For additional information relating to this article, please contact:

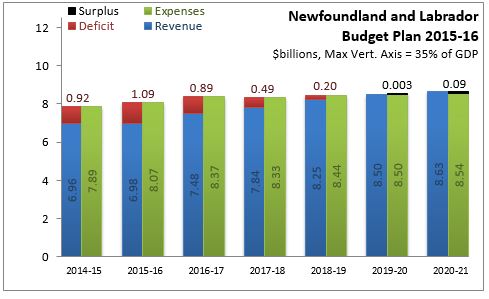

May 01, 2015NEWFOUNDLAND AND LABRADOR BUDGET 2015-16 On April 30, Newfoundland and Labrador released its Budget for 2015-16. With falling oil prices, Newfoundland and Labrador's fiscal situation has worsened. The government now expects a deficit of $1.09 billion in 2015-16 following a deficit of $924 million in 2014-15. With the economy projected to shrink in each of the next four years, Newfoundland and Labrador does not anticipate returning to balance until 2019-20. Through 2020-21, Newfoundland and Labrador plans on average revenue growth of 3.6 per cent while expenditures are limited to 1.3 per cent per year. Newfoundland and Labrador's revenues will be enhanced by increasing personal and sales tax rates.

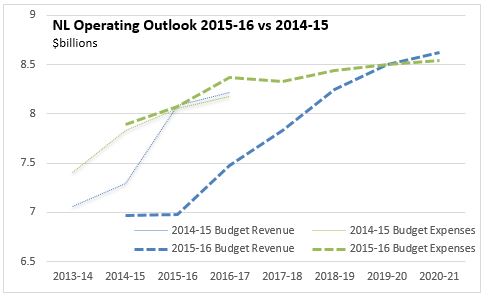

Falling oil prices have resulted in a significant downward revision to Newfoundland and Labrador's revenue projections. Compared with the 2014-15 Budget Estimate, Newfoundland and Labrador's revenues are now projected to be over $1.1 billion lower in 2015-16 and a further $0.7 billion lower in 2016-17.

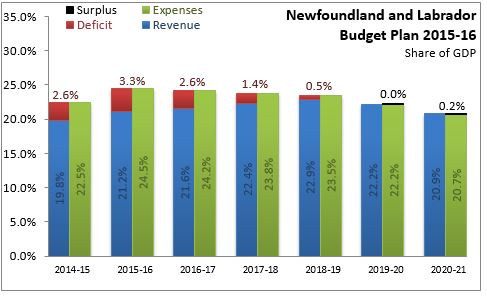

In the coming years, Newfoundland and Labrador's provincial government is expected to grow as a share of GDP. This is exacerbated by the expected decline in nominal GDP in 2014 and 2015 as a result of falling oil prices. Newfoundland and Labrador's deficit is expected to peak at 3.3 per cent of GDP in 2015-16.

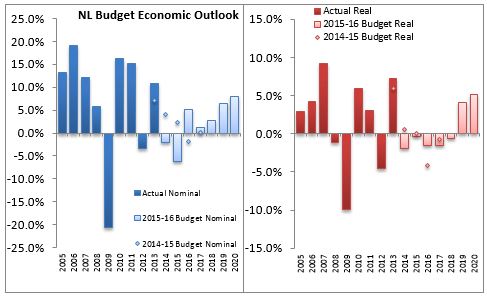

Newfoundland and Labrador's economic outlook has been revised down because of falling oil prices. Real GDP is currently estimated to have fallen by 1.9 per cent in 2014 and the decline is expected to continue through 2018. Real economic growth is only projected to return in 2019 and 2020. Some of this decline had been previously foreseen; major capital investments are being completed and oil production for certain fields is moving beyond peak output. However, additional capital projects may be threatened by persistent low commodity prices. With lower capital spending, Newfoundland and Labrador's employment is expected to decline by 6.6 per cent from 2014 through 2018. However, a falling labour force is expected to limit upward pressure on unemployment rates.

Key Measures and Initiatives

Newfoundland and Labrador's Budget features a number of initiatives to improve its fiscal balance, including:

- Raising the Harmonized Sales Tax rate by 2 percentage points to a combined Federal and Provincial rate of 15 per cent. Increases to the HST credit are expected to offset the impact on those with lower incomes.

- Introducing new personal income tax brackets for income above $125,000 (14.3 per cent) and aove $175,000 (15.3 per cent). The previous top marginal rate had been 13.3 per cent on income above $68,508.

- Increasing the financial corporations capital tax rate from 4 to 5 per cent.

- Ending the Residential Energy Rebate program

- An attrition plan featuring 80 per cent replacement of retirees. This is projected to reduce the size of the broader public sector by 1,420 as of FY2019-20, saving $300 million over five years.

Other measures:

- Establish a Generations Fund in which to accrue revenues from offshore oil projects

- New interactive digital media tax credit

Newfoundland and Labrador Budget 2015-16