The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

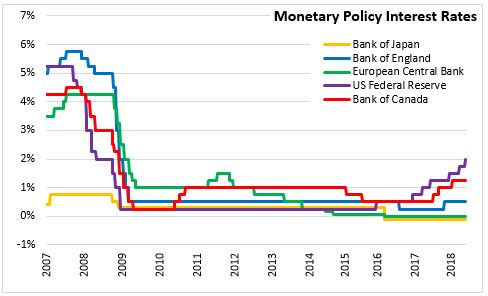

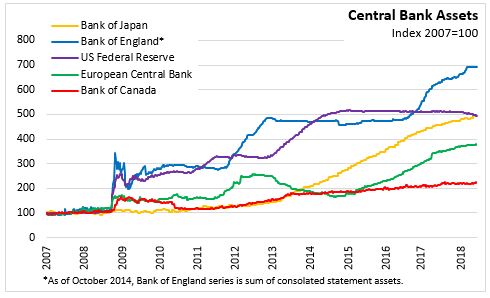

June 21, 2018MONETARY POLICY: UK The Bank of England's Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 0.5% and to maintain the UK non-financial corporate bonds stock of £10 billion and the stock of UK government bond purchases at £435 billion. The MPC notes that if the economy develops as expected than an ongoing tightening of monetary policy would be appropriate to return inflation to target. The MPC preference is to use the Bank Rate as the primary instrument for monetary policy and expects to maintain the stock of purchased assets until the Bank Rate reaches 1.5 per cent. Changes to monetary policy are expected to be gradual.

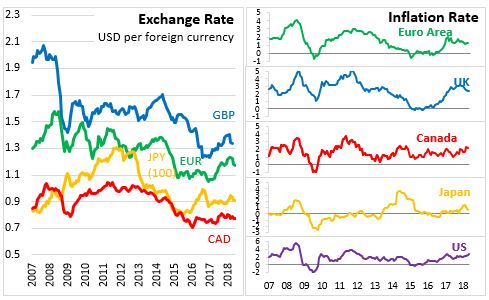

The Bank of England expects GDP to grow by around 1.75 per cent per year on average through 2020. Growth is expected to move towards net trade and business investment and away from consumption. The economy will be growing at a faster pace than a diminished rate of supply growth (1.5% per year) and as a result the economy will be operating with excess demand in 2020 that will feed into higher pay growth and domestic cost pressure. Weakness in Q1 appears to have been temporary with indicators of household spending and sentiment bouncing back in Q2. Employment growth has continued to be solid and global GDP prospects are sound.

CPI inflation was unchanged at 2.4 per cent in May but is projected to increase in the near term due to higher oil prices and a weaker exchange rate. Pay growth has picked up compared to last year and the labour market remains tight.

Bank of England

<--- Return to Archive