The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

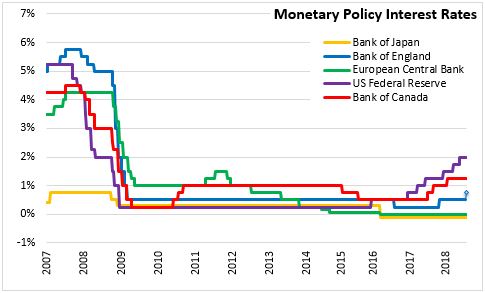

August 02, 2018MONETARY POLICY: UK The Bank of England's Monetary Policy Committee (MPC) voted unanimously to increase the Bank Rate by 0.25 percentage points to 0.75 per cent. The MPC also voted to maintain the stock of UK non-financial corporate bonds stock at £10 billion and the stock of UK government bond purchases at £435 billion.

The economic and inflation outlook continues to evolve in line with the MPC's expectations. If the economic and inflationary outlooks continue in line with expectations, the MPC projects that gradual and limited tightening of monetary policy is necessary to sustain inflation at its 2 per cent target.

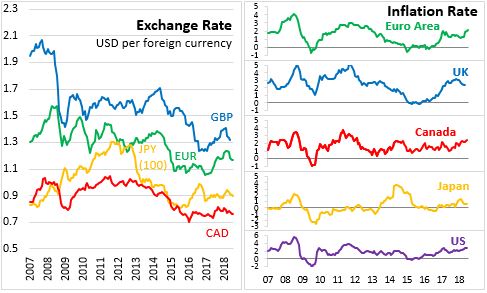

A dip in output for the first quarter appears to be temporary and the UK economy is expected to accelerate in the second quarter. There is little slack in the UK economy, evidenced by low unemployment rates. The UK's growth is expected to rely on improvements in trade and business investment while household consumption grows in line with subdued real incomes. Current excess inflation above the target is attributed to higher energy prices and the depreciation of the British Pound.

Including a rising Bank Rate over time, the Bank of England's GDP projection averages 1.75 per cent per year through 2020. Global growth exceeds potential while financial conditions are still accommodative. Over the forecast horizon, external inflationary pressures are expected to ease while domestic inflationary pressures rise. On balance between these factors, the MPC expects CPI growth slightly above target for the next two years before settling to the 2 per cent inflation target three years from now.

Bank of England

<--- Return to Archive