April 21, 2016CURRENT ECONOMIC ENVIRONMENT AND OUTLOOK - NOVA SCOTIA Nova Scotia Economic Outlook

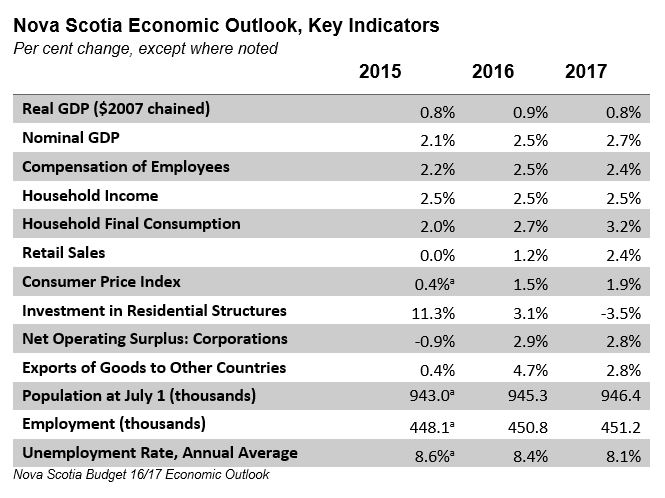

Note: Forecast was made with data and information as of June 3, 2015.

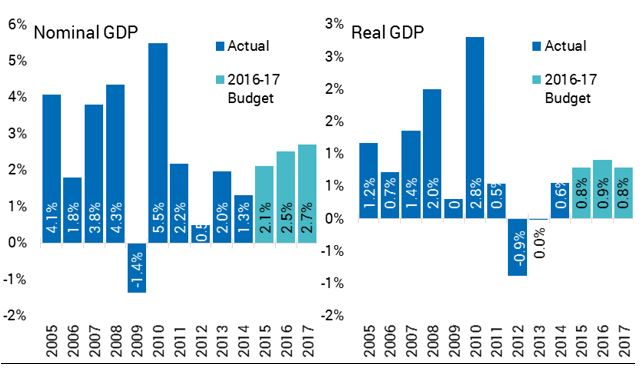

Nova Scotia’s economy is projected to have grown by 0.8 per cent in real terms during 2015. Nominal Gross Domestic Product (GDP) growth was limited by lower consumer prices to an estimated 2.1 per cent. For 2016, the economic outlook indicates that Nova Scotia’s real GDP will grow by 0.9 per cent. This will be followed by growth of 0.8 per cent in 2017.

Nominal GDP growth is expected to accelerate to 2.5 per cent in 2016 and 2.7 per cent in 2017. Trends emerging in 2015 are expected to continue through 2016. Major project investments are expected to continue sustaining growth, including a full year of production at the Halifax shipyard and ongoing work on the Nova Centre, Maritime Link, and offshore exploration projects. Nominal GDP and its components correlate to the revenue potential of key tax bases, including household income, consumer expenditures, and residential construction.

Contributions to growth from major investments are expected to slow in 2017 as a number of projects reach conclusion

