The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

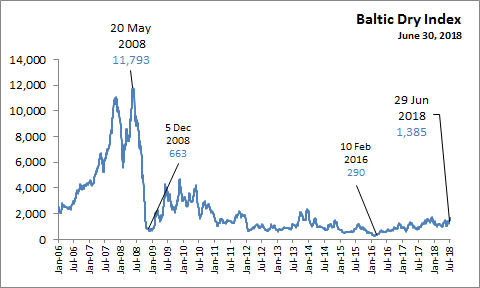

July 30, 2018BALTIC DRY INDEX SECOND QUARTER 2018 The BDI measures procurement costs of shipping raw materials by sea. When these costs go down, producers benefit from increased margins, and consumers benefit from lower prices for finished products.

On May 20, 2008, the Baltic Exchange reported the BDI = 11,793 a new high for the index. Before the year was out, the BDI dropped to 663 on 5 December 2008.

On February 10, 2016, the Baltic Exchange reported the BDI = 290 a new low for the index. When the index drops below 500, shipping companies tend to idle their fleets as variable costs cannot be recovered.

On the last trading day in June 2018, the Baltic Exchange reported the BDI = 1,385, an increase of 19 points over the last trading day in December 2017 (1366), and an increase of 1095 points over February 10, 2016.

On the last trading day of the quarter, 29 June 2018, the Baltic Exchange reported the BDI = 1,385. The BDI is below the recent high of 1743 reported December 12, 2017, but appears to be converging on the December high as recent activiity reports gains from the recent low of 948 in 6 April 2018, and the surge to 1,695 in 16 July 2018.

From media reports:

- As trade flows of commodities suddenly shift to avoid tariffs, and countries try to find alternative sources for resources, the Baltic Dry Index has increased 22 percent since June 22. Coal, iron ore, and grain are all in demand and maritime bulk carriers moving those goods are enjoying a favorable rate environment. Amazon.com

LLYod Baltic Dry

Bloomberg (interative chart)

Baltic Dry Index - BDI (BALDRY), wikinvest

The Shipping News

The Baltic Exchange

<--- Return to Archive