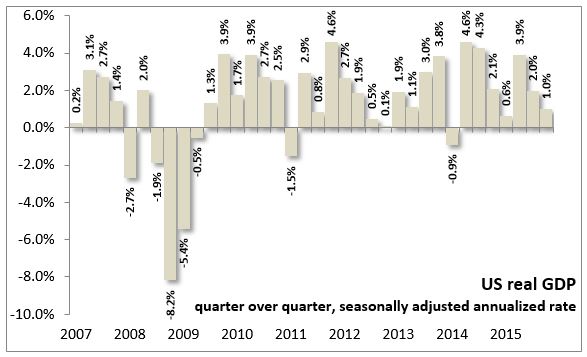

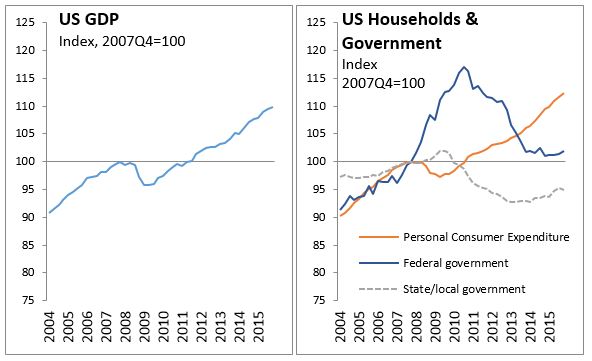

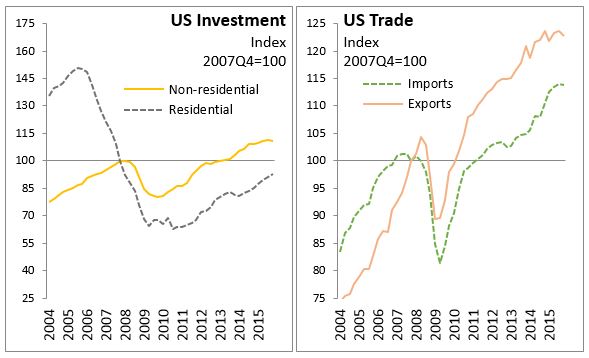

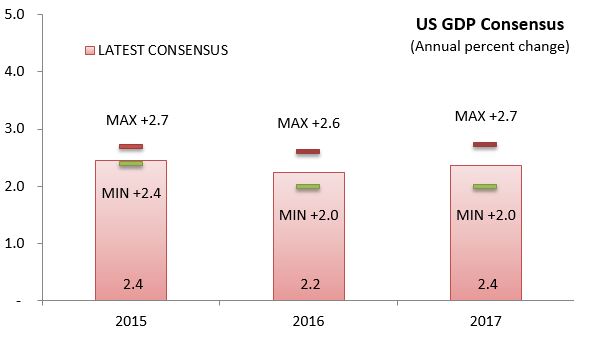

April 21, 2016CURRENT ECONOMIC ENVIRONMENT AND OUTLOOK - UNITED STATES In 2014 and 2015, the US economy grew 2.4 per cent per year. Consumer spending is growing at a faster rate each year since 2012. Residential investment increased as US housing starts rose to over 1.1 million and home prices increased. Business investment was generally positive outside the oil and gas sector. A strengthening US economy has lifted the US dollar relative to most of its trading partners lowering US exports, but enhancing trade opportunities for countries exporting to the US, such as Canada. In 2015, Canada’s foreign exchange rate depreciated at the fastest rate in decades, falling from an annual average of $0.905 USD to $0.782 USD. US Government consumption and investment grew for the first time since 2010.

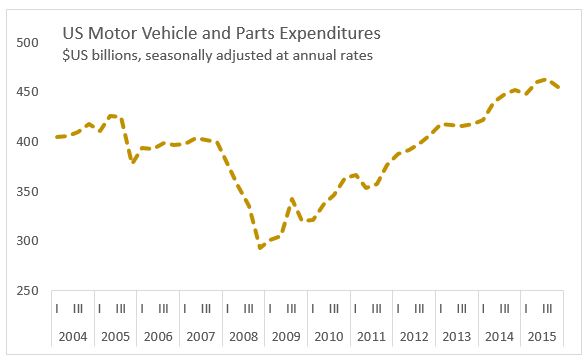

US consumers are increasing purchases and are showing greater planned purchases, a positive sign for further growth. Signs that the lower gasoline prices are translating into other sales has emerged. Strong employment gains, reduced debt loads, lower energy costs, and accomodative financial conditions are all supporting further consumption growth. Real personal consumption has grown by an average of 2.6 per cent (seasonally adjusted, annualized rate) over the past four quarters. US motor vehicle expenditures continue to track upwards.

Federal fiscal austerity was less of a drag on the economy in 2015 with government consumption and investment posting positive growth for the first time since 2010. Both federal and state and local had positive growth. Business investment has been positive, but soft with the slowing oil sector and weaker earnings. Exports have been slower as the US dollar has appreciated against its major trading partners and restrained exporters.

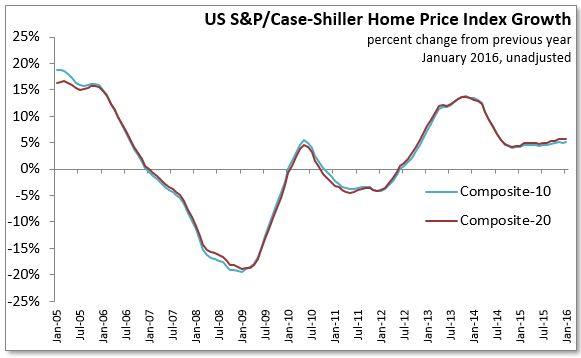

The US residential sector continues its upward trend, rising on average of 2.2 per cent over the last four quarters. Housing starts are tracking up to a seasonally adjusted annualized rate of 1.2 million in February 2016 as employment gains and household formation are beginning to translate into new demand. Forecasts are for housing starts to continue to increase with the current levels still below fundementals. Home prices are maintaining a fairly consistent growth rate of around 5 per cent in year over year terms.

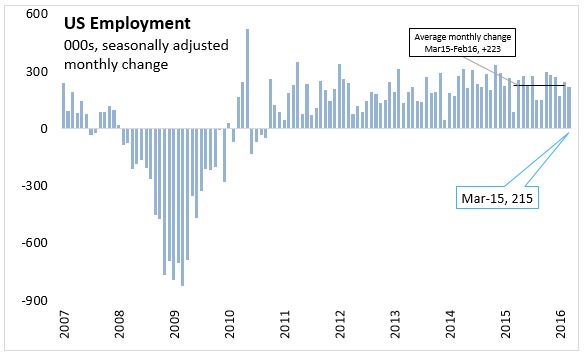

The US economy continues to generate employment gains at a solid pace, on average creating 233,000 new positions per month over the last year. The unemployment rate has declined to 5.0 per cent, but its rate of decline has slowed in recent months, with employment and labour force tracking one another. The participation and employment rate have started to recover after remaining at historically low levels following the global financial crisis.

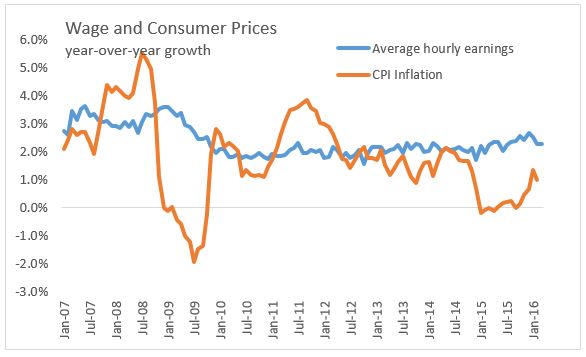

The strengthening US economy and improving labour market conditions led the US Federal Reserve to raise by ¼ percentage point its target range for the federal funds rate to 0.25 per cent to 0.5 per cent, in December 2015. Employment gains have remained solid even amid some weakening in other indicators. Inflationary pressures have been modest with the fall in energy prices and a strengthened US dollar. The Federal Reserve has expressed caution about increasing the federal funds rate in the short term. The Federal Reserve is signaling that monetary conditions will remain accommodative for some time and will be driven by the pace of improvement in economy. CPI inflation is beginning to pick up with oil prices dropping out of the year-over-year comparison.

The United States economy is expected to continue to grow at about its current pace, expanding by 2.2 per cent in 2016 and 2.4 per cent in 2017. Employment improvements will continue and lower gasoline prices will continue to support domestic demand. Consumer fundamentals will remain solid and the housing market recovery will continue with new household formations. Government spending will accelerate to make a larger positive contribution to growth but net exports will remain a small drag for the US economy.

Note: The Nova Scotia Department of Finance monitors private sector forecasts from major financial institutions as well as the Conference Board of Canada, IMF, World Bank, central banks and OECD to prepare a consensus outlook for the world, the US, Canada. The latest consensus was prepared March 22, 2016.