For additional information relating to this article, please contact:

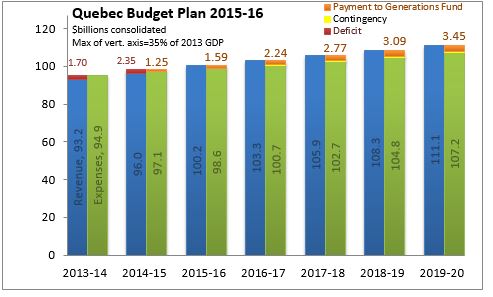

March 31, 2015QUEBEC BUDGET 2015-16 Quebec published its 2015-16 Budget on March 26. For 2015-16, the Quebec Budget is balanced, with a payment of $1.59 billion to Quebec's "Generations Fund". In the next five years, Quebec anticipates small surpluses of revenues over expenditures - all of which will be paid into the Generations Fund.

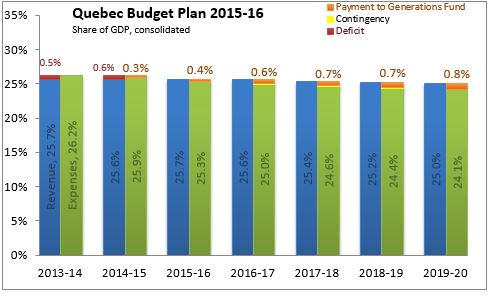

The Quebec government has a relatively large footprint in the province's economy. Over the next fiscal plan, both revenues and expenditures are expected to decline as a share of GDP. The contribution to the Generations Fund (similar to a surplus) is projected to reach 0.8 per cent of GDP by 2019-20.

Quebec's economic outlook has been less impacted by volatility in world oil markets. The Quebec Budget assumes that economic growth will unfold largely as assumed in the 2014-15 outlook. Real GDP growth is expected to be slightly stronger as US recovery and a favourable exchange rate and terms of trade support export growth for Quebec. This is expected to have a subsequent positive effect on non-residential business investment. In addition, Quebec households are projected to benefit from lower oil costs, boosting household consumption in other areas.

Key Measures and Initiatives

Quebec had been reporting deficits for several years, including a deficit of $2.35 billion projecteed for 2014-15. Closing the gap has involved several initiatives announced between the 2014-15 Budget and the 2015-16 Budget, including:

- Reducing department budgets by $3.4 billion (relative to fiscal plan)

- Limiting factors related to compensation growth ($0.69 billion)

- Reducing tax expenditures ($0.6 billion)

- Reducing staffing levels ($0.5 billion)

- Changes to municipal funding ($0.3 billion)

- 20 per cent reduction in rates of tax credits ($0.27 billion)

- Changes to childcare funding ($0.19 billion)

- Compensation spreading for physicians ($0.19 billion)

Quebec has also announced a number of tax reductions intended to improve economic conditions, including several recommendations from the Quebec Taxation Review Committee:

- Elimination of the health contribution (currently up to $1,000) by 2019

- Introduction of a "tax shield" that reduces taxes by up to $5,000 per household after experiencing an increase in employment income. This measure lowers the effective marginal taxes from additional work effort.

- In addition to the tax shield, the Quebec Budget also encourages labour supply from its older age cohorts; raising the tax credit for experienced workers and increasing the eligibility age for the age tax credit from 65 to 70 (though no individual who currently receives the credit will lose it).

- Reducing the Health Services Fund contribution (payroll tax) from small businesses

- Lowering the small business tax rate for manufacturing and primary sector firms from 8 per cent to 4 per cent, but excluding construction and service sector businesses with three employees or less from eligibility for the small business deduction.

- Reducing the general corporate tax rate from 11.9 per cent to 11.5 per cent.

- Reducing investment tax credit rates for manufacturing and processing equipment, leaving the credit in place only for investment in resource regions.

- Enchanced tax credits for new economy and cultural industries; reduced refundability of tax measures for international financial centres.

Quebec Budget 2015-16