The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

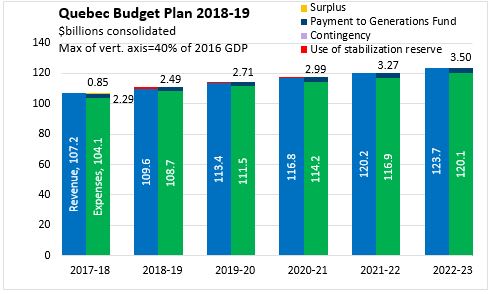

March 29, 2018QUEBEC BUDGET 2018-19 Quebec's 2018-19 Budget reports revenues in excess of program and debt service expenses. However, Quebec dedicates specific revenues to make payments into its Generations Fund, used to offset debt.

For 2017-18, the payment to the Generations Fund amounts to $2.29 billion, leaving a surplus of $850 million (paid into the stabilization reserve).

Quebec's payments to the Generations Fund are projected to rise from $2.49 billion in 2018-19 to $3.5 billion by 2022-23. During this time, the Province plans to withdraw funds from the stabilization reserve in 2018-19 ($1.56 billion), 2019-20 ($936 million) and 2020-21 ($479 million) to ensure that its Budget remains balanced after payments to the Generations Fund.

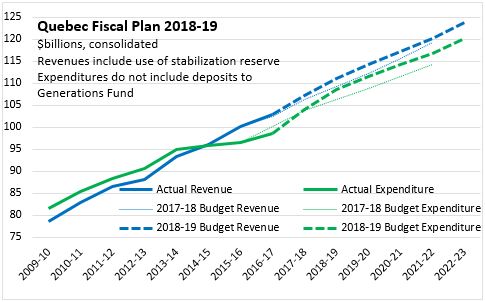

Quebec's revenue outlook has been increased by stronger than expected economic growth, offset by new measures to reduce some taxes. The outlook for expenditures is also raised by a number of new initiatives. Payments to the Generations Fund continue to rise, but at a slower pace than announced in last year's Budget. Quebec's revenues and expenditures are both projected to grow at an average annual pace of 2.9 per cent from 2017-18 through 2022-23.

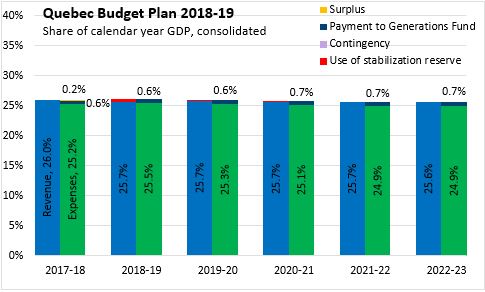

The Quebec fiscal plan anticipates that revenues and payments to the Generations fund will remain very consistent over the next five fiscal years - closely matching the pace of nominal GDP growth. Revenues are projected to remain stable at 25.7 per cent of GDP over the next four fiscal years, before edging down slightly to 25.6 per cent in 2022-23. Payments to the Generations Fund are projected to rise slightly from 0.6 per cent of GDP in 2018-19 to 0.7 per cent of GDP from 2020-21 through 2022-23. Over this time expenditures are projected to decline as a share of GDP, falling from 25.5 per cent in 2018-19 to 24.9 per cent by 2022-23. In the near term, use of the stabilization reserve amounts to 0.4 per cent of GDP in 2018-19, 0.2 per cent in 2019-20 and 0.1 per cent in 2020-21.

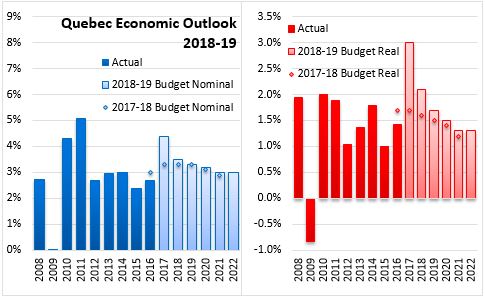

Quebec's economic growth in 2017 is estimated to be the strongest in 17 years, with real GDP rising by 3.0 per cent and unemployment rates reaching record lows. Outperformance on previous expectations was driven by rising consumer expenditure, employment, wages and business investment. Stronger growth is projected to continue in 2018 with real GDP rising 2.1 per cent with greater machinery and equipment investment caused by higher business confidence as well as rising exports from growth in the US (notwithstanding uncertaintey over NAFTA) and the rest of Canada. Real GDP is projected to increase by a further 1.7 per cent in 2019, with slowing housing starts and employment gains.

Key Measures and Initiatives

After several years of net contributions to the Generations Fund, Quebec's fiscal plan envisions a new phase of lower indebtedness (repaying $2 billion per year in 2018-19) and sharing the beenfits of this fiscal flexibility. Key initiatives include:

- Increasing parental leave benefits and childcare tax credits

- Broadening tax credits for caregivers and seniors living independently

- Introducing a non-refundable tax credit for first time homebuyers, extending home renovation tax credit

- Increasing the tax shield (on lower social transfers) from $3,000 to $4,000

- Enhancing tax credits for experienced workers, on-the-job training and professional development

- Reducing payroll taxes (lower Health Services Fund contributions)

- Lowering the tax rate from 8 per cent to 4 per cent (by 2022-23) on small busines income in services and construction sectors to match those in primary and manufacturing industries

- Increasing and extending additional capital cost allowances for business investments in cutting-edge technologies

- Reducing the compensation tax for financial institutions and the size of payroll subject to the tax

- Investments in transit around Quebec City and electric vehicle usage throughout the province

- Investments of $250 million (with returns) for equity participation in projects at Quebec's shipyards

- Compensation for lost value of taxi permits as the industry undergoes changes

- Requirement for sales taxes to be collected on services and intangible property sold from abroad and from other provinces

- Restricting income sprinkling

Quebec Budget 2018-19

<--- Return to Archive