For additional information relating to this article, please contact:

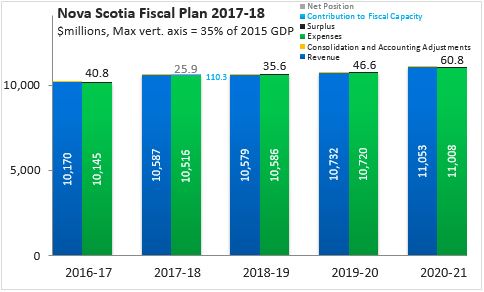

April 27, 2017NOVA SCOTIA BUDGET 2017-18 The Province of Nova Scotia has released its 2017-18 Budget. After a surplus of $40.8 million forecast for 2016-17, Nova Scotia projects a surplus of $136.2 million in 2017-18, with a net position of $25.9 million. The Budget specifically commits $110.3 million in one-time revenue received from Federal and municipal governments in respect of the Halifax convention centre project to future fiscal capacity for the Provincial Health Complex. This capital amount had appeared in the 2016-17 Budget Estimates. It is reported in 2017-18 estimates as it is required to be recognized by accounting standards at the date of substantial completion of the convention centre.

Nova Scotia's net position stands at $25.9 million in 2017-18. In subsequent years of the fiscal plan, the surplus is projected to rise to $35.6 million in 2018-19 to $46.6 million in 2019-20 and to $60.8 million in 2020-21.

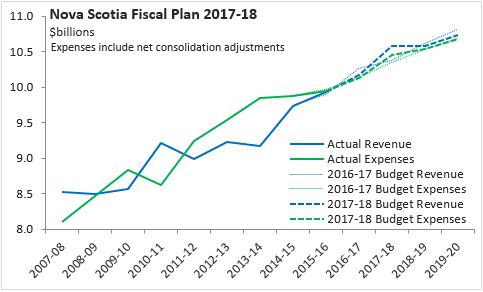

Compared with the fiscal plan presented in last year's Budget, the main change in Nova Scotia's fiscal outlook is the shift of $110.3 million in revenues from Federal and municipal government recoveries from 2016-17 into 2017-18. Otherwise, there are small variances from last year's fiscal plan to the current fiscal plan. The size of surpluses is based on average annual revenue growth projected at 2.12 per cent per year outpacing expenditure growth averaging 2.07 per cent.

Nova Scotia Provincial government revenues and expenditures are projected to grow at a slower pace than nominal GDP over the next four years. As a result, the footprint of provincial government in the economy is projected to decline by about 1 per cent of GDP. Over this period, the surplus remains steady at 0.1 per cent of GDP.

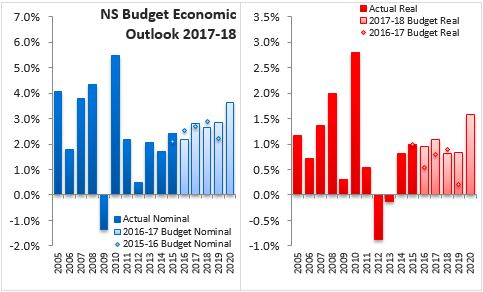

Nova Scotia' economy has returned to stable growth after declining in 2012 and 2013. Real GDP grew by 0.8 per cent in 2014 and by 1.0 per cent in 2015. The Department of Finance and Treasury Board estimates that real GDP grew by a further 1.0 per cent in 2016, with an outlook for 1.1 per cent growth in 2017 and 0.8 per cent growth in 2018. Continuing work on major projects, infrastructure and other investments are projected to support real GDP growth in 2017 and 2018, picking up from growth led by external demand. During 2014 and 2015, export growth was supported by a declining exchange rate. For 2016-2018, export growth has moderated and now depends more on projected economic recovery in both Canada and the US as well as rising exports to China.

With a declining labour force, Nova Scotia's employment growth has been limited. This has kept the unemployment rate down, but it has also required productivity improvements to keep the provincial economy growing. Recent productivity gains (2013-2015) have been well above historic trends. With prices and foreign exchange rates normalizing, the pace of inflation is expected to return to normal over the next couple of years, lifting the pace of nominal GDP growth to 2.8 per cent in 2017 and 2.6 per cent in 2018.

Key Measures and Initiatives

The 2017-18 Nova Scotia Budget focuses on five priorities: Healthy People and Communities, Infrastructure, Youth & Jobs, New Ideas for a Better Economy and Support for an Aging Population. The Budget features a number of initiatives in support of each of these priorities. Notable tax changes include enhancing the Basic Personal Amount in the personal income tax by up to $3,000 for taxable incomes of up to $75,000 (January 1, 2018) and raising the small business tax threshold from $350,000 to $500,000.

Nova Scotia Budget 2017-18