The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

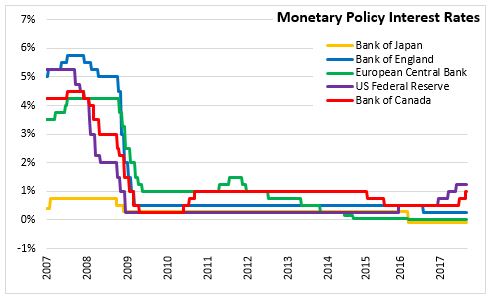

September 14, 2017MONETARY POLICY: UK The Bank of England's Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 0.25 per cent and continue with UK non-financial corporate bonds purchases of up to £10 billion and to maintain the stock of UK government bond purchases at £435 billion. The MPC notes that "monetary policy cannot prevent either the necessary real adjustment as the United Kingdom moves towards its new international trading arrangements or the weaker real income growth that is likely to accompany that adjustment over the next few years". The MPC is balancing the speed at which to return inflation to target and support that monetary policy provides to jobs and economic activity through most of the forecast period.

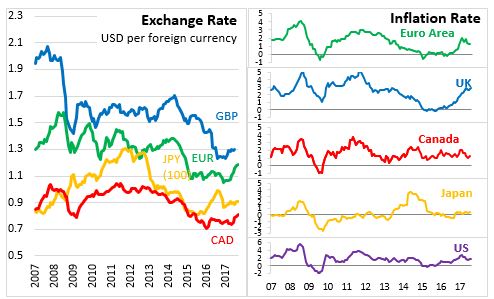

The MPC noted that GDP growth was 0.3 per cent in the second quarter with private final demand softer than anticipated. Unemployment continues to decline reaching a 40-year low at 4.3 per cent in August. Evidence continues to accumulate that the rate of potential supply growth has slowed in recent years. Pay growth has shown signs of a modest recovery. The exchange rate has been volatile and the price of oil has increased. Headline and core CPI inflation are slightly higher than anticipated. Inflation in August was 2.9 per cent and is expected to rise above 3 per cent in October.

Bank of England

<--- Return to Archive