For additional information relating to this article, please contact:

October 29, 2014US MONETARY POLICY The Federal Open Market Committee (FOMC) issued its latest monetary policy statement today.

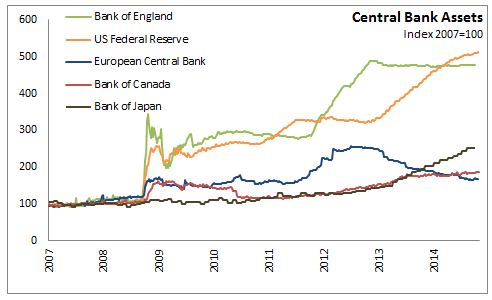

The FOMC announced that it would maintain the target range for the federal funds rate at 0 to 1/4 percent but has end its asset purchasing program. The FOMC will continue reinvesting principal payments from its holdings of mortgage-backed securities and rolling over maturing Treasury securities and thus holdings of longer-term securities will continue to be at sizable level. The committee also reaffirmed that they anticipate that the current 0 to 1/4 per cent federal funds rate will remain appropriate for a considerable time and that even after employment and inflation are near mandate levels that economic conditions could warrant a federal fund rate below the normal long run rate.

The FOMC views information since September suggesting that economy is expanding at a moderate pace with labour market indicators showing that the underutilization of labour resources as gradually diminishing. Household spending is rising moderately and business fixed investment is advancing even as housing sector remains slow. Inflation continues to be below the long-run objective with longer-term inflation expectations remaining stable. Over the short term inflation will be held down by lower energy prices but the Committee feels that risk of persistently below 2 per cent inflation has diminished.

US Federal Reserve

US Federal Reserve