The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 18, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 1.25 per cent. The Bank Rate is correspondingly 1.5 per cent and the deposit rate is 1.0 per cent.

Global Growth

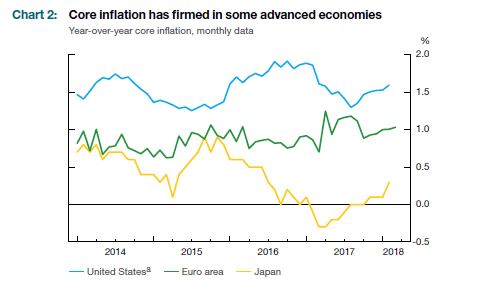

Global economic growth continues to be solid and broad-based with upturns in world trade and business investment. The Bank of Canada has incorporated higher estimated potential output for some major advanced economies reflecting greater labour force participation. Core inflation has firmed and financial conditions remain supportive; however, trade policy concerns are a growing risk to the global economic expansion.

Chart Source: Bank of Canada

The US economy is expanding at solid pace with weaker consumption in Q1 expected to be temporary. The labour market continues to improve with around 200,000 new jobs per month and rising prime-age labour force participation rate. Consumption should continue to be healthy with the strong labour market and new federal fiscal stimulus while business investment is supported by expanding private demand and tax changes. The US economy, already near capacity, is expected to grow above potential at 2.7 per cent in 2018 and 2019 with the possibility that there will be further upward pressure on inflation and bond yields.

Euro Area economic growth has been broad-based and is expected to continue to grow at above potential with positive developments around jobs and confidence measures. The Euro Area is expected to slow by 2020 as monetary policy support is withdrawn and capacity constraints intensify. Japan's economic activity has improved amid global strength and high consumer confidence but will moderate by 2020 with a planned increase to the value-added tax in 2019. China's economy was stronger than expected in 2017 but will still see growth slow to around 6 per cent in 2020.

US core inflation has firmed and is expected to rise with more excess demand and some transitory effects declining. US wage growth is expected to pick up with the tighter labour market. Core inflation in the Euro Area and Japan have also increased but are only expected to rise gradually over the projection horizon. Higher global oil demand and lower OPEC production have led to inventory declines and a reduced risk of lower oil prices. Natural gas prices have fallen due to weather-related demand fluctuations and supply increases. Lumber prices have been stronger due to robust US housing starts and rail bottleneck issues.

Chart Source: Bank of Canada

Canada Growth Outlook

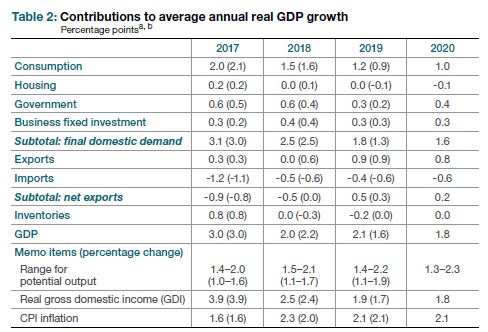

Economic growth in Canada has moderate with the economy operating close to capacity. Temporary factors such as volatile trade shipments, transportation bottlenecks, and regulatory changes are resulting in significant short-term fluctuations to growth. Outside of these temporary factors, the economy is expected to grow slightly above potential over the next three years. Real GDP is forecasted at 2.0 per cent, 2.1 per cent and 1.8 per cent in 2018, 2019 and 2020. The composition of growth is expected to shift away from household spending towards business investment and exports with higher interest rates contributing to the adjustment.

Chart Source: Bank of Canada

The labour market continues to improve across both sectors and regions with growth in employment and hours. The unemployment rate is near a 40-year low and job vacancies have risen by 25 per cent over past year. The Bank of Canada's Business Outlook Survey, reports that business have stronger hiring intentions, some recruitment challenges and are face rising wage pressures from labour competition and to a lesser extent minimum wage increases.

Chart Source: Bank of Canada

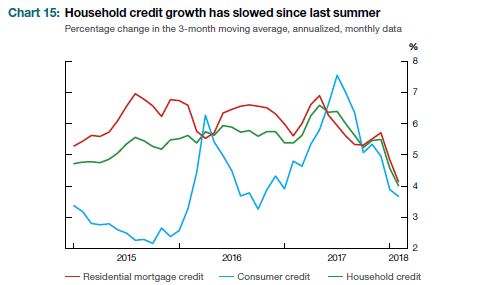

In 2018, consumption is expected to continue to contribute to growth with elevated consumer confidence and a strong labour market. Over the projection horizon, higher interest rates and slowing growth in disposable income are expected to gradually dampen household spending amid elevated debt levels. Housing activity is estimated to have contracted sharply in Q1 with implementation of new standards for mortgage lending. Over 2019 and 2020, household formation is anticipated to remain robust but housing activity will gradually decline with higher interest rates and the longer-run impacts of housing policy measures.

Business investment is expected to expand due to increasing foreign and domestic demand, capacity pressures and positive business sentiment but be partially restrained by trade-policy uncertainty, regulatory concerns and the incentive to shift investment to the US following US tax reform. Export growth will rise in line with foreign demand. Canada's share of US non-energy goods imports continued to decline despite the depreciation of Canadian dollar in recent years amid the competitiveness challenges faced by Canadian exporters.

Chart Source: Bank of Canada

Inflation Outlook

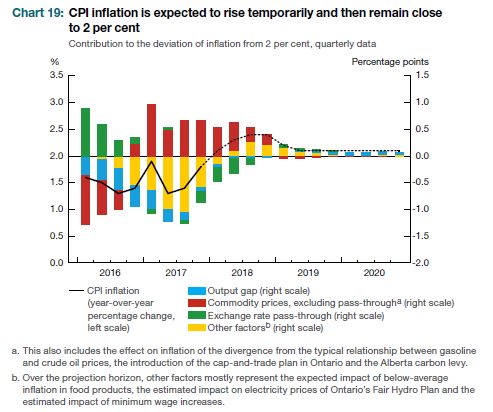

CPI inflation is anticipated to remain slightly above 2 per cent through 2018. The Bank of Canada expected temporary factors, such as elevated gasoline prices and impact of minimum wage increases, to more than offset the fading effects of electricity price rebates and low food price inflation. In 2019, inflation is expected to return to about 2 per cent.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is May 30, 2018. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on July 11, 2018.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive