The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 25, 2018TRADE GAINS: PROVINCIAL SUMMARY, 2016 Trade Gain

Trade gain is a measure of the contribution of the terms of trade and the real exchange rate to growth in real gross domestic income (rGDI). Trade gain measures changes in the (provinces’) terms of trade, and the real exchange rate. Sometimes these elements work in concert, sometimes in opposition.

The terms of trade is a component of trade gain. By definition, changes in the terms of trade directly impact the purchasing power of domestic production. A change in the terms of trade is not a change in GDP.

In our model, the terms of trade is the ratio of indices of export and import prices. The evolution of a country's balance of external trade depends not only on changes in the volume of goods and services exported and imported but also on the prices at which they are traded. Thus, the ratio of export to import prices -- "the terms of trade", determines the volume of exports necessary to pay for a given volume of imports or, analogously, the volume of imports which can be purchased with the proceeds of a given volume of exports. Other things being equal, if the price of exports falls relative to that of imports (a fall in the terms of trade), the trade balance will deteriorate, and vice versa.

Changes in the terms of trade are the result of price changes in the international market, while changes in foreign exchange measures changes between the foreign and domestic prices.

The other component contributing to the growth of real gross domestic income (rGDI) is the growth iin real gross domestic product (rGDP).

PURCHASING POWER

Positive trade gain is shown as blue. In Prince Edward Island, a positive trade gain occurs over most of the period starting in 2009 through to 2016. Note that terms of trade contribution index (2007=100) typically exceeds the GDPr index (2007=100) over all or most of the period. Note that the foreign exchange contribution index is countervailing the contribution of the terms of trade contribution. AS GDI does not fall below GDPr, trade gain is positive a there is a gain in purchasing power relative to 2007.

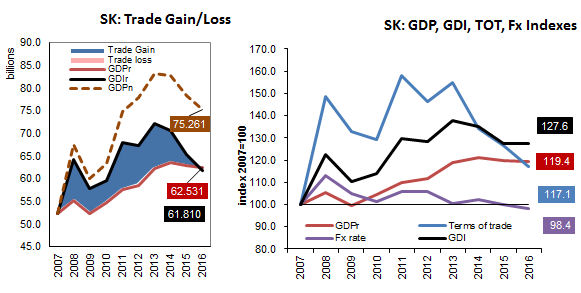

In the case for Saskatchewan, the contributions of the terms of trade and foreign exchange are sufficient to generate a positive trade gain up to 2013. After 2013, both the terms of trade and foreign exchange contribute to a decline.

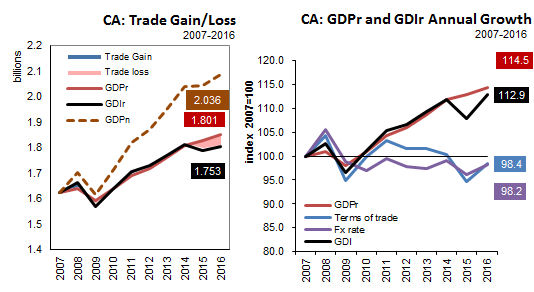

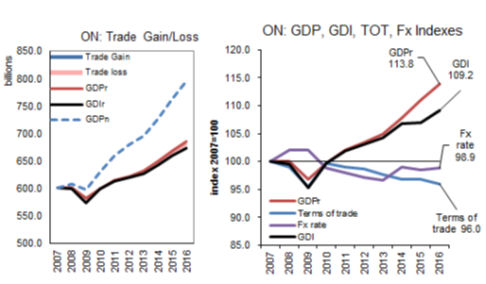

In the figures, a posIn the following figures, a negative trade gain is shown as pink. Canada, Newfoundland and Labrador, Ontario, Manitoba, Alberta and British Columbia illustrate this in 2016.

Newfoundland and Saskatchewan are recent arrivals in the negative trade area having enjoyed an increase in purchasing power through most the period.

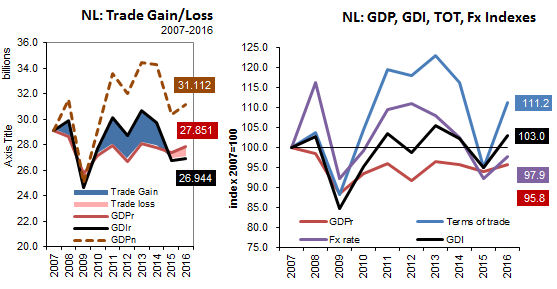

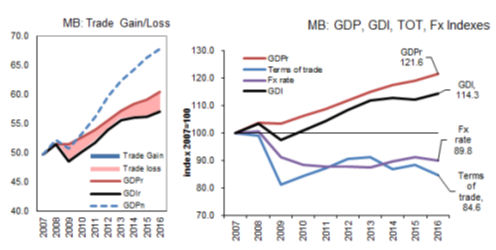

Manitoba and British Columbia have had negative trade gain for most of 2007 to 2016.

Note that the terms of trade index falls below the rGDI index over most or all the period. This indicates a loss in purchasing power.

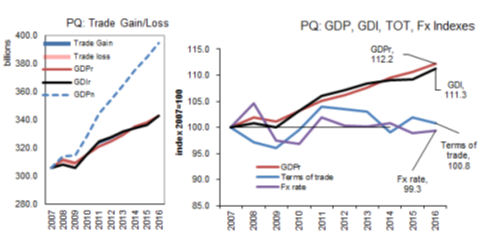

In the following gain or loss in purchasing power is ambiguous. Included are Quebec and New Brunswick.

RESULTS

In 2016 rGDI index (2007=100), in Saskatchewan was 127.6, and in Prince Edward Island was 116.0, ranking these provinces first and second in growth of rGDI. Growth in Saskatchewan trailed off in 2016 after reaching a provincial period high of 136.8 in 2013. Meanwhile, PEI showed steady, increasing growth in the rGDI index over the period. Growth in the rGDI index exceed growth in the rGDP index in both provinces, indicating a positive effect from trade gain.

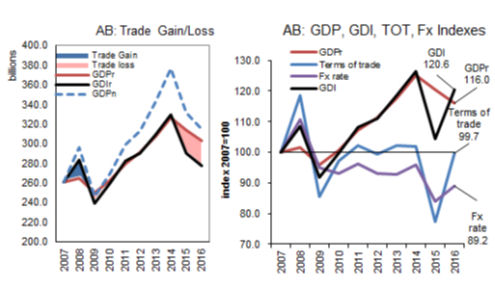

Alberta scored well during the 2007-2014 period but the rGDI index fell off to 120.6 in 2016. The province’s terms of trade index growth did not perform well resulting in rGDI index growth barely matching the rGDP index growth. So, no benefit from trade gain.

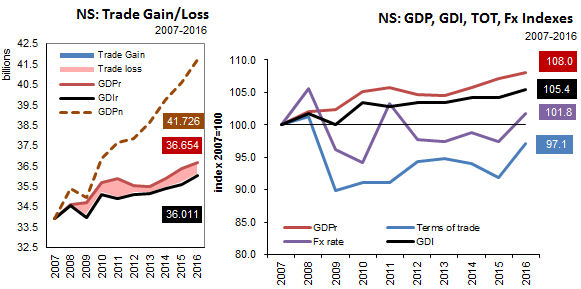

Over the period of study, Nova Scotia also demonstrated increasing growth in the rGDI index. Overall rank in 2016 was eighth. Because growth in the rGDI index was less than growth in the rGDP index over most of the period, the impact from trade gain was negative.

A look at the performance of Newfoundland yields some interesting results. Over most of the period the province’s rGDI index increased faster than rGDP index because of the trade gain. In 2011, the contribution to the rGDI index from the terms of trade was 4.6% and the real exchange rate contribution to the rGDI index was 1.0% for a trade gain of 5.5%. Real GDP contribution to the rGDI index was only 2.7%.

Computed from CANSIM Tables 384-0038.

<--- Return to Archive