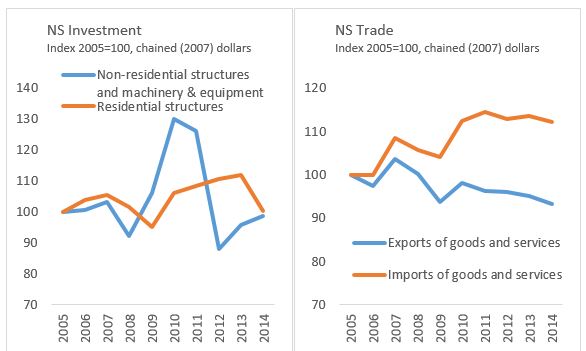

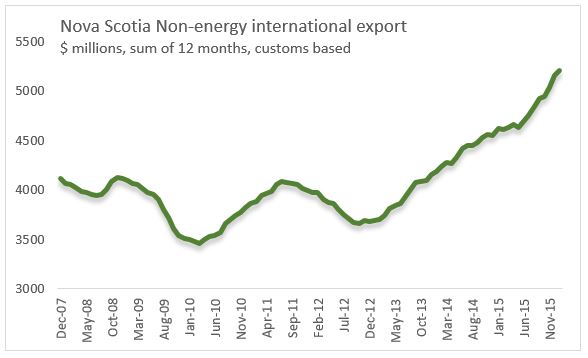

While oil prices remain low, a favourable foreign exchange rate and rising US demand are expected to keep Nova Scotia international goods exports recovering, rising by 4.7 per cent in 2016 and by 2.8 per cent in 2017 . Growth in non-energy merchandise exports is expected to more than offset the declining value and volume of natural gas shipped to the US.

Over the medium term, a return to higher oil prices and foreign exchange rates will coincide with rising interest rates to slow the contribution to Nova Scotia’s growth from the external sector.

In the short term, the combination of major project investments, non-energy exports, and a stable labour supply are expected to contribute to some modest employment growth for Nova Scotia in 2016 and 2017.

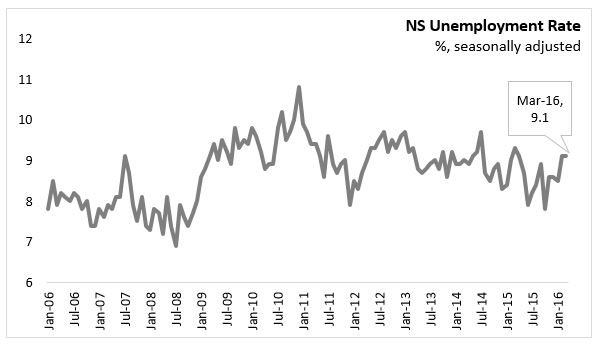

At under 452,000, employment levels are not expected to return to the highs recorded in 2012. Although returning workers displaced by slowing oil investment will stabilize the labour force, this is expected to be a temporary phenomenon. Continued retirement of the large baby boom cohort is still expected to limit labour supply and employment growth. The Nova Scotia unemployment rate is projected to remain below its recent average—8.4 per cent in 2016 and 8.1 per cent in 2017.

With limited employment gains, growth in household income is likely to be attributable to wage and productivity improvements in the short run. The Nova Scotia economic forecast anticipates that employee compensation will grow by 2.5 per cent in 2016 and by 2.4 per cent in 2017. Overall household income is expected to match this pace, though there are increasing contributions from public and private pension income sources.

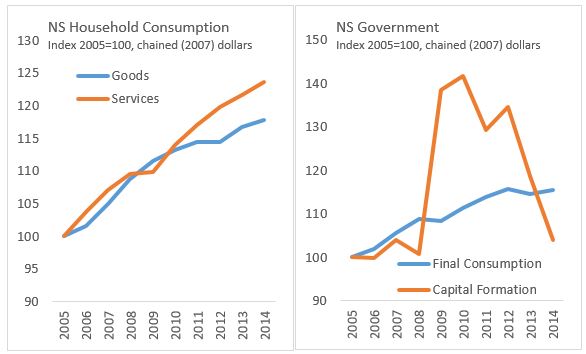

Nominal household consumption is expected to grow by 2.7 per cent in 2016 and by 3.2 per cent in 2017 as income growth and lower oil prices improve household purchasing power. The household consumption forecast is consistent with the growth rates observed for 2012–2014, but higher than expected growth of 2.0 per cent in 2015, which was weighed down by low oil prices.

