For additional information relating to this article, please contact:

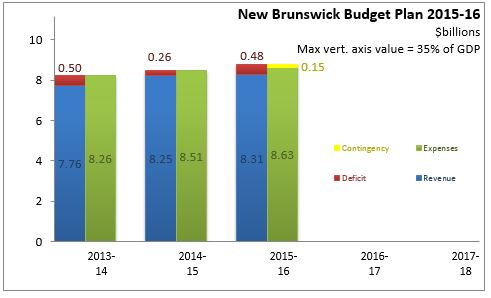

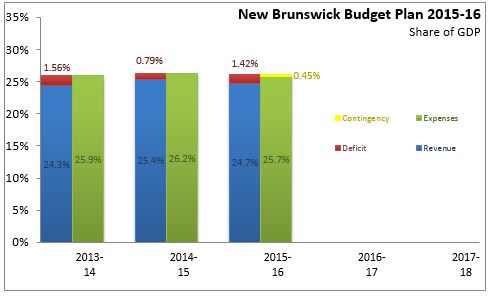

March 31, 2015NEW BRUNSWICK BUDGET 2015-16 New Brunswick tabled its 2015-16 Budget on March 31. The New Brunswick Budget anticipates a deficit of $476.8 million in 2015-16. The deficit for 2014-15 is forecast to be $255.4 million, with the improvement largely coming from one-time revenues that are not expected to repeat. The 2015-16 deficit also incorporates a contingency provision of $150 million to protect against adverse shocks.

New Brunswick has a relatively large provincial government compared wtih the size of its economy. Provincial spending is expefted to be 25.7 per cent of GDP in 2015-16, down from 26.2 per cent in 2014-15. Provincial revenues are projected to decline to 24.7 per cent of GDP from 25.4 per cent in 2014-15. The New Brunswick Budget deficit amounts to 1.42 per cent of GDP, but this includes a contingency provision amounting to 0.45 per cent of GDP.

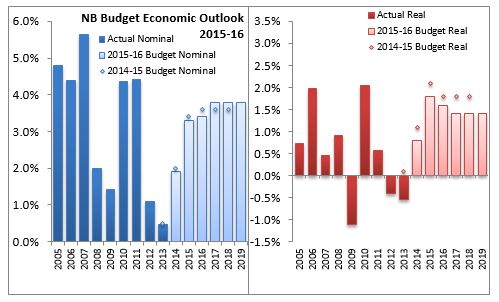

New Brunswick's economy declined in 2012 and 2013. The Budget anticipates that the recovery in real GDP for 2014 (0.8 per cent) will accelerate to 1.8 per cent in 2015. Manufacturing activity is expected to enjoy growth from lower energy prices and a lower foreign exchange rate. Employment and wages are expected to rise on stronger mining investment and production. In 2016, the government's strategic infrastructure initiative is expected to support export-led growth.

Key Measures and Initiatives

To deal with an estimated structural deficit of $400 million, the Province has embarked on a Strategic Program Review. Until the results of this program are complete, the New Brunswick government will not update its medium-term fiscal plan. However, in the interim, the 2015-16 Budget introduces a number of measures and initiatives to improve the province's fiscal situation:

- Eliminating the New Brunswick Tuition Rebate

- Creating a new tax bracket for taxable income between $150,000 and $250,000 with a marginal tax rate of 21 per cent

- Creating another bracket for taxable income greater than $250,000 with a marginal tax rate of at 25.75 per cent

- Increasing fuel taxes on gasoline by 1.9 cents per litre and on diesel fuel by 2.3 cents per litre

- Closing Service New Brunswick outlets and courthouses

- Reducing teaching positions in the education system by 249

- Freezing contributions to universities and community colleges; mposing a tuition freeze on public universities

- Removing maximum daily amount cap on seniors paying for nursing homes

The government has also adopted some measures to improve economic performance:

- The small business corporate income tax rate was lowered from 4.5 per cent to four per cent on January 1, 2015. It will be further reduced to 2.5 per cent.

- The tax credit on dividends received from small business will be decreased from 5.3 per cent to 4.0 per cent to match the new small business corporate income tax rate.

- The Small Business Investor Tax Credit rate for individuals will increase from 30 per cent to 50 per cent. The enhancement will increase the maximum tax credit from $75,000 per year to $125,000 per year

- A new Youth Employment Fund will help provide work experience and training for 1,500 youth per year

New Brunswick Budget 2015-16