The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 11, 2017EXPERIMENTAL ESTIMATES OF QUARTERLY BUSINESS ENTRY AND EXIT FOR CANADA, 2Q 2017 According to the Statistics Canada’s experimental quarterly estimates of the number of business entry and exit, there were 1,115,090 private sector firms in Canada in the second quarter of 2017, down 0.2 per cent from 1,117,330 in the previous quarter. The average annual number of private sector firms in Canada rose 23.4 per cent between 2001 and the year to date average of 2017 (1,116,210).

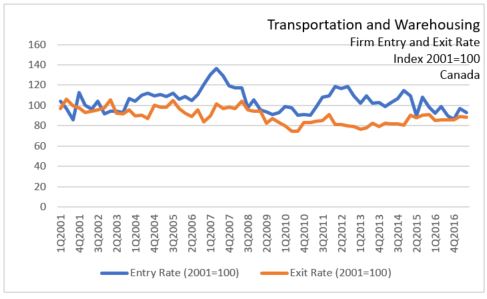

Firm growth varied across industries with the highest growth in private sector businesses observed in transportation and warehousing, real estate and rental and construction sectors. Declines were observed in the manufacturing and agriculture, wholesale trade and other services.

Note: The business sector covers all industrial sectors except educational services, health care and social assistance, and public administration. Exits in 2015 and 2016 are projected using data on business closings and entries. A closing is a business with employment in the current quarter and no employment in the future quarter. All quarterly estimates have been annualized. The average for the four quarters of a given year is equal to the annual estimate.

Firm turnover (entry and exit) is very important to business innovation and productivity improvement. Firm entries are an important source of productivity growth and technology adoption as new firms introduce new ideas, business models and technologies. Firm exits remove less productive firms selected out of the market through competitive forces.

The entry (exit) rate is obtained by dividing the number of entries (exits) by the average total number of enterprises in the previous and current quarters.

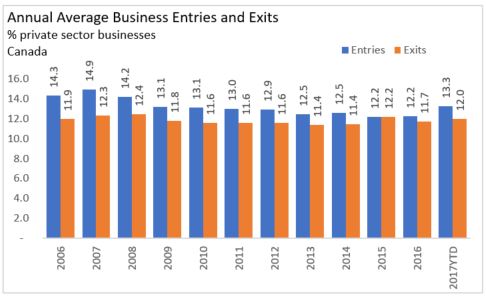

Entry rates in the business sector in Canada went up 1.1 percentage points from 2016 in the first two quarters of 2017 to 13.3, which is still below the peak of 15.1 in 2004.

Over the same period, the exit rate in the business sector in Canada measured by the percentage of firms exiting the market declined 0.8 percentage points from 12.8 per cent in 2001 to 12.0 per cent in the first half of 2017.

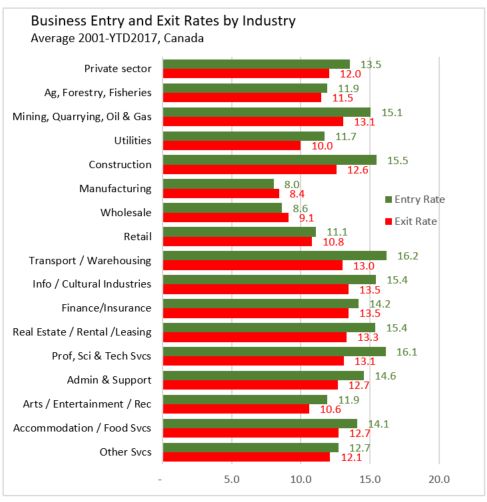

Business exits and entry rates varied by industry over the 2001 to 2017 (year to date) period. On average, the transportation and warehousing sector had the highest rate of firm entries over the period (16.2 per cent). The manufacturing sector had the lowest average entry (8.0 per cent) and exit (8.4 per cent) rates.

