The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 06, 2018PRINCE EDWARD ISLAND BUDGET 2018-19 The Prince Edward Island government has tabled its 2018-19 Budget, featuring surpluses for the current fiscal year and through the subsequent two years as well.

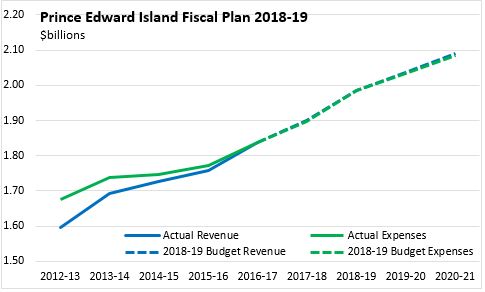

Prince Edward Island's maintenance of modest surpluses keeps both expenditure and revenue growth at an annual average pace of 3.2 per cent from 2017-18 through 2020-21.

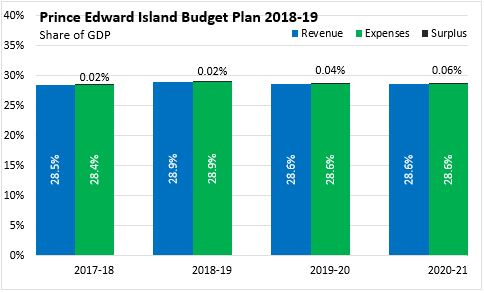

Measured as a share of GDP, Prince Edward Island's surpluses amount to less than 0.1 per cent. With strong nominal GDP growth expected to continue in 2018, revenues and expenditures are projected to decline slightly as a share of GDP - falling from 28.9 per cent each in 2018-19 to 28.6 per cent each in the subsequent two fiscal years.

Prince Edward Island's economic growth has surpassed expectations from the previous Budget, on higher population growth as well as rising employment, labour income, housing starts and retail sales. Prince Edward Island's real GDP growth is expected to be faster than previously projected for 2018, though the outlook for nominal GDP is consistent with prior projections.

Key Measures and Initiatives

Prince Edward Island's Budget focuses on :

- Increasing basic personal amounts by $500 on each of January 1, 2018 and January 1, 2019 with a target for regional tax parity over 5 years

- Removing the provincial portion of HST from the first block of residential electricity and rebating provincial HST on firewood, pellets and propane

- Reducing the small business tax rate by 0.5 per cent in this fiscal year with a commitment to future reductions

- Creating a new bursary of $3,600 for a 4-year college/university program (in addition to existing bursaries), raising student debt reduction grants to $3,500 per year (up to 4 years if they remain resident in Prince Edward Island) and offering grants for free college/university tuition to lower income students

- Mental health supports, including a new mobile mental health response team and expanded student well-being teams

- Increased child care subsidies and new child care spaces

- New Seniors Independence Program to provide financial assistance for housekeeping tasks to seniors who wish to stay in their homes

Prince Edward Island Budget 2018-19

<--- Return to Archive