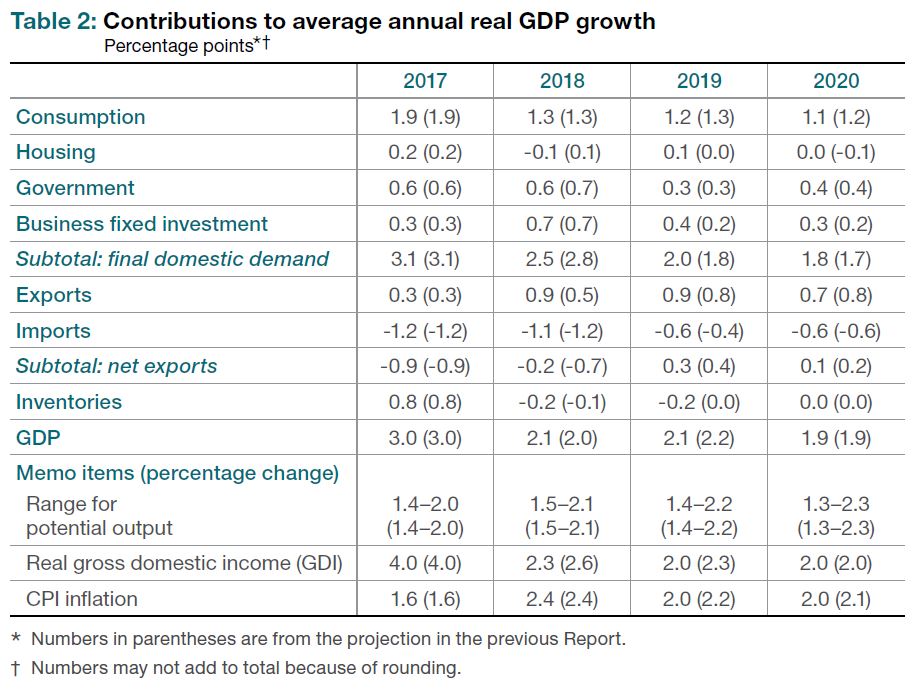

The Canadian economy is growing close to its potential and with a more balanced composition than last year. The economy is being supported with favourable financial conditions and by solid growth in foreign and domestic demand. The completion of negotiations of a new United States-Mexico-Canada Agreement (USMCA) removes a source of uncertainty for business investment and exports. Households will continue to adjust to higher interest rates and mortgage underwriting guidelines. Income and consumption are expected to grow with rising wages and a larger population.

Chart Source: Bank of Canada

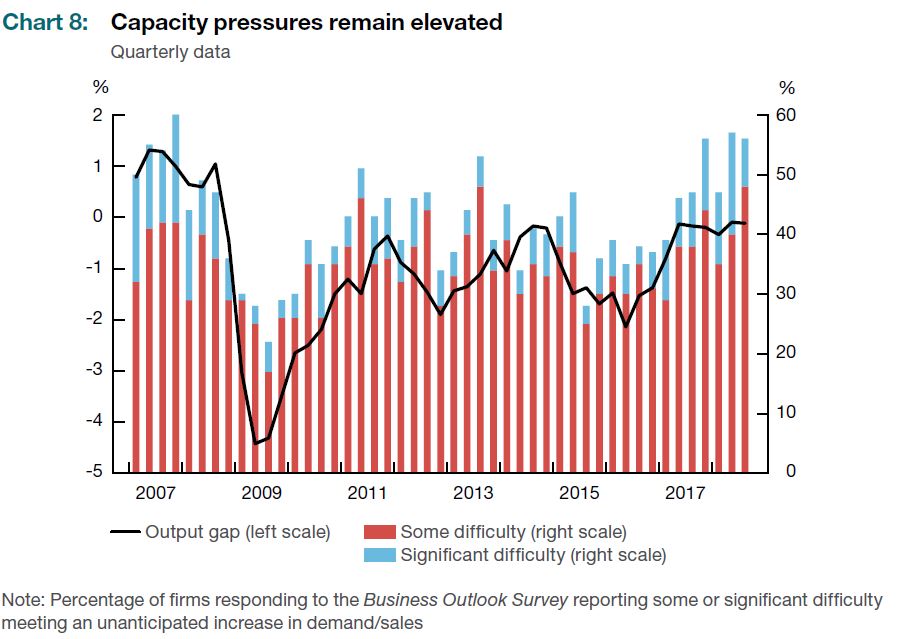

The Canadian economy has been operating near capacity for more than a year and firms report that capacity pressures are elevated and labour shortages more intense. The unemployment rate in September was 5.9 per cent, near its 40-year low. Wage growth has remained moderate but is expected to rise with a tightening labour market and productivity growth. The economy is projected to track close to its potential going forward with notable contributions from the non-residential construction (except oil and gas), non-durable goods manufacturing, wholesale trade, and professional and transportation services.

Chart Source: Bank of Canada

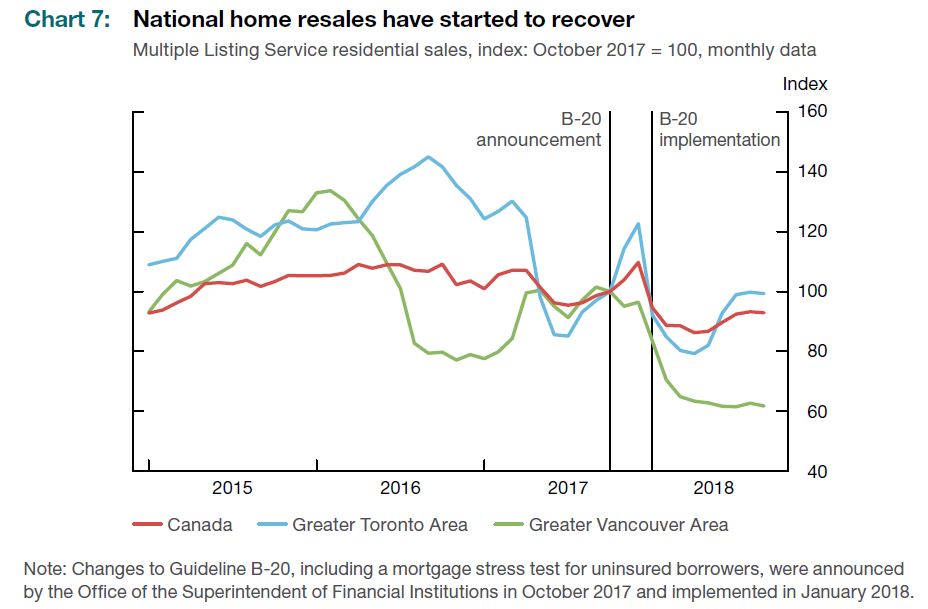

Income growth will support consumption and housing as household adjust to revised mortgage guidelines and higher interest rates. Net international migration has risen in recent quarters driven by work permit holders. Housing resales responded quickly to new mortgage guidelines and resale activity is expected to continue at lower levels than before the changes.

Businesses, outside oil and gas sector, are adding capacity as domestic and foreign demand continues to be solid. Corporate profits are near historical highs and confidence is elevated. The Bank of Canada's Business Outlook Survey (BOS) reports that investment intentions are strong due to solid demand, capacity pressures, and firms maintaining efficiency with competitors. Large scale investments (LNG projects) and adoption of digital technology are also positive for the investment outlook.

Exports are underpinned by solid foreign demand, growing export capacity and diminished uncertainty around trade policy. Transportation capacity is expected to remain as a restraint on the energy sector. The Bank of Canada assesses that Canada's exports will be lower by 0.6 per cent, over the period Q3 2018 to Q4 2020, due to lost competitiveness from US tax reform and uncertainty of global trade policies. Growth in non-commodity is expected to be broad-based with positive developments for machinery and equipment and professional services and support services amid rising US business demand. The auto sector will decline in part due to production mandates on Canadian auto assemblers.

Chart Source: Bank of Canada

Inflation Outlook

CPI inflation increased over the Summer to 3.0 per cent before declining back to 2.2 per cent in September. The Bank of Canada notes that inflation above 2 per cent has been primarily due to temporary factors such as gasoline prices in Q1 and airfare. Core inflation measures have remained close to 2 per cent, consistent with an economy operating near full capacity. CPI inflation is projected to decline from 2.7 per cent in Q3 2018 to close to 2 per cent in early 2019. The effects of past increases in gasoline prices and minimum wage are expected to fade out in Q1 2019 while tariff countermeasures will be out of the CPI calculation by the end of 2019.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is December 5, 2018. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on January 9, 2019.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive