The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

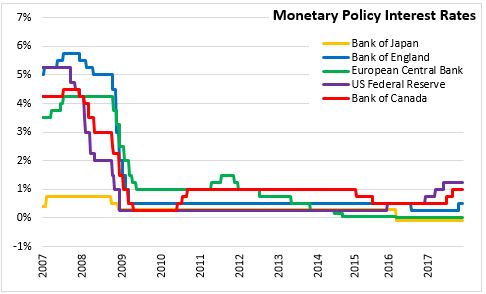

December 06, 2017BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.0 per cent. The Bank Rate is correspondingly 1.25 per cent and the deposit rate is 0.75 per cent.

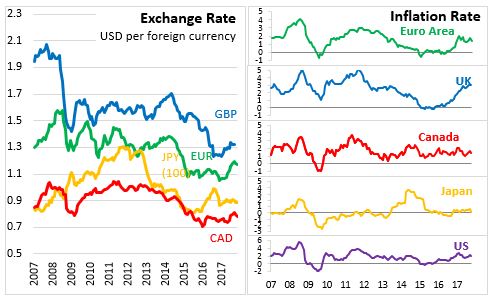

The Bank of Canada noted that the global economy has evolved as expected since October. US growth was stronger than forecasted but is expected to moderate in coming months. Oil prices have moved higher and financial conditions have eased. The global outlook remains subject to uncertainty around geopolitical and trade developments.

Growth for Canada is expected to moderate the during second half of 2017 but remain above potential. Employment growth has been strong and supportive of consumer spending. Public infrastructure spending is becoming more evident in the data. Exports declined more than expected in Q3 after strong growth earlier in 2017. The Bank of Canada noted that inflation has been slightly higher than anticipated and will continue to be lifted in the short term by gasoline prices. Core inflation measures have started to increase, reflecting continued absorption of economic slack.

The next Monetary Policy Report with an updated outlook for the economy and inflation will be January 17, 2018.

Bank of Canada

<--- Return to Archive