For additional information relating to this article, please contact:

July 24, 2014INCOME AND TAXES OF INDIVIDUALS: SUB-PROVINCIAL 2012 Yesterday, Statistics Canada released data on family income and related variables derived from personal income tax returns for 2012. This allows for examination of the distribution of income and taxes in provinces, cities, smaller population centres and rural areas across the country.

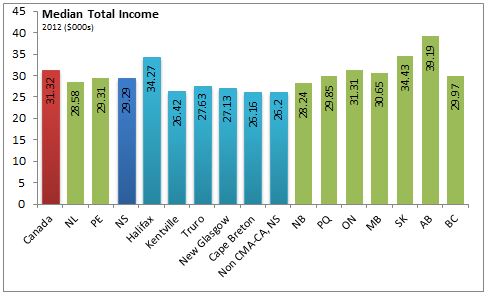

National median income for individual taxfilers from all sources was $31,320 in 2012. Nova Scotia's median total income in 2012 was $29,290. Median total income in Nova Scotia is below the national average as higher incomes are reported in central and western provinces. Halifax's median income of $34,270 is almost $3,000 higher than the national median, while other communities and regions of Nova Scotia report median income between $26,160 (Cape Breton) and $27,630 (Truro).

In Nova Scotia, there were 722,880 individual taxfilers, of whom 714,170 reported income from some source. Tax records allow examination of the distribution of income of individuals in certain ranges.

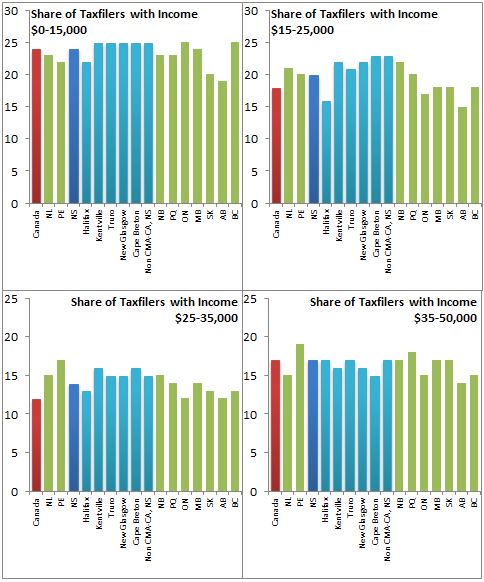

In Nova Scotia, 24 per cent of individual tax returns reported total income under $15,000. This is consistent with the national average, though a lower share of Halifax returns reported income under $15,000 compared with other communities in the province. A higher portion of Nova Scotians report income in the ranges of $15,000-$25,000 (20 per cent) and $25,000 to $35,000 (14 per cent) than the national average. As with lowest income range - Halifax has a lower portion of tax returns reported in these income ranges compared with the rest of the province. About the same percentage of Nova Scotians report income in the range of $35,000 to $50,000 (17 per cent) as the national average. This is also the case across other communities in the province. A smaller portion of Nova Scotians report income above $50,000 (across all ranges) than the national average. However, Halifax reports a higher or equal portion of income reported in these upper ranges compared with the national average.

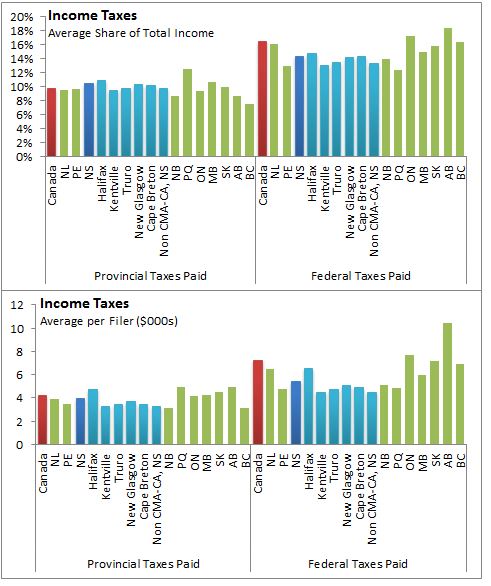

Nova Scotians pay between 9.6 per cent and 11 per cent of their total income in Provincial personal income taxes, compared with between 13.1 per cent and 14.9 per cent in Federal income taxes. Among those paying Provincial income taxes, the average payment ranges between $3,300 and $4,800 in Nova Scotia, compared with Federal taxes (among those with Federal tax payable) ranging from $4,500 to $6,600.

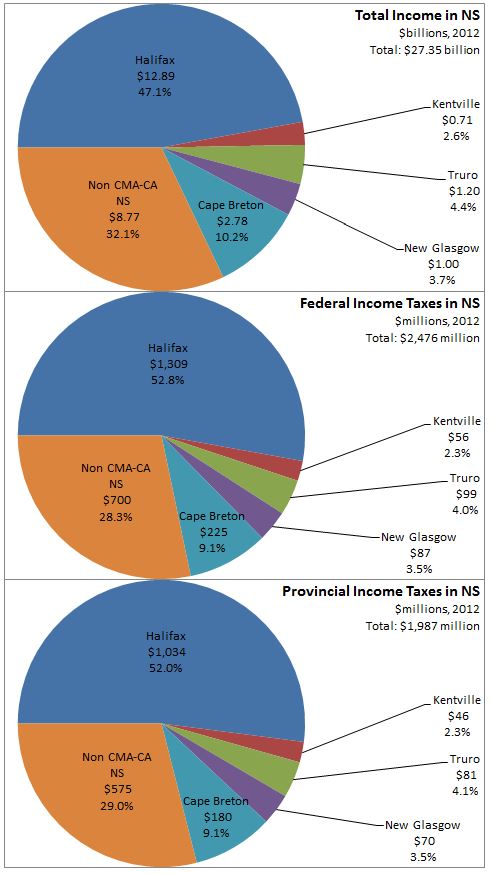

Of the $27.35 billion in total income reported from all sources in Nova Scotia, $12.89 billion was reported by Halifax residents. Halifax accounted for $1.31 billion of the $2.48 billion in Federal personal income taxes paid as well as $1.03 billion of the $1.99 billion in Provincial personal income taxes paid.

Statistics Canada - Neighbourhood Income and Demographics (13C0015)

Statistics Canada - Neighbourhood Income and Demographics (13C0015)