The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

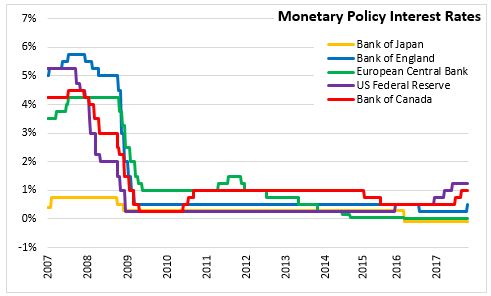

November 02, 2017MONETARY POLICY: UK The Bank of England's Monetary Policy Committee (MPC) voted to increase the Bank Rate by 0.25 percentage points to 0.5% and to maintain the UK non-financial corporate bonds stock of £10 billion and the stock of UK government bond purchases at £435 billion. The MPC notes that "monetary policy cannot prevent either the necessary real adjustment as the United Kingdom moves towards its new international trading arrangements or the weaker real income growth that is likely to accompany that adjustment over the next few years". The MPC is balancing the speed at which to return inflation to target and support that monetary policy provides to jobs and economic activity through most of the forecast period. In raising the Bank Rate, the MPC noted that slack in the economy has eroded and the unemployment rate is at a 42-year low.

UK GDP is expected to grow modestly over the next few years at a reduced potential rate. Consumption growth will remain sluggish in the near term while net trade is lifted by strong global demand and past sterling depreciation. Business investment is growing at a moderate pace but is being influenced by uncertainties around Brexit. CPI inflation was 3.0 per cent in September and is expected to rise further in coming months as the past depreciation of sterling and rising energy prices are passed through to consumer prices.

Bank of England

<--- Return to Archive