The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

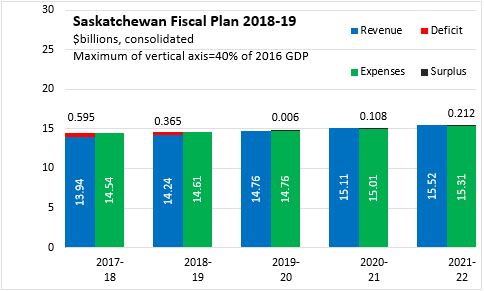

April 11, 2018SASKATCHEWAN BUDGET 2018-19 The government of Saskatchewan has tabled its 2018-19 Budget - the final provincial budget for the 2018-19 fiscal year. Saskatchewan's government anticipates narrowing the deficit from $595 million in 2017-18 to $365 million in 2018-19. Starting in 2019-20, the Saskatchewan government projects surpluses rising to $212 million by 2021-22. These projections no longer make provision for contingency.

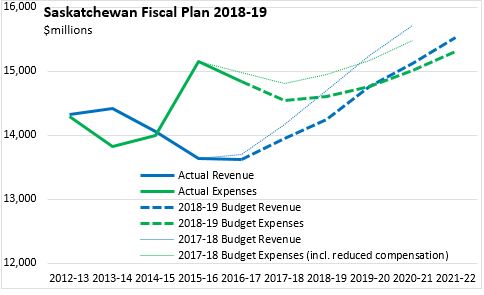

Saskatchewan's outlook for both revenues and expenditures have been revised down. Current projections note stronger non-renewable resource revenue and provincial sales tax, but lower personal and corporate income tax revenues. Non-renewable revenues now make up 10 per cent of Saskatchewan's revenues, down from 32 per cent in 2008-09. From 2017-18 throgh 2021-22 Saskatchewan anticipates revenue growth averaging 2.7 per cent per year while expenditures rise by 1.3 per cent per year.

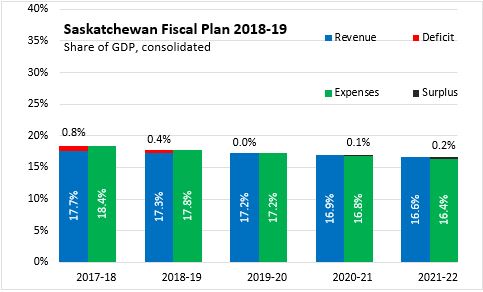

With Saskatchewan's nominal GDP returning to growth as commodity prices rise, the share of GDP represented by government is projected to decline. Revenues as a share of GDP are projected to fall from 17.7 per cent of GDP in 2017-18 to 16.6 per cent by 2021-22. Expenditures are projected to decline from 18.4 per cent of GDP in 2017-18 to 16.4 per cent in 2021-22. The deficit for 2018-19 is estimated at 0.4 per cent of GDP. By 2021-22, the surplus is projected to be 0.2 per cent of GDP.

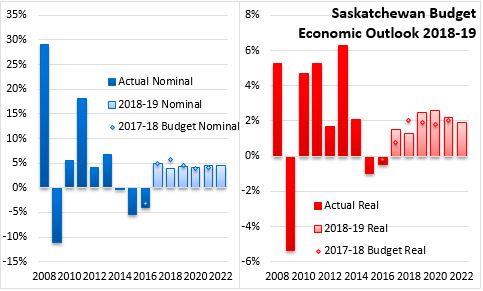

Saskatchewan's economic outlook assumes a rise in oil prices ($72/bbl USD WTI by 2022) along with greater drilling activity. Althoug potash prices are expected to remain stable over the medium term, real output is expected to rise. Mining output is expected to be dampened by a temporary reduction of uranium output in 2018 and crop production is expected to be slightly below levels from 2017 (but above long run averages). Real GDP is projected to increase by 1.3 per cent in 2018, rising to 2.5 per cent in 2019. Nominal GDP growth is expected to be 4.0 per cent in 2018, rising to 4.3 per cent in 2019. Saskatchewan's nominal GDP is sensitive to commodity prices.

Key Measures and Initiatives

With a focus on returning to balance, the Saskatchewan Budget emphasizes maintaining core services while providing targeted tax relief:

- Saskatchewan's expenditure restraint includes controlling compensation costs as well as additional targets to reduce expenditures by $35 million in each of the next two fiscal years through efficiencies, attrition and centralization of services/organizations.

- Piloting a Saskatchewan Technology Start-Up Incentive, a 45 per cent non-refundable tax credit for individual and corporate equity investments in eligible technology start-ups (max: $140,000 benefit per investor)

- Initiating a Value-Added Agriculture Incentive, a 15 per cent non-refundable credit for capital investments (minimun $10 million) to expand capacity in agricultural value-added processing.

- New funding through a Federal-Provincial agreement to create 2,500 more child care spaces

- Developing a new rental support program (while grandfathering existing users and applicants in the Saskatchewan Rental Housing Supplement)

- Removing the provincial sales tax exemption for used vehicles (to align with practice in other provinces), but allowing a deduction for PST on trade-in cars and exempting used vehicles under $5,000.

- The budget includes no provision for a carbon tax

Saskatchewan Budget 2018-19

<--- Return to Archive