The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

September 05, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.50 per cent. The Bank Rate is correspondingly 1.75 per cent and the deposit rate is 1.25 per cent. The Bank of Canada noted that higher interest rates will be warranted to keep inflation near target and that the Governing Council will take a gradual approach to policy adjustments.

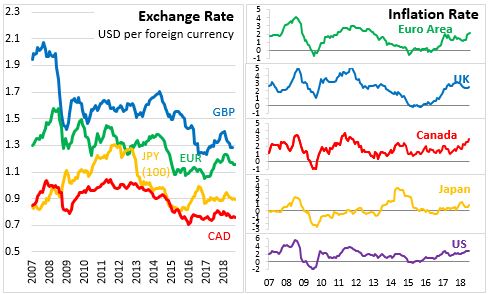

The global economy has been performing consistent with the Bank of Canada's expectations from their July Monetary Policy Report (MPR). The US economy is particularly strong with growing consumer spending and business investment. Trade tensions remain a key risk to global outlook and financial stresses have intensified in some emerging market economies. The Canadian economy grew 1.4 per cent in Q1, but rebounded with 2.9 per cent growth in Q2. The Bank of Canada forecasts that GDP growth will slow in Q3 due to fluctuations in energy production and exports. Trade policy uncertainty continues to weigh on businesses and the housing market is starting to stabilize amid higher interest rates and changes in housing policies. Continued growth in employment and labour income are supporting consumption while credit growth has moderated.

CPI inflation increased to 3.0 per cent in July due to an unexpected increase in the airfare component. The Bank of Canada expects inflation to move back towards 2 per cent in early 2019 as the effect of higher gasoline prices dissipates. Core inflation measures remain around 2 per cent, consistent with an economy near capacity.

Bank of Canada

<--- Return to Archive