The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 22, 2024NEWFOUNDLAND AND LABRADOR BUDGET 2024-25 The Province of Newfoundland and Labrador has tabled its provincial budget for 2024-25.

Newfoundland and Labrador's Budget reports expenditures that are funded by Federal government transfers separately from base government expenditures. In addition, the Newfoundland and Labrador Budget makes provisions for adjustments resulting in changes in volatile oil prices.

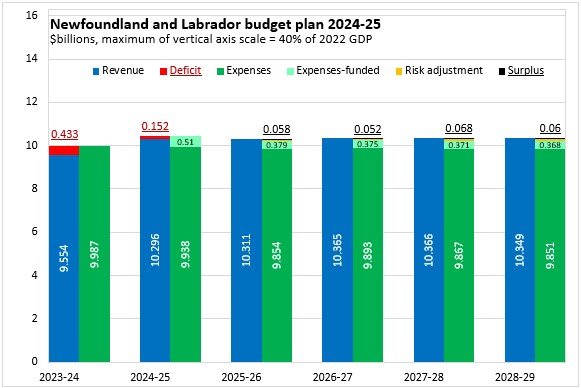

In 2024-25, the Newfoundland and Labrador government anticipates a deficit of $152 million. This is down from the $433 million deficit now estimated for 2023-24. In 2025-26 and the three subsequent fiscal years, Newfoundland and Labrador anticipates small surpluses.

Including fully-funded expenses, Newfoundland and Labrador's expenditures are expected to grow by 3.1% from the latest 2023-24 forecast to the 2024-25 estimate. At the same time, revenues are projected to rebound by 9.4% after a 6.2% contraction in 2024-25. After 2024-25, Newfoundland and Labrador plans to keep expenditure growth limited to just 0.1% in 2025-26 and 0.5% in 2026-27. Expenditures are projected to be unchanged in 2027-28 and to decline by 0.2% in 2028-29. Over this period, revenues are projected to contract by 2.1% in 2025-26, grow by 0.3% in 2026-27, contract by 0.3% in 2027-28 and contract again by 0.2% in 2028-29.

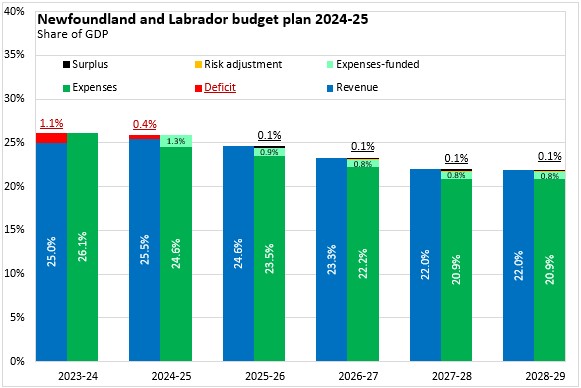

Measured as a share of GDP, the footprint of provincial government in the Newfoundland and Labrador economy is expected to decline from 25.9% of GDP in 2024-25 to 22.0% of GDP by 2027-28 and 2028-29. Newfoundland and Labrador's deficit is projected to by 0.4% of GDP in 2024-25 while subsequent surpluses are projected to be stable at 0.1% of GDP.

Newfoundland and Labrador's net debt for 2024-25 is projected to rise to $17.8 billion or about 44% of projected nominal GDP.

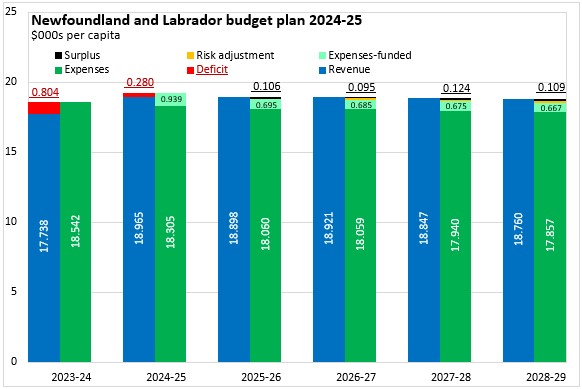

Newfoundland and Labrador's expenditures in 2024-25 amount to $19,244 per capita, including those reported as fully funded. These expenditures are projected to fall over the subsequent fiscal years, declining to $18,525 per capita by 2028-29. After a deficit of $280 per capita in 2024-25, Newfoundland and Labrador's surpluses amount to between $94 and $124 per capita in subsequent fiscal years.

