For additional information relating to this article, please contact:

July 26, 2016US S&P CORELOGIC CASE-SHILLER HOME PRICE INDICES, MAY 2016

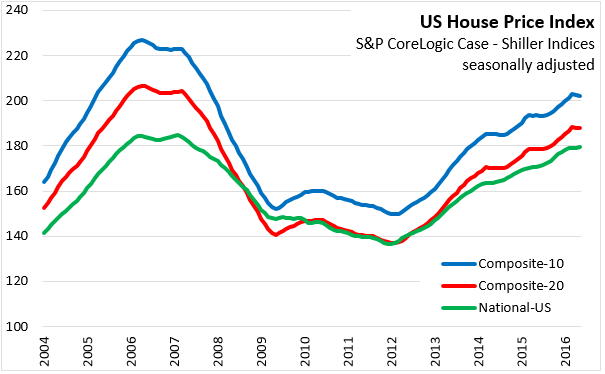

S&P Dow Jones Indices reports that US national house prices, as measured by the S&P CoreLogic Case - Shiller Indices rose by 0.2 per cent nationally in May (seasonally adjusted). Prices were down slightly for the urban composite indices - declining -0.2 per cent for the 10 largest metropolitan areas and by -0.1 per cent for the 20 largest areas. Twelve cities saw price increases, two were unchanged and six experienced price decreases.

"Home prices continue to appreciate across the country,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. "Overall, housing is doing quite well. In addition to strong prices, sales of existing homes reached the highest monthly level since 2007 as construction of new homes showed continuing gains. The SCE Housing Expectations Survey published by the New York Federal Reserve Bank shows that consumers expect home prices to continue rising, though at a somewhat slower pace."

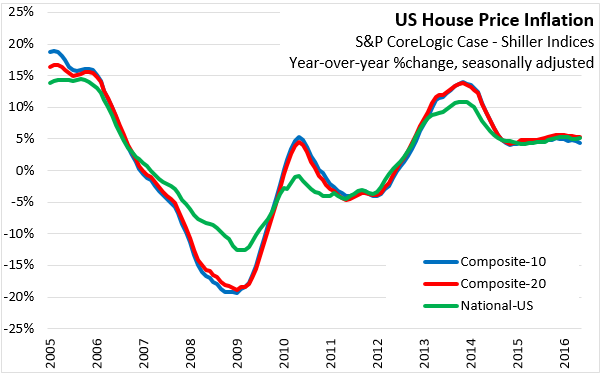

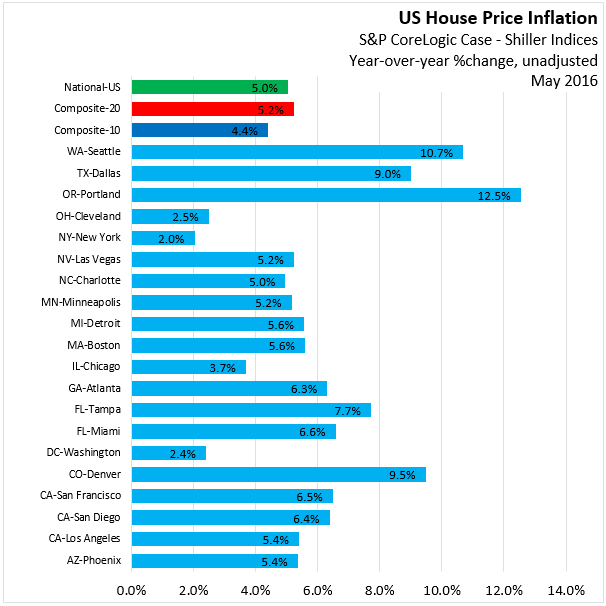

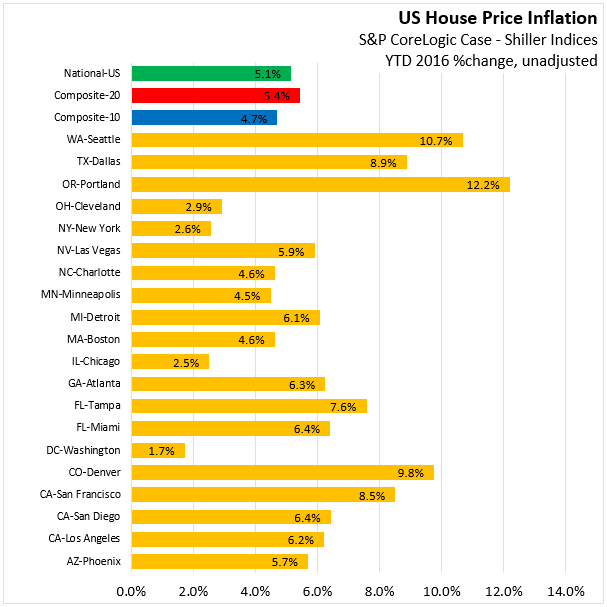

Compared with May 2015, US house prices grew by 5.0 per cent (unadjusted figures) - with stronger growth among the 20-city composite (5.2 per cent) than in the 10 largest cities (4.4 per cent). US house price inflation has stabilized at a year-over-year rate of around 5.0 per cent since late 2014.

Among the major metropolitan areas monitored by the S&P CoreLogic Case - Shiller Indices, the strongest growth continues to be in Portland (OR), Seattle, Denver, and Dallas. House price inflation is slower in Chicago, Cleveland, New York City and Washington DC.

Note: Effective today, 26 July 2016, the S&P/Case - Shiller Home Price Indices have been renamed to the S&P CoreLogic Case - Shiller Indices.