For additional information relating to this article, please contact:

August 25, 2014STUDY: BUSINESS ENTRY AND EXIT RATES IN CANADA: A 30-YEAR PERSPECTIVE. The study focused on firm entry and exit rates in Canada, which illustrate one aspect of the dynamism that is essential to a well-functioning economy. The entry of new firms is a source of productivity growth and technology adoption, while exits remove less productive firms. Other measures of dynamism, such as employment re-allocation, were not examined.

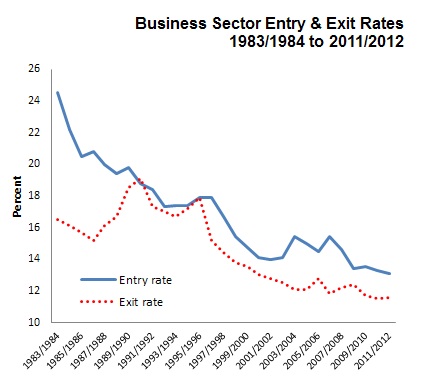

The rate at which businesses both entered and exited industry in Canada fell between 1983/1984 and 2011/2012. The entry rate, the number of entrants divided by the population of all active firms, declined over a 30-year period, falling from 24.5% to 13.1%. The exit rate, the number of firms leaving an industry relative to the sector's total population, also declined from 16.5% to 11.6%.

The study revealed that the largest differences between entry and exit rates occurred in the 1980s, when entry rates declined but exit rates increased. The entry rate declined by 5.7 percentage points between 1983/1984 and 1990/1991, while the exit rate increased by 2.6 percentage points. Over subsequent decades, both entry and exit rates declined.

By 1995/1996, a more stable difference between entry and exit rates had been established. The difference averaged 1.98 percentage points between 1996/1997 and the end of the study period in 2011/2012.

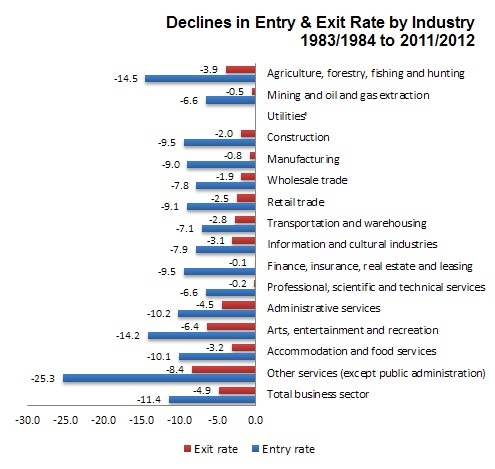

Declines in entry and exit rates were widespread across industries. From 1983/1984 to 2011/2012, entry rates in many industries fell by between 7 and 11 percentage points, while exit rates declined by

between 2 and 7 percentage points. These were similar to the magnitude of the overall decline found in the business sector over the 30-year period examined.

Manufacturing entry and exit rates show many of the same features as overall business-sector entry and exit rates: a wider gap in the 1980s that was reduced by a rise in the exit rate, a long downturn in the entry rate, and long-term similarity in entry- and exit-rate trends. However, after the late 1990s, unlike the business sector overall, in which the entry rate surpassed the exit rate, in the manufacturing sector, the entry rate fell below the exit rate. That is, the number of manufacturing firms began to decline. This coincides with the period when manufacturing�s share of value-added in the Canadian economy began to decline. By contrast, in the 1980s and 1990s, when the share of manufacturing in value-added rose, the entry rate surpassed the exit rate resulting in an increase in the number of manufacturing firms.

The differences in manufacturing entry and exit rates across decades reflect differences in the economic environment manufacturers faced. In the 1980s and 1990s, the Canadian dollar depreciated relative to the American dollar, and in the 1990s, the implementation of NAFTA changed the composition of Canada�s manufacturing industry. During these decades, the number of firms increased, and the share of manufacturing in value added in Canada moved counter to the international trend.

Source: Statistics Canada Publication: Study: Business Entry and Exit Rates in Canada: A 30-Year Perspective.