The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 17, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada increased its target for the overnight rate by 0.25 percentage points to 1.25 per cent. The Bank Rate is correspondingly 1.5 per cent and the deposit rate is 1.0 per cent.

Global Growth

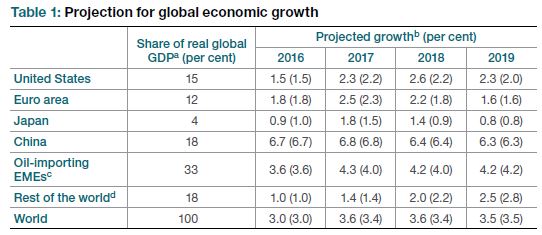

The global economy continues to strengthen and broaden across countries. Growth in the US and other advanced economies remains solid with inflation below central bank targets but expected to rise. Global financial conditions remain accommodative amid strengthening global growth with monetary policy in some countries putting upward pressure on short-term rates. The Bank of Canada noted that their outlook is subject to considerable uncertainty, particularly around geopolitics and trade policy.

Chart Source: Bank of Canada

The US economy is expanding at a robust pace with recent data for household consumption and housing showing continued momentum. The labour market continues to improve and business and consumer confidence remain elevated. Tax reforms at the personal and corporate levels are expected to help stimulate household expenditures and capital spending.

Euro Area growth has been stronger than expected and broad-based across member countries. Japan's economic activity was strong in Q3 with business and economic conditions improving the outlook for 2018. Growth in China is evolving as anticipated as the economy rebalances amid the government's structural reforms and moves to address financial sector vulnerabilities.

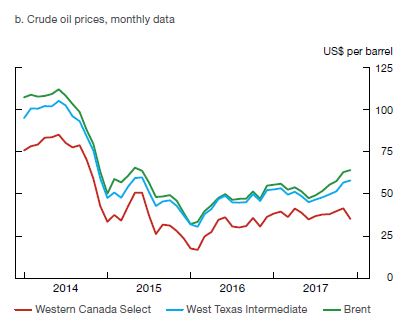

Oil prices have increased by about 20 per cent since October. Political tension, pipeline outages, lower expectation for US shale oil, and OPEC extending their lower production levels have kept downward pressure on supply. The spread between Western Canada Select (WCS) and West Texas Intermediate (WTI) has widened as Canadian producers face transportation constraints. Since October, lumber prices have risen moderately supported by US single family home demand and agriculture prices have not moved.

Chart Source: Bank of Canada

Canada Growth Outlook

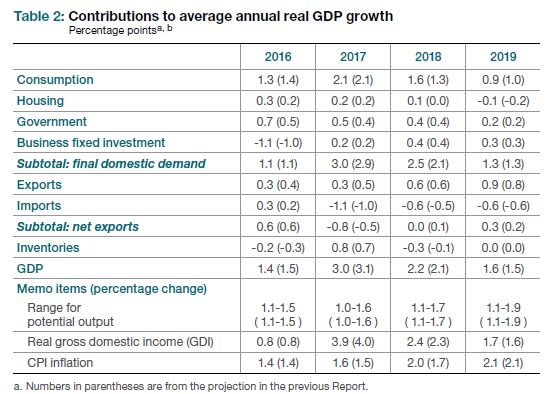

The Canadian economy had strong growth in 2017 and is close to capacity. Growth is expected to moderate to 2.2 per cent in 2018 and 1.6 per cent in 2019. Growth is currently being supported by accommodative monetary policy and public infrastructure spending. The national unemployment rate is at a historical low level while wage growth has somewhat improved.

Household spending growth is projected to decline as robust employment gains and household income growth are expected to slow. Higher interest rates are expected to increase debt-service cost and elevated household debt levels are likely to amplify the negative impact to consumption. Residential investment is projected to be flat with interest rates rising and housing policy measures weighing on growth in the sector.

Business investment should be lifted with increasing utilization creating a need for new capacity, but will be held back by elevated uncertainty around trade policy and the US tax reforms driving increased investment in the country. Exports are anticipated to rise over the next two years in line with foreign demand.

Chart Source: Bank of Canada

Inflation Outlook

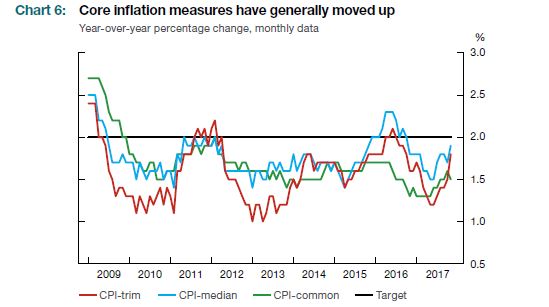

Inflation is estimated at 1.8 per cent in Q4 2017 with temporary factors, including movements in the exchange rate, keeping inflation below target in recent quarters. The drag from weak food inflation is expected to dissipate by the Q4 2018, later than previously expected as competition among food retailers has been more persistent. Inflation is expected to 2.0 per cent in 2018 and 2.1 per cent in 2019.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is March 7, 2018. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on April 18, 2018.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive