The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

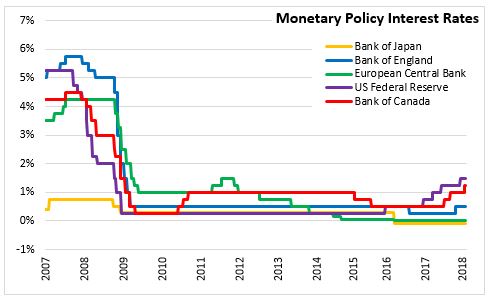

February 08, 2018MONETARY POLICY: UK The Bank of England's Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 0.5% and to maintain the UK non-financial corporate bonds stock of £10 billion and the stock of UK government bond purchases at £435 billion. The MPC notes that the erosion of slack in the economy has reduced the degree in which it is appropriate to accommodate an extended period of inflation above target and that it is appropriate to set monetary policy so that inflation returns to its target at a more conventional horizon.

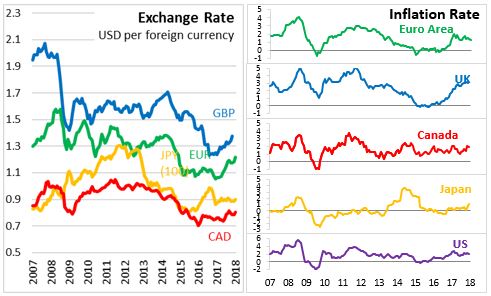

Global economic growth has accelerated and become increasingly broad-based and investment driven. UK net trade is benefitting from global demand and past sterling depreciation. Higher profitability, low cost of capital and limited spare capacity are supporting business investment even as it is restrained by Brexit-related uncertainties. Household consumption is expected to remain subdued, reflecting weak real income growth. CPI inflation was 3.0 per cent in December and is expected to remain around 3 per cent in the short-term, reflecting higher oil prices. Past sterling depreciation remains the primary factor in above-target inflation in the UK. CPI inflation is projected to gradually decline over the forecast but remain above 2 per cent target over next few years.

Bank of England

<--- Return to Archive