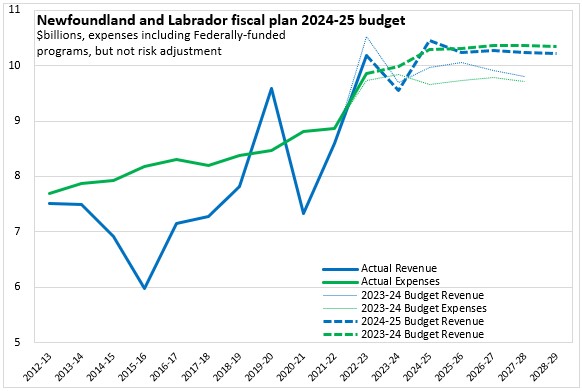

Both revenues ($474 million) and expenditures ($639 million) are projected to be higher than previously anticipated for 2024-25. Newfoundland and Labrador's revenue growth for 2024-25 is notably stronger than anticipated in last year's fiscal plan. Expenditures are also projected to remain higher over the duration of the fiscal horizon.

Newfoundland and Labrador's overall fiscal position is projected to be weaker than previously anticipated for 2023-24, 2024-25 and 2025-26 before returning to about the same size of surpluses in 2026-27 and 2027-28.

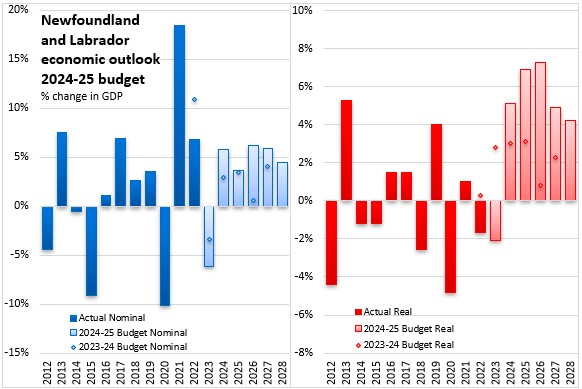

Newfoundland and Labrador's economic outlook is highly sensitive to assumptions about prices, production and investment in large natural resource projects. The Budget assumes oil prices of $82 (US dollars per barrel, WTI) as well as an exchange rate of 74.7 US cents per Canadian dollar. Newfoundland and Labrador's real GDP is projected to grow by 5.1% in 2024 as exports rebound on higher output of natural resource (oil, nickel, iron ore) as well as labour markets bolstered by housing construction and investment in the West White Rose oil project. Newfoundland and Labrador's population is expected to continue rising, contributing to higher household income.

Key Measures and Initiatives

Newfoundland and Labrador's Budget prioritizes health care, seniors, supporting industry and communities. Highlights include:

Health care

- total health care spending of $4.1 billion

- $30 million to hire additional providers for family care teams, and to create new teams

- More than $620 million (10 years) for health information management infrastructure

- $10 million to recruit and retain health care professionals

- $2 million to increase the medical school seats

- $500,000 for a new nursing mentorship program

- $5 million for MyHealth NL

- $1.3 million for mobile primary care clinics

- $600,000 to implement a mobile X-ray pilot project

- $6.5 million for a cardiac catheterization suite

- $1.8 million for expanding the continuous glucose monitoring program for patients with type 1 diabetes

- $10 million to expand virtual care services

- Adding more than 20 new drugs to the drug program

- $14 million for mental health and addictions

- $1.5 million to expand the mobile crisis response teams

Seniors

- $10 million for a new Seniors’ Well-Being Plan

- $70.3 million for the Seniors’ Benefit

- $6 million to establish centres of excellence in aging at regional hospitals

- Free driver medicals for people 75 and older

- $750,000 for a seniors’ stroke program

- $750,000 for nurse practitioners to support the home dementia program

- $850,000 to expand the use of endovascular treatment for hyperacute stroke care

- $200,000 to continue the Seniors’ Social Inclusion Initiative

Supporting industries

- A reduction in the small business corporate tax rate, effective January 1, 2024, from 3% to 2.5% on the first $500,000 of active business income

- $1.1 billion for infrastructure projects

- $2.6 million for the Critical Minerals Strategy

- $3.75 million to improve air access

- $35 million for economic development initiatives

- $10 million for the Year of the Arts and the 75th Anniversary of Confederation initiatives

- $2 million to create a Cultural Facility Infrastructure Fund

- More than $170 million for workforce development

Communities

- $50 million (five years) to support water and wastewater projects

- $3 million increase in base funding for Municipal Operating Grants

- $400,000 increase for municipal training opportunities

- $400,000 increase for municipal fire departments

- $36 million (four years) to build more than 100 new provincial-housing units

- $13 million for the Transitional Supportive Living Initiative in St. John’s

Newfoundland and Labrador Budget 2024-25

<--- Return to Archive