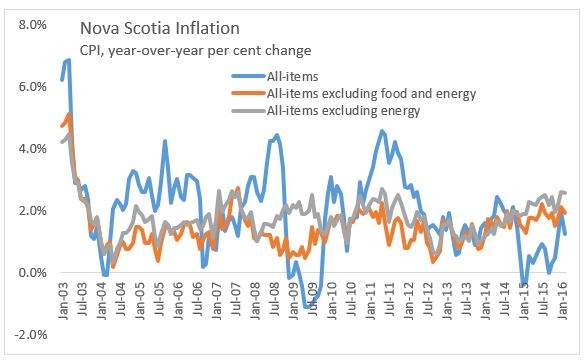

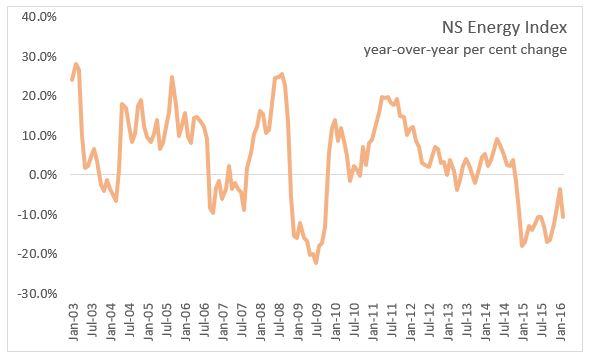

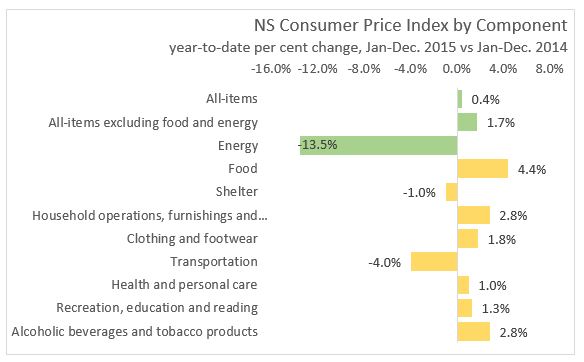

Consumer price inflation is projected to remain modest in the face of lower energy prices, boosting the real purchasing power for Nova Scotia’s households.

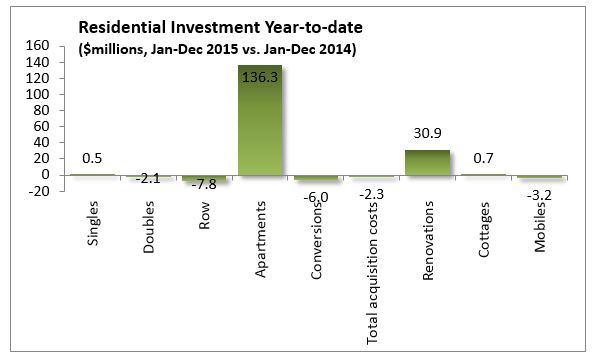

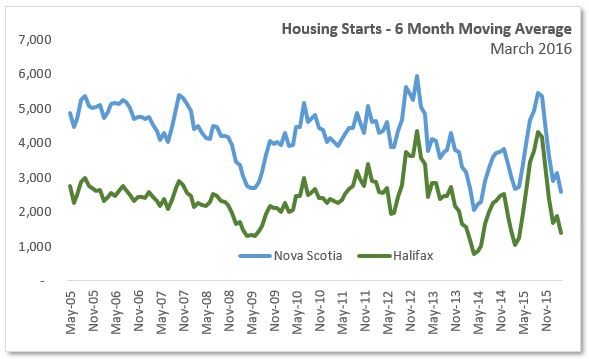

The apparent recovery in residential housing investment observed in 2015 merely brought activity levels closer to their long run average after a sharp correction in 2014. In 2016, the economic outlook anticipates that a number of major multi-unit housing projects in Halifax will continue towards completion, leading to annual growth of 3.1 per cent. However, the limited number of residential building permits in late 2015 suggests that housing activity will decline towards the end of the year and will shrink by 3.5 per cent in 2017.

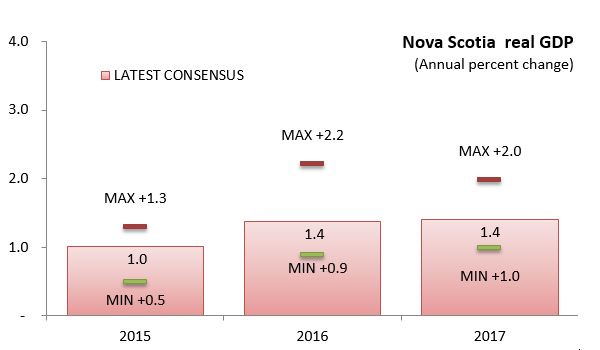

The private sector consensus projects growth of 1.4 per cent in both 2016 and 2017.

