The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 17, 2024FEDERAL BUDGET 2024-25 Canada's Federal government has tabled its 2024-25 Budget.

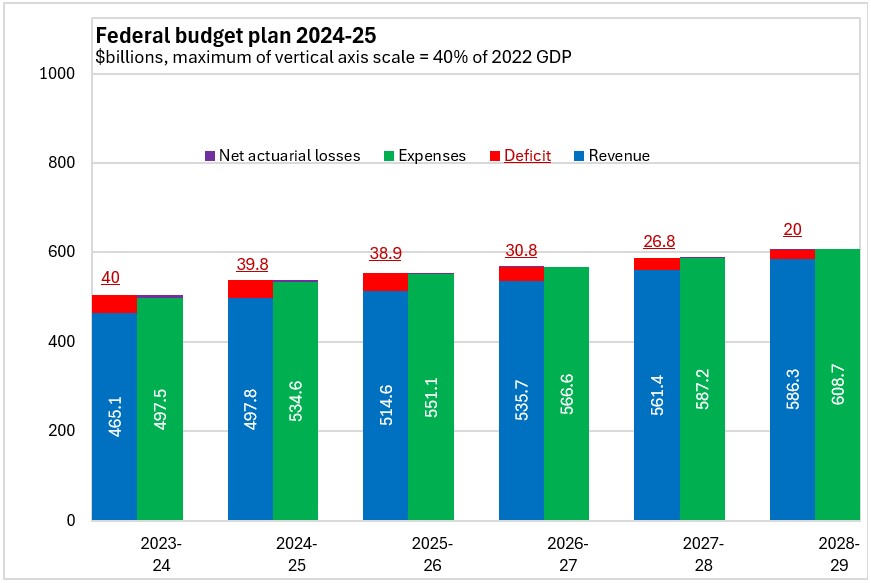

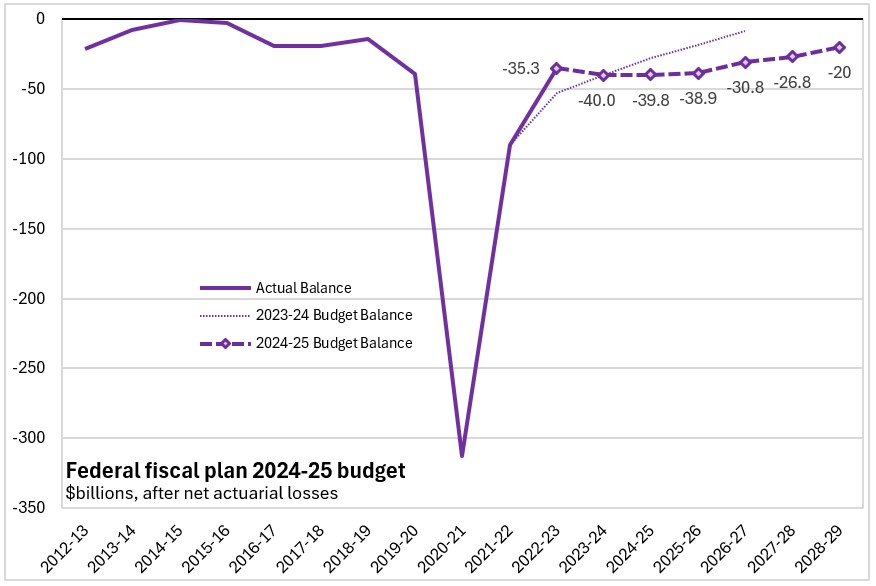

The 2024-25 Federal Budget includes a deficit of $39.8 billion (after net actuarial losses). This is little changed from the deficit of $40.0 billion currently forecast for 2023-24. The deficit for 2025-26 is also projected to remain at this level: $38.9 billion. Deficits are projected to persist through to fiscal year 2028-29, by which time the deficit falls to $20 billion.

The 2024-25 Budget anticipates revenue growth of 7.0% and expenditure growth of 7.5%, compared with the latest forecast for 2023-24. Revenue growth is projected to slow to 3.4% in 2025-26 and to average 4.4% per year over the subsequent three years. Expenditure growth is projected to slow to 3.1% in 2025-26 and to average 3.4% per year over the subsequent three years.

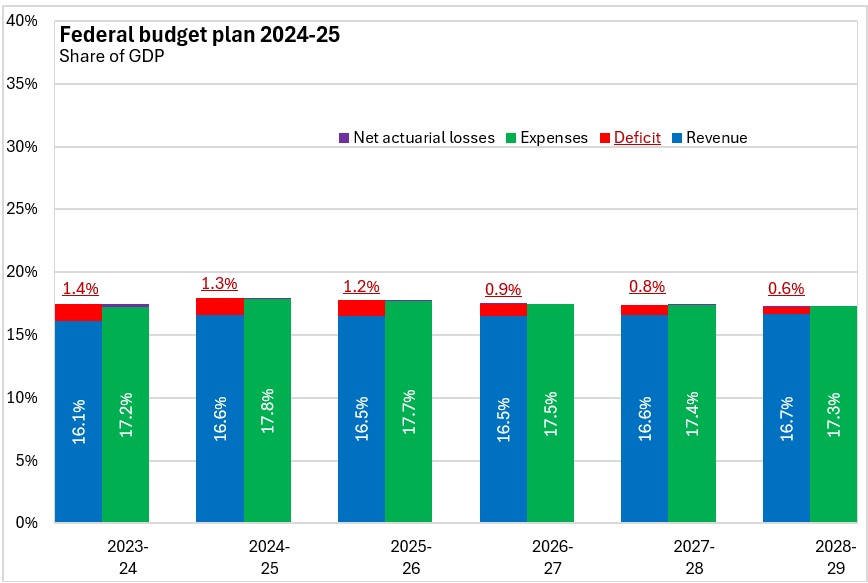

Measured as a share of GDP, the Federal deficit is projected to be 1.3% in 2024-25, falling to 1.2% in 2025-26. By 2028-29, the Federal deficit is projected to fall to 0.6% of GDP. Canada’s Federal expenditures are projected to fall from 17.8% of GDP in 2024-25 to 17.3% of GDP by 2028-29 as economic growth outpaces spending growth.

Canada’s Federal net debt is projected to remain stable at 45.8% of GDP in 2024-25, gradually falling to 43.0% of GDP by 2028-29.

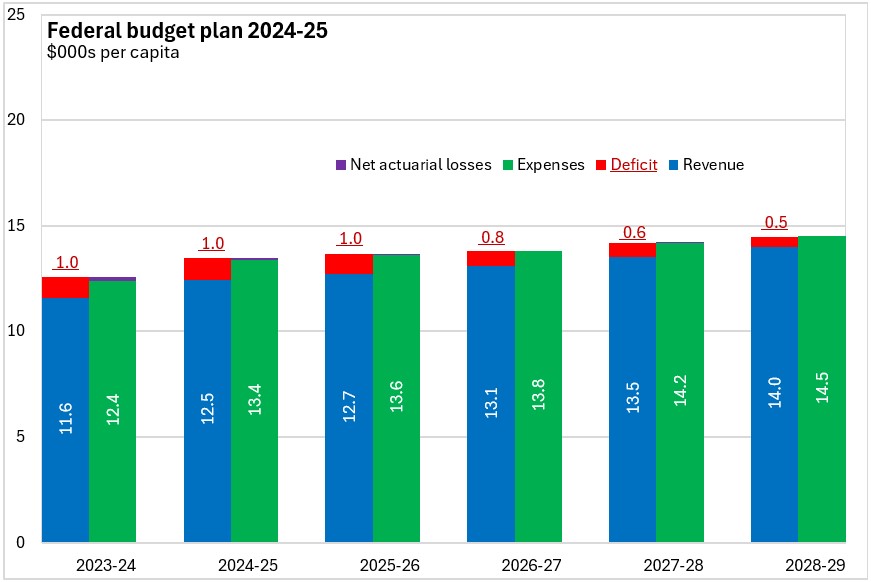

Canada's 2024-25 Federal Budget expenditures amount to $13,381 per capita (as well as net actuarial losses of $78 per capita), funded by revenues of $12,459 per capita and a deficit of $996 per capita. Although the per capita deficit remains stable at $961 in 2025-26, it is projected to fall to $477 per capita by 2028-29.

