The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 25, 2018TRADE GAIN AND GDP GROWTH 2016 PURCHASING POWER

The object of the following analysis is to address the use of important trade indicators, and Nova Scotia’s international trade performance. The primary indicator is real gross domestic income (rGDI) and its growth, relative to other economic indicators.

Real gross domestic income (rGDI) measures the purchasing power generated by domestic production and international trade. The difference between GDIr and GDPr is refered to as the “Trade Gain” or “Trade Loss” related to international trade. Over time, the volume of exchange between international exports and international imports can change (fewer exports required to purchase more imports, or vise-versa). The ability to purchase more with less is an increase in purchasing power – a wealth effect. The converse is a decline in purchasing power.

Thus, a change in the Purchasing Power, or GDIr, is equal to

- the contribution of changes in real gross domestic product (GDPr),

- the contribution of changes in foreign exchange (value of CDN$ in international markets).

- The contribution of changes in the terms of trade (commodity prices)

The contribution of the foreign exchange rate is the net change between domestic and international prices, weighted by the relative size of the international market to the domestic market. The contribution of the terms of trade is weighted by the average price change for imports and exports.

Changes to the volume of exchange in international trade are attributed to changes in the province’s terms of trade and the foreign exchange rate. While terms of trade and foreign exchange have an impact on the whole economy, international trade represents only a small portion of the economy, and thus the impact of the international trade section will be somewhat muted. Trading gain measures the contribution of international trade on the relative wealth of the provincial or national economy.

Real GDI is an alternative (and arguably better) measure of the material standard of living or investment in production capacity. It is a more accurate reflection of involvement in international trade.

By definition, GDIr can be greater than, equal to, or less than GDPr. Thus “trade gain” could also be a “trade loss”.

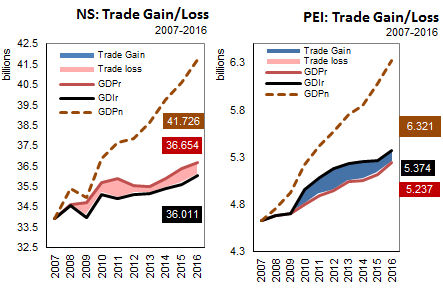

For example, in Nova Scotia, over the period 2008-2016, real gross domestic income (GDIr) fell below real gross domestic product (GDPr), resulting in a trade loss. In contrast, over the period 2009-2016, Prince Edward Island reported real gross domestic income (GDIr) higher than real gross domestic product (GDPr), resulting in a trade gain.

Computed from CANSIM Tables 384-0038.

<--- Return to Archive