Note: The Nova Scotia Department of Finance monitors private sector forecasts from major financial institutions as well as the Conference Board of Canada, IMF, World Bank, central banks and OECD to prepare a consensus outlook for the world, the US, Canada. The latest consensus was prepared March 22, 2016.

Nova Scotia Recent Economic Growth

Production in the goods sectors accounts for 20 per cent of the gross domestic product generated in the province. Services in the private sector account for just over 50 per cent of GDP while health, education and public administration amount to just under 30 per cent of output.

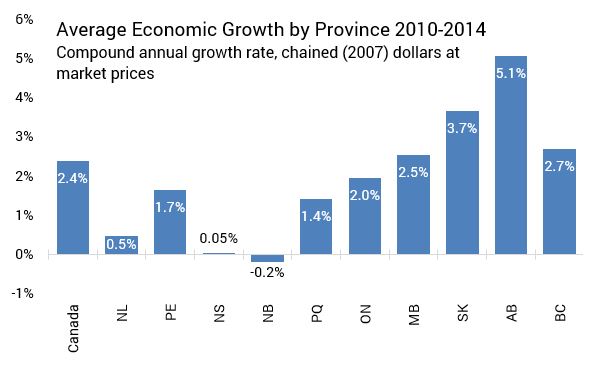

From 2010 to 2014, Nova Scotia’s real GDP was virtually unchanged. The size and growth of Nova Scotia’s GDP has been revised down in historical revisions to the Provincial Economic Accounts by Statistics Canada. Over this period, real GDP in the province grew by only 0.05 per cent per year. Nominal GDP increased by 1.5 per cent per year. Over many previous decades, Nova Scotia’s income per capita has grown faster than the national average, resulting in the province ‘catching up’ to the national standard of living. In the last five years, Nova Scotia’s per capita real GDP fell from 81.0 per cent of the national average to 77.2 per cent.

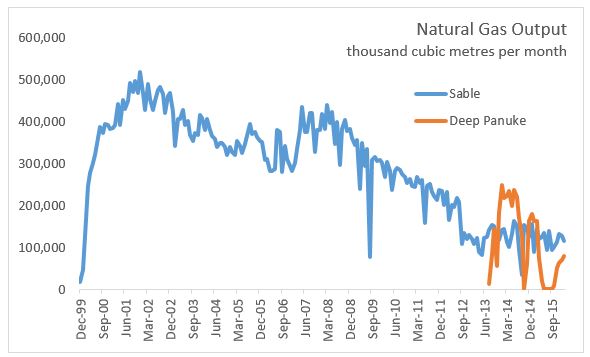

During the 2010-2014 period, the provincial economy faced numerous shocks: restraint in Federal government and military employment, slowing government capital expenditures, closures in forestry and manufacturing sectors, building new industrial and commercial facilities in Halifax, corrections in housing construction as well as the introduction of natural gas output from the Deep Panuke platform. There were also persistent trends: rising exports of non-energy goods and commodities, declining natural gas output from the Sable offshore energy project, net population outmigration and increasing retirement of an aging workforce.

In 2015, the global economic environment shifted on the substantial and unexpected persistence of lower oil prices. There are a number of ways in which this affects Nova Scotia’s economy, but on balance the effect is generally positive for the province, as it is for many oil importers.

With lower oil prices, the value of the Canadian dollar has depreciated considerably, making Nova Scotia’s exports more competitive in international markets. Domestic non-energy goods exports continued their rise, gaining 13.3 per cent in 2015. This more than offset the decline in the value of energy exports as output from the Deep Panuke and Sable natural gas fields declined. Nova Scotia’s manufacturing shipments led the country in growth at 6.8 per cent.

Major projects and investment activities often have a visible impact on the Nova Scotia economy. With commencement of substantial activity in construction of the Arctic Offshore Patrol Ships at the Halifax Shipyard, the first effects of the National Shipbuilding Procurement Strategy are becoming visible in the provincial economy. Likewise, several other ongoing projects are expected to contribute stronger investment in the coming years: the redecking of the MacDonald Bridge, construction of the Nova Centre, connection of the Maritime Link and offshore exploration by Shell and BP.

Nova Scotia Demographics in 2015

In the most recent quarters Nova Scotia’s population started to grow again, reaching an all-time high of 945,824 as of January 1, 2016. For January 1 to December 31, 2015, deaths continue to outnumber births in Nova Scotia. Immigrants to Nova Scotia totaled more than 3,400 in 2015, the largest number since 1995. Net interprovincial migration resulted in an outflow of 1,198 the smallest figure in five years.

Nova Scotia Labour Market in 2015

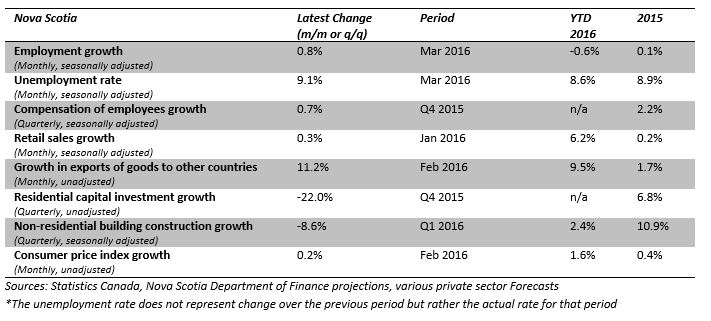

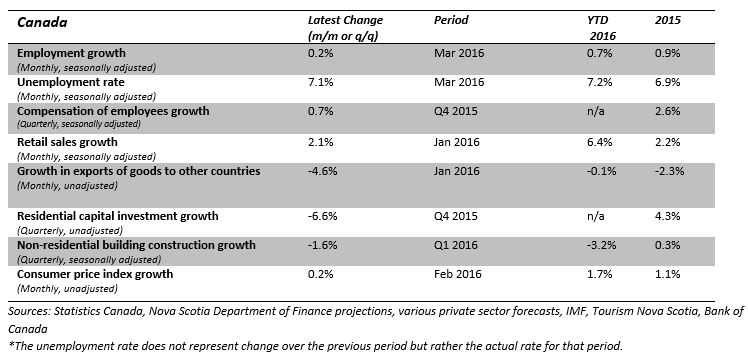

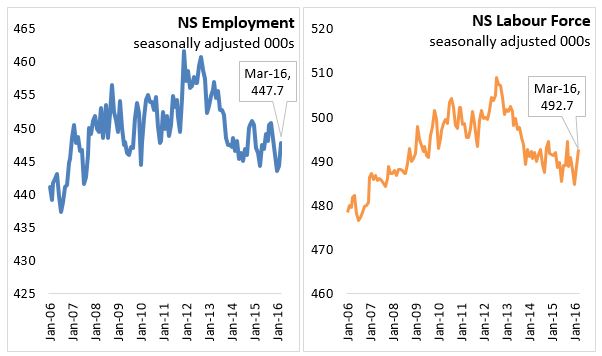

Employment and the labour force declined in 2013 and 2014 from peak levels seen in 2012. For 2015, employment and the labour force were more stable. Employment grew by 0.1 per cent while the labour force declined by 0.3 per cent. The unemployment rate averaged 8.6 per cent in 2015, rising in Halifax and declining outside of Halifax.

