For additional information relating to this article, please contact:

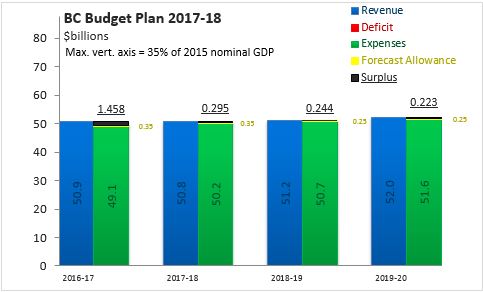

February 22, 2017BRITISH COLUMBIA BUDGET 2017-18 The Province of British Columbia has presented its 2017-18 Budget. British Columbia is reporting surpluses in each year of its fiscal plan. The surplus for 2016-17 has increased to $1.458 billion from a budget estimate of $0.264 million. This improvement is largely the result of stronger assessments and year-to-date results in key revenue sources: personal income tax, corporate income tax, property transfer tax, sales tax. The 2016-17 surplus had been even higher at $2.242 billion in the Q2 update, but this was reduced by additional spending for housing and infrastructure initiatives.

For 2017-18, British Columbia expects a more modest surplus of $295 million as revenues are expected to decline slightly as one-time income and property tax revenues are not expected to persist. British Columbia's 2017-18 revenue outlook is further diminished by reduced small business tax rates and lower Medical Service Plan premiums. Through the remainder of the fiscal horizon, British Columbia plans to run modest surpluses of $244 million in 2018-19 and $223 million in 2019-20. British Columbia makes a forecast allowance of $350 million in 2017-18 as well as $250 million in each of the next two fiscal years. In addition to the forecast allowance, British Columbia as includes a Contingencies vote of $400 million in 2017-18 and $300 million in 2018-19 as well as in 2019-20 (shown here as part of expenditures).

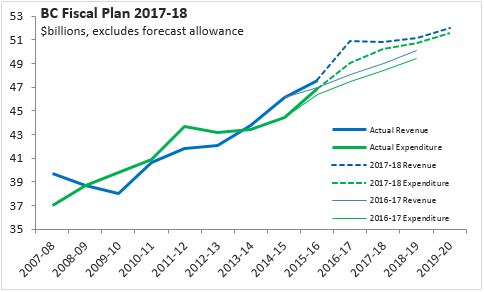

Compared with last year's fiscal plan, British Columbia is now projecting higher revenues and higher expenditures for 2016-17. However some of these one-time revenues are not expected to repeat while other revenues will be reduced by changes to tax rates. From 2016-17 through 2019-20, British Columbia's revenues are projected to grow by an annual average rate of 0.8 per cent while expenditures grow at 1.7 per cent over this period. Despite expenditure growth outstripping revenues, British Columbia is able to maintain roughly the same surplus as previously projected, albeit with higher revenues and expenditures.

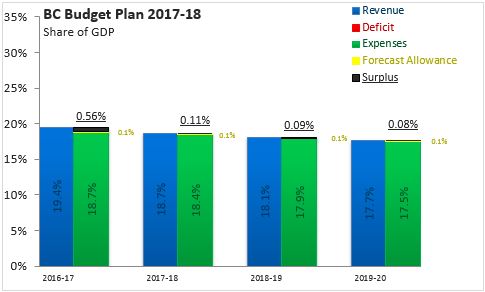

British Columbia's nominal GDP growth is notably faster than projected growth for either revenues or expenditures. As a result, the footprint of the British Columbia government in the provincial economy is expected to shrink - revenues fall from 19.4 per cent to GDP in 2016-17 to 17.7 per cent of GDP in 2019-20 while expenditures fall from 18.7 per cent of GDP to 17.5 per cent of GDP. British Columbia's Budget surpluses are projected to be about 0.1 per cent of GDP, with a similar amount set aside as forecast contingency. Over the course of this fiscal plan, British Columbia's debt-to-GDP ratio is projected to decline from 16.1 per cent in 2016-17 to 16.0 per cent in 2019-20; higher capital spending keeps British Columbia's debt-to-GDP ratio stable despite ongoing surpluses.

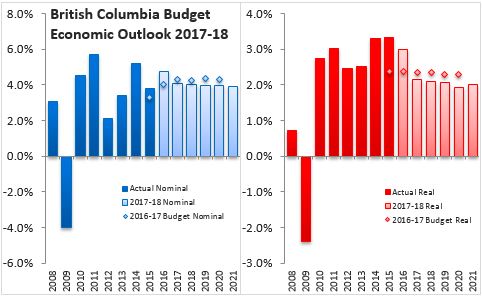

British Columbia's economy has enjoyed steady growth since the recession; real GDP growth of 3.3 per cent in 2015 was the strongest since 2006, exceeding expectations in retail sales, housing starts and employment. British Columbia's economic forecast anticipates steady real GDP growth of 2.1 per cent in the next two years, followed by 2.0 per cent in the three subsequent years. Recent growth has been fuelled by consumer spending, exports and residential investment. The British Columbia Budget assumes that residential construction will moderate in the coming year while employment and wage growth will keep household spending positive. British Columbia's exports have been a source of growth for the province, but they British Columbia Budget notes that these are particularly vulnerable to changes in commodity prices and trade policies (especially in the US).

Key Measures and Initiatives

British Columbia's 2017-18 Budget delivers 'dividends' of its ongoing fiscal surpluses, allowing the province to

- cut Medical Services Plan premiums in half for households with incomes up to $120,000, effective January 1, 2018

- reduce the small business tax rate is also reduced to 2 per cent from 2.5 per cent effective April 1

- expand the digital media tax credit to augmented and virtual reality products

- introduce a tax credit for volunteer firefighters and search and rescue volunteers

- increase expenditures in k-12 education, assistance for those in need, mental health and substance use treatment

British Columbia Budget 2017-18