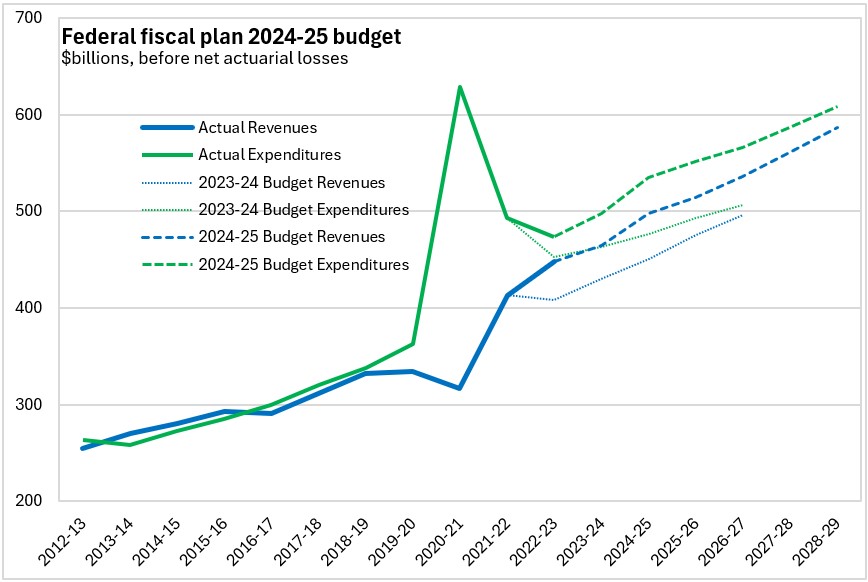

Comparing the fiscal plan from the 2023-24 Federal Budget with that from the 2024-25 Federal Budget, revenues are projected to be $47 billion higher for 2024-25 than planned at this time last year. Federal expenditures are projected to be $58.4 billiion higher for 2024-25 than planned at this time last year.

The 2023-24 Budget plan included more aggressive narrowing of the deficit than is now anticipated.

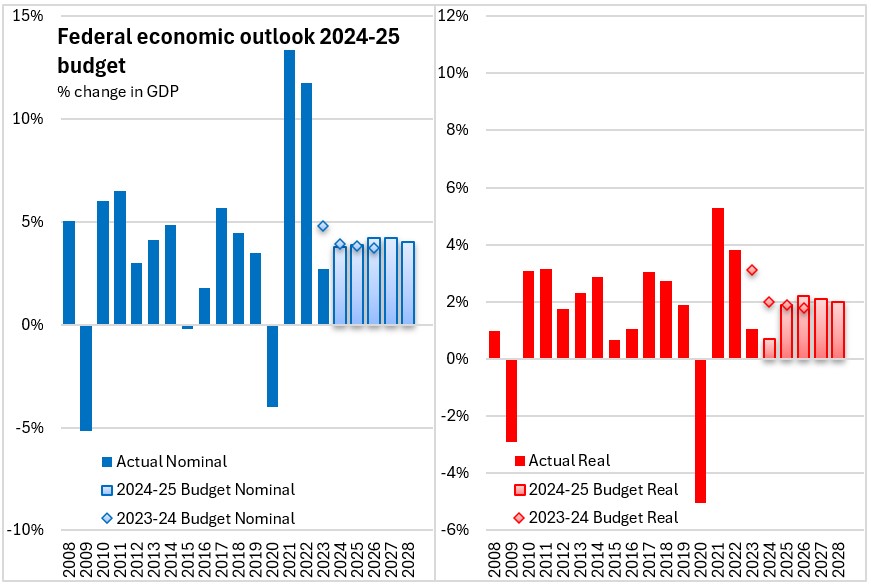

Canada’s economy has avoided recession despite tightening monetary policy to cool inflation. The robust labour market has provided wage gains that have outpaced inflation for the last 13 months. However, inflation is still expected to remain above the Bank of Canada’s (mid-point) target through the first half of 2024. After making a ‘soft landing’ in early 2024 (containing inflation without triggering recession), interest rates are expected to start declining in mid-2024. Considerable uncertainty remains about timing of interest rate cuts. Interest rates are projected to fall to 3.1% in 2025 and then to average 2.7% over the next three years. Despite the soft landing, Canada’s GDP growth has underperformed relative to expectations from the 2023-24.

For 2024, Canada’s real GDP growth is projected to be 0.7%. As inflation is contained and interest rates fall, Canada’s real GDP growth is projected to rebound to a seasonally adjusted annualized rate of just over 2% in the first half of 2025 (1.9% for 2025 as a whole). Unemployment rates are projected to rise slightly (6.3% for 2024), but remain well below levels typically seen during a monetary tightening cycle.

The 2024-25 Federal Budget’s downside economic scenario is driven by geopolitical tensions, weak growth in China and persistent inflation in the US that force interest rates to stay higher for longer. This leads to a slight contraction (-0.1%) for real GDP in 2024. The upside economic scenario assumes robust household balance sheets in the US that support global growth and commodity price gains. This drives economic growth up to 1.4% in 2024 and 2.2% in 2025.