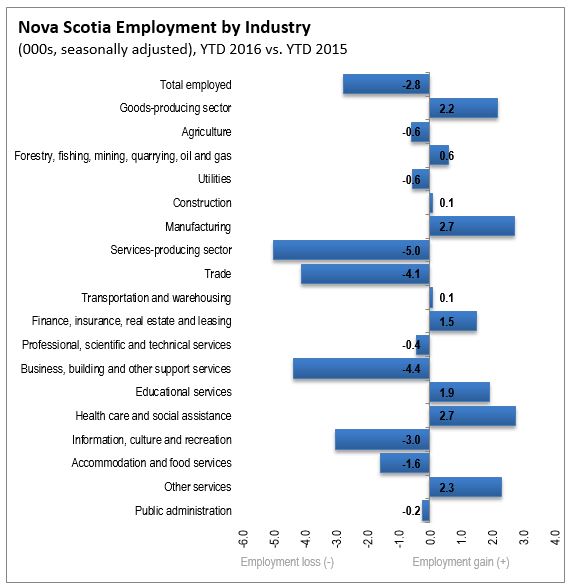

For the first quarter of 2016, employment has declined by 2,800 (-0.6%) compared to the first quarter of 2015. Job declines in the service sectors of trade, business/building support, informational/culture and accommodations/food services have offset gains in goods sectors of manufacturing and forestry, fishing, mining, and oil and gas. Educational and health care and social assistance have seen positive job growth year over year.

Job vacancies were on average higher in 2015, relative to the past few years, but have recently slid. The job vacancy rate and unemployment to vacancy ratio have also pointed to more slack in the labour market in recent months. Average weekly earnings growth of 1.8 per cent in 2015 similar to the national average but slower than other provinces in the Atlantic region and central Canada.

Compensation of employees increased 2.2 per cent over in 2015. Declines in mining and oil and gas extraction, military, and public administration offset gains in other areas.

Nova Scotia Inflation in 2015

Consumer price inflation was soft through 2015, as lower world oil prices have lowered energy prices 13.5 per cent in Nova Scotia. Overall, CPI inflation is up 0.4 per cent in in 2015 with the CPI excluding food and energy rising 1.7 per cent. Similar to the national trend, food prices increased with a lower Canadian dollar, increasing 4.4 per cent in Nova Scotia in 2015.

Nova Scotia Retail and Wholesale Trade in 2015

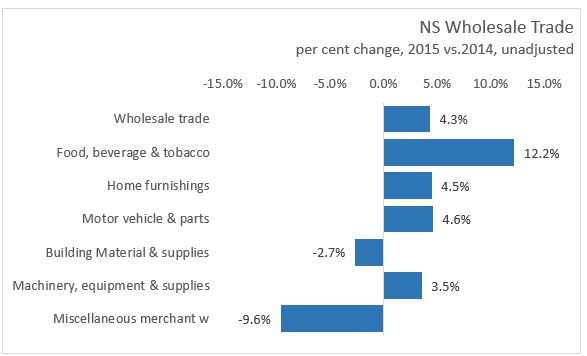

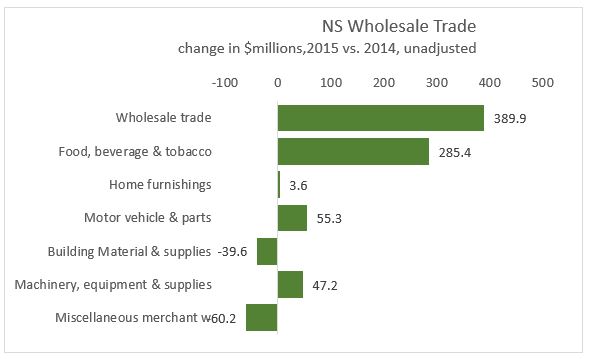

Wholesale trade had declined over the winter months but recovered back to 2014 levels over the summer, and rose 4.3 percent overall in 2015 compared to 2014. Most of the increase occurred with a $285.4 million increase in food, beverage and tobacco. (Note: wholesale and retail data do not separate price and volume changes). Motor vehicles and machinery and equipment, wholesale trade have also increased in 2015.