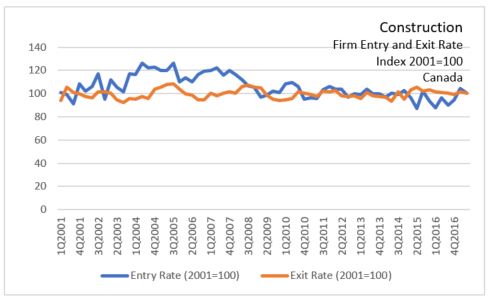

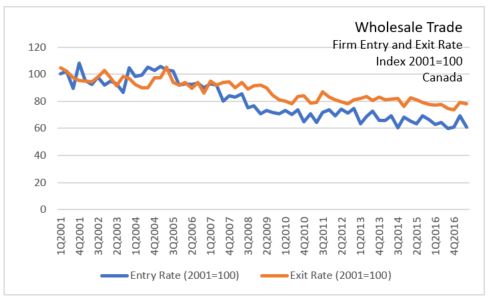

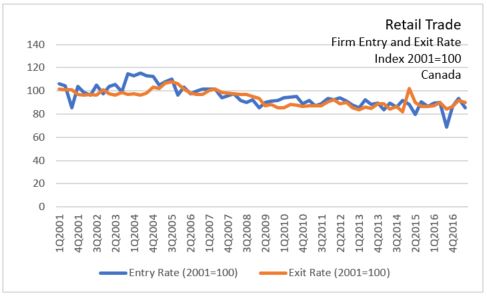

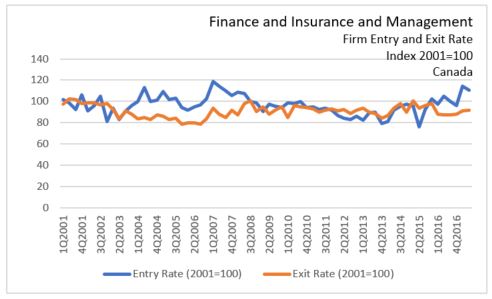

Business entries and exits varied over time across industries. In some sectors, there were pronounced pro-cyclical impacts during the pre-recession period as firm entries outpaced firm exits, such as construction, transportation and warehousing, wholesale and retail trade, and finance and insurance sectors.

Following the recession, the rate of firm entries and firm exits trended down in these sectors except for a recent increase in entry rates in the Finance and Insurance and Management sector.

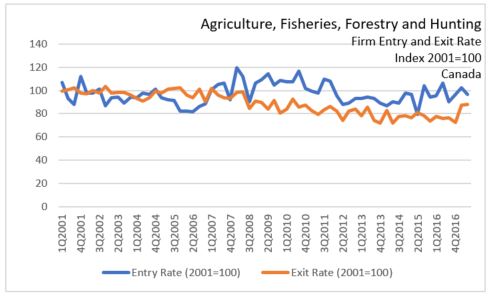

Trends were reversed in the Agriculture, Forestry and Fishing sector which saw exit higher exit rates in the pre-recession period and higher entry rates in the post-recession period.

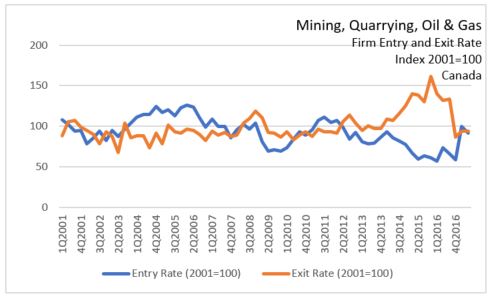

In the Mining, Oil and Gas sector, firm exits have been trending upwards since 2012 while firm entries have been trending down. This reflects the sharp drop in GDP growth in the sector since the third quarter of 2015.

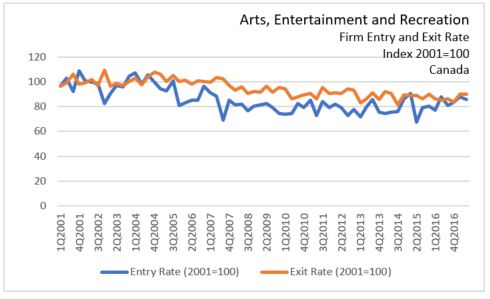

The manufacturing sector and the arts, entertainment and recreation sector have observed steady declines in both the rates of entry and exit in both the pre-recession and post-recession period.

Source: Statistics Canada Quarterly Dynamics industry Tables Q22017, CANSIM Tables 527-0013

<--- Return to Archive