The Federal Budget also makes long-range projections for economic and fiscal outcomes. Over the long-term (though 2055-56), debt is projected to continue declining steadily, even under scenarios with slower economic growth assumptions. Over the medium term, Canada’s economic growth (average 1.8% per year) is expected to be driven in equal parts by rising labour supply (immigration offsetting falling participation rates) and by increasing productivity. Over the long term, productivity plays a more important role than labour supply in how the Canadian economy grows.

Key Measures and Initiatives

Canada's 2024-25 Federal Budget prioritizes solving the housing crisis, restoring fairness for younger generations and economic growth/productivity. Many initiatives from the 2024-25 Federal Budget were announced in the days leading up to its tabling. Key measures include:

Housing

- Increase the capital cost allowance rate from 4% to 10% for apartments

- Expand the removal of GST from rental housing to include student residences built by public universities, public colleges, and public school authorities

- Increase in the annual limit for Canada Mortgage Bonds from $40 billion to $60 billion

- Add $15 billion in loans for the Apartment Construction Loan Program (expected to generate 30,000 additional units)

- Adjustments to the Apartment Construction Loan program: extending the terms of the loans offered, including housing projects for students and seniors, adding a portfolio for multiple concurrent projects, flexibility on affordability/efficiency/accessibility requirements, funding construction of apartments above commercial spaces, launching a new frequent builder stream for proven home builders, partnering with provincial governments that have ambitious housing plans,

- Lease public lands for affordable housing (to ensure new construction stays affordable)

- Make more public land available for housing

- Create a Secondary Suite Loan Program to encourage construction and rental of under-used space in existing residential properties.

- $4.3 billion for the Urban, Rural and Northern Indigenous Housing Strategy

- Add $400 million to the Housing Accelerator Fund that addresses barriers to expanding housing

- Add conditions to housing funding around high-frequency transit lines and post secondary institutions

- Create a $6 billion Canada Housing Infrastructure Fund to support construction of infrastructure (water, wastewater, solid waste) needed alongside more housing.

- Changing how homes are built with an industrial strategy for housing and building materials

- Incorporating standardized designs, innovative home-building technology and pre-fabricated manufacturing to speed construction and reduce costs

- Establishing tenant protections and adding rental payments to credit scores

- Extending mortgage amortizations for first time buyers of new homes to 30 years.

- Increasing the Home Buyers' Plan limit on RRSP withdrawals for down payments to $60,000 and lengthening the grace period on repayment by 3 years

- Supporting municipal enforcement of regulations on short term accommodations

- Removing tax deductions for some short term rental operators

- Extending the ban on foreign home buyers to 2027

- Adding $1 billion to the Affordable Housing Fund

- Launching a $1.5 billion Canada Rental Protection Fund to keep existing affordable units in the housing stock.

- Launching a $1.5 billion Co-operating Housing Development Program

- Adding $1 billion over 4 years to stabilize homelessness reduction programming

- $250 million (cost-matched) to address needs of unhoused Canadians living in encampments

Fairness for younger generations

- $1.1 billion for extended student grants and interest-free student loans for low-income households

- Adding to student aid to support higher rents

- $60 million for Futurpreneur to support innovative young entrepreneurs

- Launching a new youth mental health fund

- Adding funds for after-school learning programs

Economic growth and productivity

- $2.4 billion for AI initiatives

- Adding $1.8 billion to research granting institutions.

- Adding $825 million to support increased scholarship and fellowship funding for graduate students and post-doctoral fellows

- Modernising the Scientific Research and Experimental Development Tax Credit.

- New tax credits for electric vehicle supply chaings

- Expanding the Clean Technology Manufacturing tax credit

- Accelerated capital cost allowance for productivity enhancing assets

- New Canadian Entrepreneurs' Incentive to reduce the inclusion rate on up to $2 million in capital gains income for entrepreneurs

- Adding to the Canada Carbon Rebate for Small Businesses (up to 499 employees)

Tax measures

- Increasing capital gains inclusion to two thirds (from 50%) for corporations and trusts as well as for individuals on gains over $250,000

- Increasing lifetime capital gains exemption to $1.25 million

- Raising tobacco excise taxes by 2 cents per cigarettes

- Launching a Canada Disability Benefit ($6.1 billion over 6 years) for low income persons with disabilities

Canada Federal Budget 2024-25

<--- Return to Archive