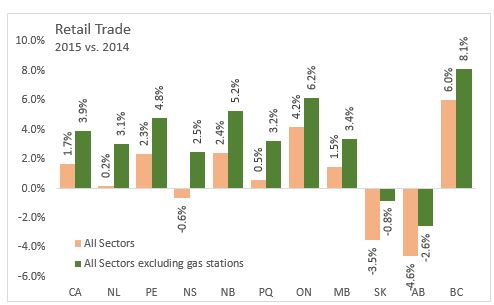

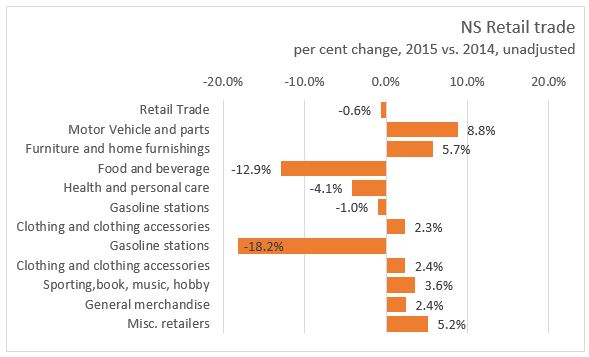

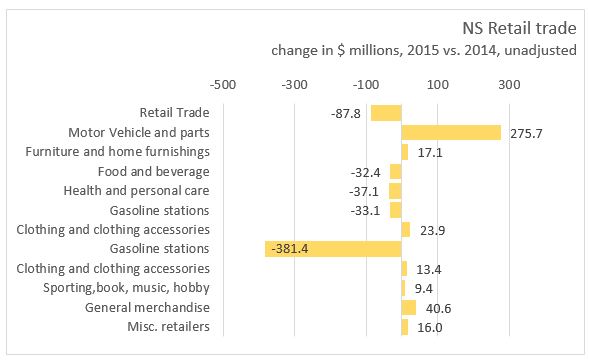

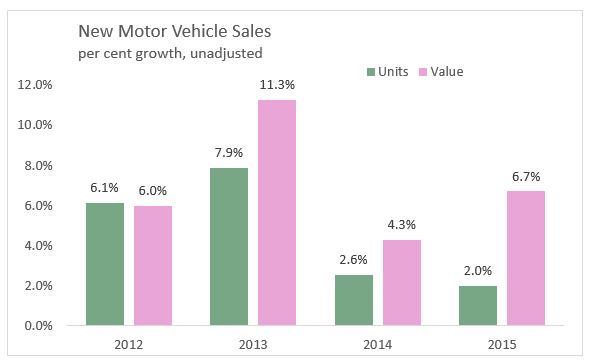

Retail sales have been soft in 2015 with lower gasoline prices reducing sales at gasoline stations and a downturn over the winter months weighing on year-to-date figures. Excluding gasoline stations, retail sales were up 2.5 per cent in 2015. Most provinces, except Alberta and Saskatchewan, saw stronger growth. Motor vehicles and parts are making the largest positive contribution to sales in 2015 with an increase of 8.8 per cent. New motor vehicle unit sales have increased 6.7 per cent while average prices are up 4.6 per cent in 2015.

Nova Scotia Construction in 2015

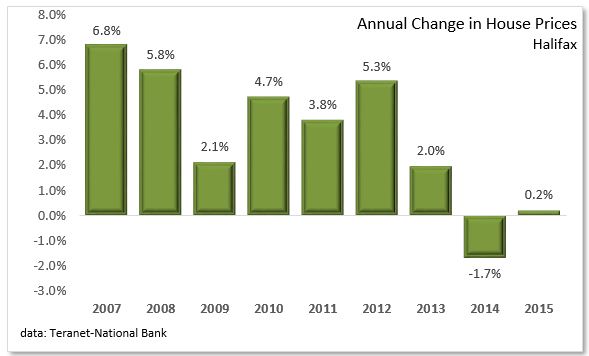

Residential investment declined 9.4 per cent in 2014 but rebounded in 2015 with a growth of 6.8. The increase in activity is concentrated in apartment construction and renovations. Housing starts and building permits have trended lower in the first few months of 2016. Home prices in Halifax have been fairly flat for the three, rising 0.2 per cent in 2015.

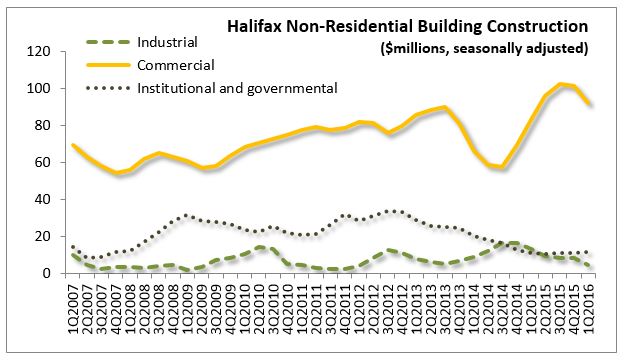

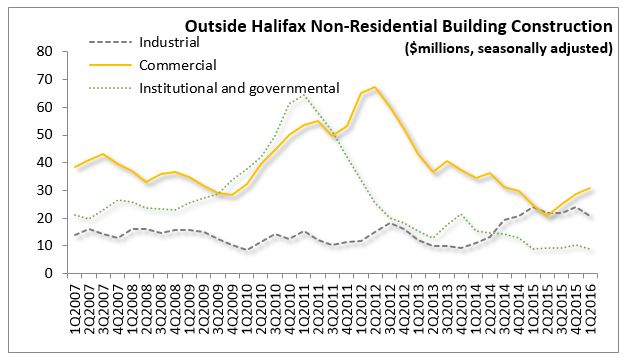

Non-residential construction was down for a fourth consecutive year in 2014. For 2015 non-residential building construction is increased 10.9 per cent in Nova Scotia. Commercial buildings in Halifax and industrial buildings outside the city increased. Institutional and governmental building construction was down 34.5 per cent.

Nova Scotia Production and Exports in 2015

In 2014, Nova Scotia enjoyed rebounding trade, with exports of international goods growing 22.3 per cent, more than any other province. While exports received a significant lift from higher natural gas output, at both of Nova Scotia’s offshore fields, there were also substantial gains in non-energy exports. Exports to other provinces fell in 2014, offsetting some of the gains.

For 2015, energy exports declined 69.7 per cent as volumes was lower from both the Sable platform (-3.7%) and Deep Panuke (-65.7%). Deep Panuke moved to seasonal operations in 2015. Non-energy exports have continue an upward trend, increasing by 13.3 per cent in 2015. Significant increases were seen in the largest exports categories of farm, fishing and intermediate products (+41%), motor vehicles and parts (+10.8%), and consumer goods (+18.9%) and forestry products (+2.9%). Smaller sectors also saw gains: metal ores and non-metallic minerals (+20.8%), electronics and parts (+3.8%), aircraft parts (+7.3%). Declines occurred with metal and non-metallic mineral products (-7.7%), chemical, plastics and rubber products (-7.7%) and industrial machinery, equipment and parts (-7.5%)

After a significant decline at the end of 2013, manufacturing shipments have trended upward, increasing 6.8 per cent in 2015. Durable goods, accounting for two-thirds of shipments, rose 3.4 per cent and non-durables were up 14.1 per cent in 2015.

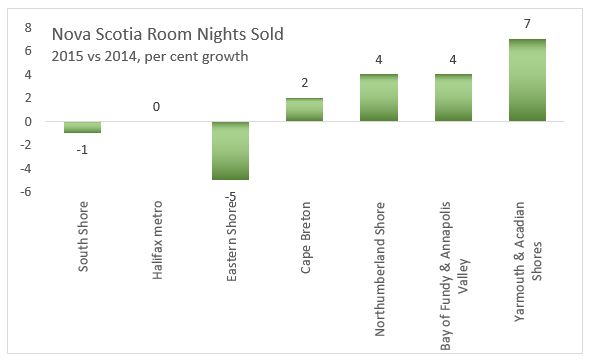

Nova Scotia Tourism in 2015

For 2014, total visitors were up 1 per cent to 1.9 million with a 2 per cent decline in road visitors, offsetting a 7 per cent increase in air travel. For 2015, visitors are up 6 per cent compared an increase in Canadian (+5%), United States (+8%) and overseas (+11%) Air visitation was down 2 per cent while road visitation has increased by 9 per cent. The occupancy rate for fixed roof accommodations was up 2 percentage points to 50 per cent with increases in all regions outside Halifax. Total room nights sold was up 1 per cent.